Bitcoin and precious metal courses increase strongly: How should you choose?

- Gold, silver and Bitcoin show different trends, and investors should adapt their strategies accordingly.

- The Bitcoin recovery and its increasing distribution will make him a top candidate for growth in the future.

The questions of whether gold, silver or Bitcoin, or which mix from the three assets should be striving for is now the focus for many investors because all three high price increases are experiencing. While they offer different opportunities, their development forces investors to rethink their strategies.

Since the markets change due to the global economic developments, the competition between traditional and digital value preservatives is intensified. Understanding the unique movements of these assets is of crucial importance for current investment decisions.

Gold and silver in the middle of the mood change

As CNF reports, the gold price, after reaching a new all -time high of $ 3,500 per ounce, has recently fallen and closed the week at $ 3,282 after he had fallen by 2 % on Friday. Analysts connected the decline in the declining trade voltages between the USA and China, which reduced the demand for Safe-Haven systems.

Despite the setback, the gold price has increased by more than 25 % since the beginning of the year and is therefore one of the strongest values in 2025. Experts such as Sneha forecast a possible decline to $ 2,500 to $ 2,600 before being relaxed.

The analysts of JP Morgan added that gold could still rise to $ 4,000 per ounce if the upward dynamics are used again. However, since the trade relationships improve, investors are interested in the interests of the interest, which leads to an immediate pricing.

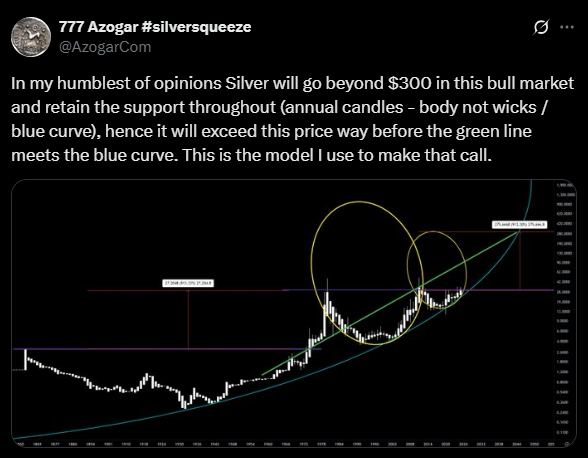

Silver has also come under pressure and currently notes at $ 33.34. Although it is supported by personalities such as Robert Kiyosaki, the influence of silver remains lower compared to gold and Bitcoin. Market observers predict a possible increase in the silver price to $ 38 and possibly $ 300 in a strong bull market, but the dynamics remain steamed for the time being.

Bitcoin gains trust and consequently on swing

Bitcoin rose by 10 % to $ 94,589 this week. It is still below the all-time high of $ 109,114, which was reached during the customs wars of the Trump era, but the rally is all optimistic. Experts point out that Bitcoin is now the fifth largest asset in the world after market capitalization.

The Bitcoin forecasts are very optimistic. Analysts assume that he will increase to $ 200,000 by the end of the year, relying on historical patterns and stronger fundamental data. ARK Invest predicts an even higher long-term goal of $ 2,400,000 and refers to growing Bitcoin ETF inflows, discussions about a strategic US bitcoin reserve and wider acceptance trends.

When writing this article becomes Bitcoin traded at $ 94,284.21.

Robert Kiyosaki and other financial experts recommend a diversified approach and say that they should be involved in gold, silver and bitcoin to compensate for risk and yield. Bitcoins scarcity, profitability and growing acceptance are the big three, Golds historical value resistance and silver potential for surprising profits.

Each assets have its own advantages, and their different price developments show that they have to develop an investment strategy from case to case. Since the economic conditions change, you should pay attention to both the technical and fundamental aspects when choosing between gold, silver and Bitcoin.

No Comments