XRP news: Commercial war between the USA and Canada strengthens Ripple’s position

- A renowned lawyer has indicated that Canada’s new prime minister could work comprehensively with XRP through national politics.

- The reason for this is the earlier relationship between the Bank of England and Ripple when Mark Carney worked as a governor.

The ruling liberal party in Canada chose the former central banker Mark Carney as the successor of Prime Minister Justin Trudeau, who announced his resignation in January. According to reports, one of his first plans is to maintain the retaliatory tariffs until “the USA will give them some respect”

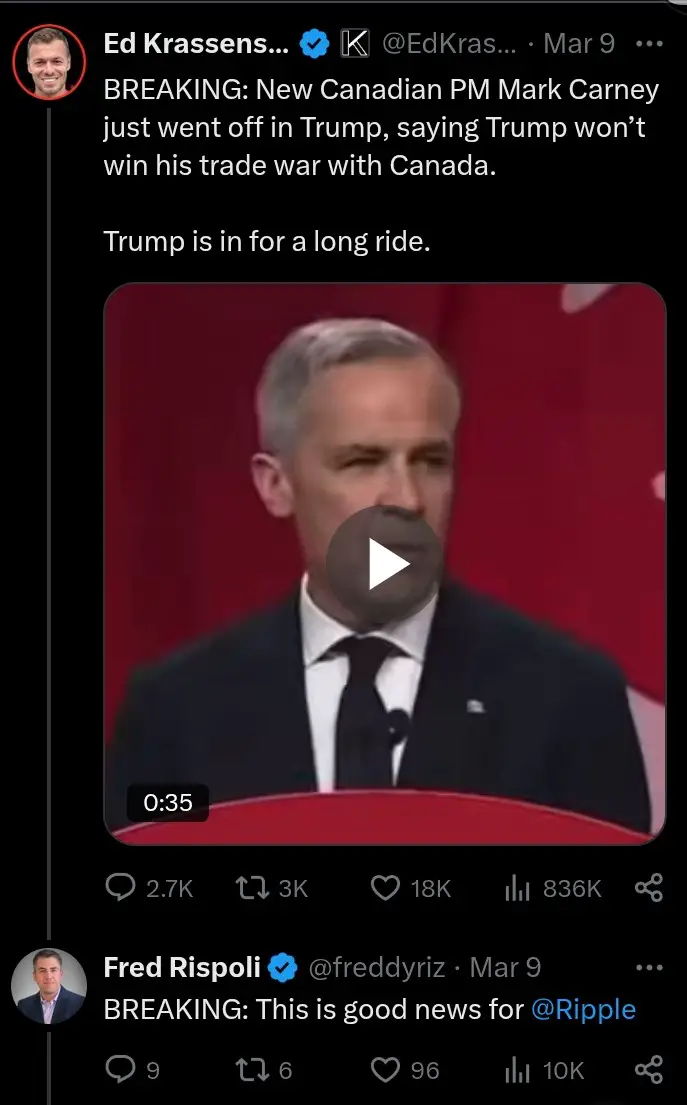

In the meantime, the trade war between the USA and Canada has significantly affected the cryptoma market, since “Extreme Fear” has recorded the market for the first time since the FTX collapse. Carney is ready to continue the trade war:

“There is someone who tries to weaken our economy. As we know, Donald Trump has unjustified tariffs raised what we build, what we sell and how we earn our livelihood. He attacks Canadian families, employees and companies, and we cannot and will not treat him to success. “

Effects on Ripple

In contrast to the expectations of the public, right -wing expert Fred Rispoli has unveiledthat Carney’s leadership could use Ripple considerably regardless of the current trade war. According to him, the newly elected prime minister “once worked with Ripple when he headed the Bank of England.”

Our research show that Carney worked as a governor of the Bank of England from 2008 to 2020. Fascinatingly, he showed his interest in financial innovations through a partnership with Ripple in 2017. This was part of the initiative to improve cross -border payments by increasing the transaction speed and reducing the settlement risks.

The Proof of Concept (POC) with Ripple should also show the synchronized movement of two currencies over two different types of real-time gross processing systems (RTGS). During the same period, the bank also worked with a start-up company for artificial intelligence (AI), Mindbridge, on a POC.

Fascinatingly, Carney does not seem to be a fan of Bitcoin because he believes that the offer rule is a “serious deficiency” that makes it difficult to deal with economic dynamics – CNF reported.

However, some crypto enthusiasts believe that Carney could certainly bring his interest in financial technology and cross-border payment solutions into national politics. Consideration of the Ripple XRP Ledger could also increase acceptance and make XRP a strong competitor in the cross-border ecosystem.

Against this background, the US Office of the Compotroller of the Currency (OCC) has announced that it has withdrawn some decisions that enable the access of national banks and state savings banks to the cryptom market. As explained in our latest blog post, several analysts, including XAIF, have disclosed that this could be a more positive catalyst for XRP compared to the strategic reserve.

In the meantime, XRP seems difficult to stay above the decisive level of support of $ 2, as it has fallen by 4 % in the last 24 hours and 9 % in the past seven days. In the meantime, the renowned crypto analyst Egrag Crypto has set an ambitious goal for the asset because he taps XRP to $ 27.

As indicated in our previous analysis, Egrag Crypto believes that XRP could record some “pullbacks in between”. Therefore, he advises dealers to take profits with 8, 9 and $ 10.

No Comments