- Solana’s meme-coin activity has decreased sharply, with the income from decentralized applications fell by $ 86 % to $ 32 million.

- The market capitalization of all Memecoins has fell by 68%since its maximum; Sol fell 58% of his ATH and now acts at $ 122.

Solana has experienced a slump in his Onchain revenue in the past few months because Memecoin mania, which has driven its expansion, loses steam. The weekly network revenue, which reached a record high of $ 55.3 million in mid -January, have now dropped to only $ 4 million, the lowest value since September.

Solana revenues are going back sharply

The Again of sales is part of a general slowdown in the embossing of memoins, which used to make a major contribution to the activity of Solana. The decentralized applications (DAPPS) on the network generated a total of $ 238 million in income – CNF reported. Now they are loud Defill fell by 86% to 32 million last week.

The decentralized financial industry (Defi) from Solana also has a severe decline. The total value of the transactions (TVL) concluded on Solana-based defi platforms has almost halved, from $ 12 billion to about $ 6.4 billion.

This steep decline coincides with a severe decline in trade activity with meme coins. In a report by the investment company Vaneck on March 5, it is pointed out that the trade with meme coins was almost 80 % of the total income of Solana at peak times.

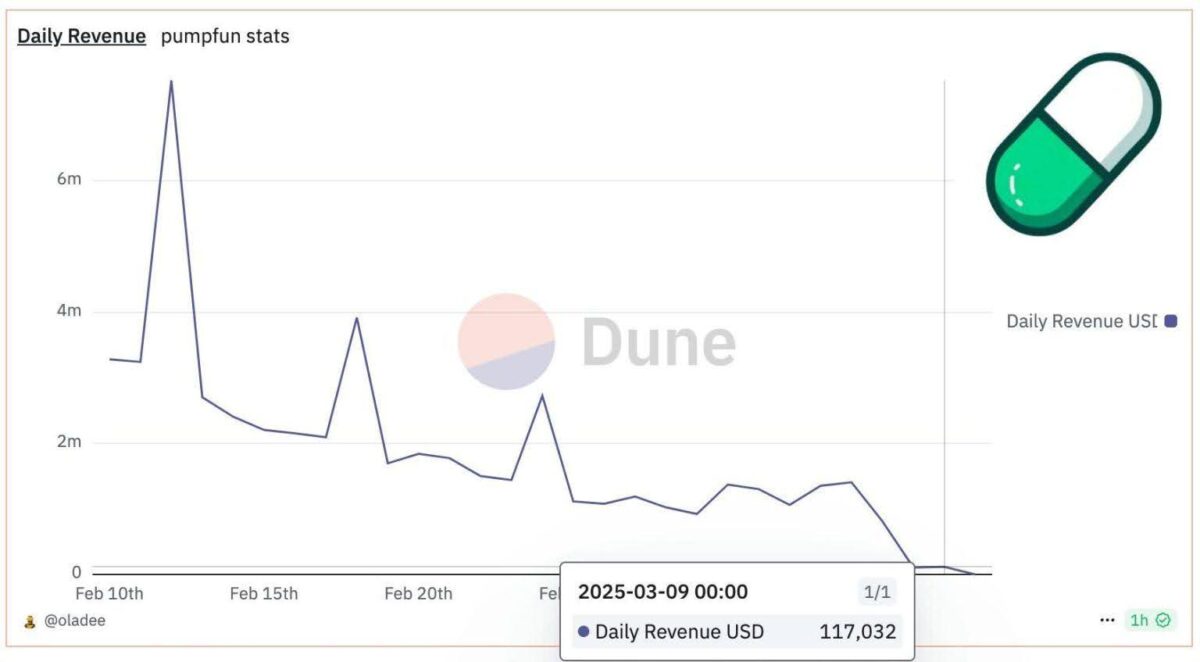

One of the leading platforms that heated up the hype pump. Fun, generated $ 15 million sales a day during the hype at the end of January. According to the data from Dune Analytics, sales on March 7 fell by 95 % to $ 800,000.

Collapse of the Memecoinmarkt triggers the Sol-fall

The Memecoin-Rausch culminated in mid-January after the Trump token from former US President Donald Trump came on the market on January 18 and Melania Trump Melania token on January 20. These market launches triggered an enormous hype and brought liquidity from other crypto-assets with it, but the hype did not last long. Trump has fallen by 86 % since his all -time high. The market capitalization of the memoin also fell 68 % from $ 137 billion to $ 44 billion in December.

The decline in Memecoin activity has also affected the Solana token Sol. After his all -time high of $ 293 in mid -January, Sol lost 58 % of his value and was traded for $ 122 when writing this article.

In response to this, the Solana community initiated a discussion about a proposal to change the tokenomics. The Governance proposal entitled Solana Improvement Document (SIMD) -0228 suggests replacing the static inflation plan with a dynamic one that changes token emissions depending on the participation in use.

Solana’s inflation rate is currently 4.6 % per year and drops by 15 % each year until it levels off at 1.5 %. The planned changes supported by industry representatives of Multicoin Capital and Anza aim to introduce a more fluid and market-friendly method to issue SOL-TOKEN.

Despite the latest volatility, the institutional interest in Solana continues to grow. CNF reported, Franklin Templeton officially submitted a registration for the Franklin Solana Trust in Delaware and thus followed a number of asset managers who want to offer Solana ETFs.

Other companies, Canary Capital and Grayscale, also submitted applications after Vaneck originally submitted a proposal for a Solana ETF in June 2024. The US stock exchange supervision SEC has already accepted some of the applications.

No Comments