Bitcoin before the drop in the course? Bloomberg predicts crash to $ 70,000

- Mike McGlone from Bloomberg says that Bitcoin can continue to fall to $ 70,000, with the Bitcoin gold ratio of 28x to fall to 21x.

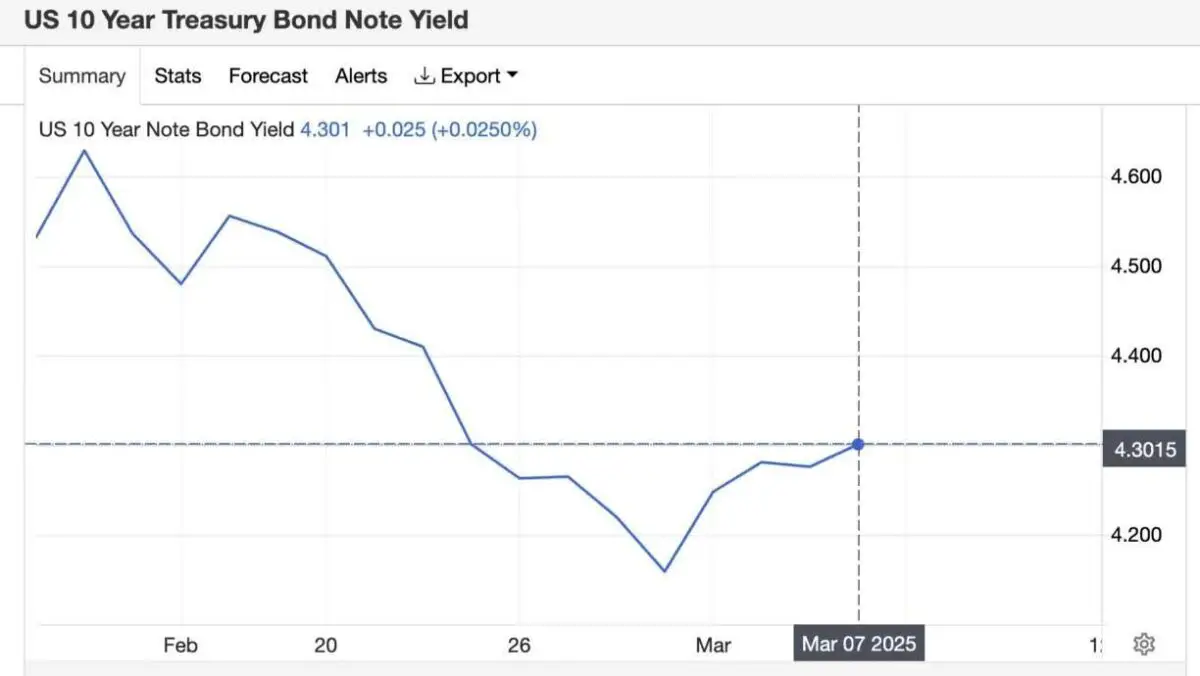

- The institutional interest in BTC has subsided because traditionally safe systems such as US state bonds offer higher returns.

The latest decline in the BitcoIN course has accelerated because market uncertainty, fear of inflation and a changed investigation increase the pressure. According to Mike McGlone, Senior Commodity Strategist at Bloomberg, the BTC course in the middle of economic uncertainty and a possible turning turn could fall to $ 70,000 at the recent increase in the US stock market.

Bitcoin price confronted with new fear

The cryptoma market is in another wave of increased concern because the bitcoin course does not gain drive. Despite the positive reactions to the latest government measures, as the proposed strategic BTC reserve in the United States, the mood of investors is still unsure.

The Bitcoin gold ratio, which indicates how much gold is required to buy a BTC, is 28: 1. However, McGlone believes that the below -average performance of Bitcoin against gold can reduce this ratio to 21: 1 in the coming months.

The Bitcoin course died today at a daily low of $ 80,052.49. This is a dramatic decline compared to the maximum of $ 95,000 last week, which reinforces the bad mood in the market.

The well-known BTC skeptic Peter Schiff has the latest downturn commented And said that a correction was long overdue. According to ship, BTC’s decline could still last for some time, possibly until the end of the decade.

Macroeconomic indicators still have a major impact on the course development of Bitcoin. The US working market data published on Friday-without agriculture-pointed out rising unemployment, which further increased the fear of inflation of investors. The publication has increased the fears that the economy would be a tougher time, and subsequently led to a change in the capital distribution strategies.

President Trump’s initial euphoria about the announcement of a strategic bitcoin reserve has subsided-CNF reported. The market participants re -rate the potential effects of such a policy in the light of general economic uncertainties.

Institutional investors are careful

Institutional investors have avoided large Bitcoin purchases, since the political decision-makers are still disagreed with the space of cryptocurrency in the financial system. A recently held summit of the White House for digital assets did not provide a clear direction, and the investors continued to hold back, as CNF reported.

As the economic concerns, there was an increasing movement towards traditional safe systems. The 10-year-old US state bond return has increased to 4.3 %, a level that was last reached in November 2023, while the return on 10-year-old German federal bonds rose to 2.45 %. The returns of Japanese government bonds have also risen to 0.88 %, a level that was last recorded in 2013.

These rising returns make bonds more attractive for institutional investors, which leads to capital flows away from risk systems such as BTC. Small investors, on the other hand, adapt their portfolios to cope with the increasing living costs due to the tariff -related price increases.

While the sales pressure is high, the Bitcoin miners continue to hold large amounts of stocks. According to reports, mining companies have deposited around $ 900 million in Bitcoin in their coffers, which indicates that long-term trust in the asset has not been broken despite the break-in.

No Comments