Solana founder Yakovenko calls Trump’s Bitcoin decree a “strategic scalpel”

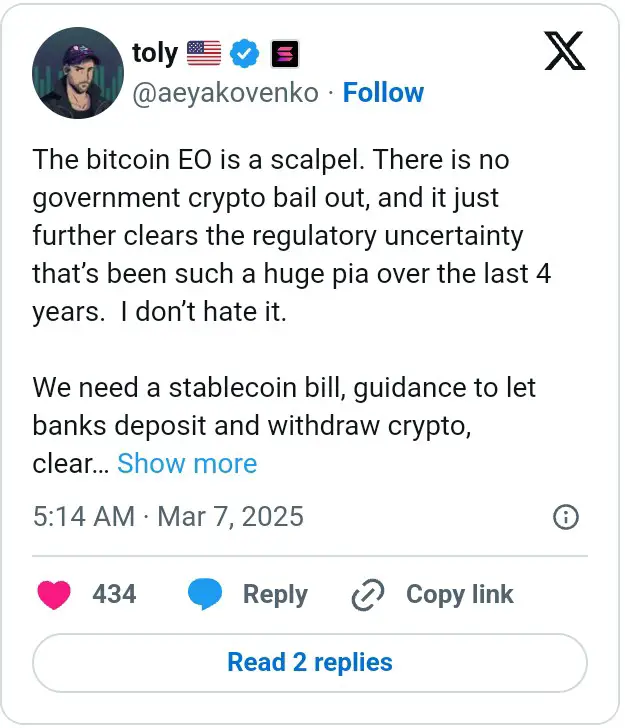

- Anatoly Yakovenko compared Donald Trump’s most recent implementing regulations on the Bitcoin reserve with a scalpel and highlighted its precision.

- He also suggested that the authorities should introduce a StableCoin law and a regulatory framework that regulates the deposits and withdrawals of cryptocurrencies in banks.

In a recent update, we explained the step of US President Donald Trump to sign a implementation regulations for the establishment of a strategic Bitcoin reserve and thus fulfill an election promise. This caused several comments from the crypto industry, with the last of the Anatoly Yakovenko.

Laut yakovenko is the executive order like a scalpel. Technically speaking, his expression stands for the precision and clarity that could bring this initiative for the cryptobranhe. In his contribution, he explained that the executive order for this facility clears up all the regulatory uncertainties that the industry has plagued in the past four years.

In the meantime, he believes that the new government should work on a StableCoin law and a framework that regulates the deposits and withdrawals of cryptocurrencies in banks. He also called for clear rules for the two stock market supervisory authorities SEC and CFTC for the emission and decentralized financing of digital assets.

Comments on the strategic Bitcoin reserve

Jakowenko’s comment comes after he had previously proposed that states should operate their own reserves as “security against errors of the Federal Reserve”

As explained in our previous reporting, he condemned a state -controlled cryptocurrency reserve, as this could undermine decentralization. Even if there is one, he suggested that it should be based on objectively measurable requirements. In particular, it should be designed in such a way that it is only suitable for Bitcoin, and it must be rationally justified:

“I don’t care what these requirements are; They can even be constructed in such a way that only Bitcoin meets them at the moment; They only have to be measurable and rationally justified. If there is a goal to achieve, the Solana ecosystem will make it. “

In the meantime, the latest executive regulation on the establishment of currency reserves indicates that all Bitcoin that are collected as part of criminal or civil law proceedings for the collection of assets and are in the possession of the Ministry of Finance must be activated. According to Arkham Intelligence, the United States currently has more than 198,000 BTC ($ 17 billion).

The arrangement stipulates that no further bitcoins are purchased for the inventory and that no asset stored in the reserve is sold. The heads of the agencies were also instructed to submit complete bookkeeping within 30 days of the digital assets of the government, which are in their possession, at the responsible bodies.

“If such an authority does not have any government digital assets, it must confirm this to the Minister of Finance and the President’s working group for markets for digital assets within 30 days of the date of this order.”

Before this groundbreaking step, the CEO of Microstrategy Michael Saylor justified the Bitcoin reserve; He considers the asset to be the basis of the crypto economy. As described in our latest blog post, he explained how positive this could be for Bitcoin and the entire cryptomarkt. However, our market data show that the price reactions were disappointing.

Bitcoin fell from $ 90,000 to $ 84,000 before taking up an upward movement to $ 89,000. At the time of going to press, the value had dropped by 2.2 % in the 24 hours earlier.

No Comments