Avalanche fights against the drop in the course-can AVAX hold the $ 19 support?

- It is predicted that Avalanche (Avax) will continue its downward trend if the bulls are unable to take control and to force a recovery from the current position.

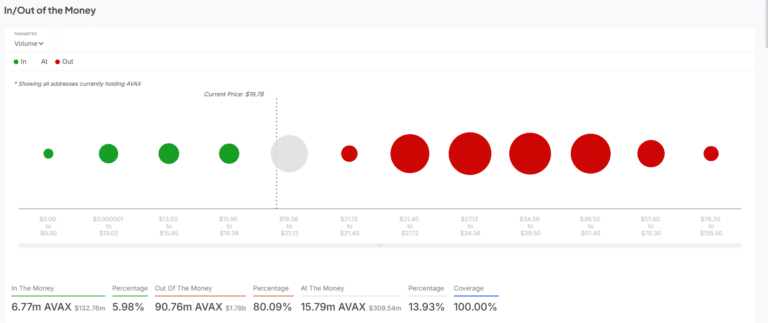

- Several on-chain indicators indicate that the asset is in a downward trend, with 80 % of the AVAX owners a loss.

Avalanche (Avax) fell under an important support brand at $ 19, as it records negative returns in all remarkable trading periods. The value has fallen by 5 % in the last 24 hours and is noted at $ 18.79. Fascinating, the weekly loss has expanded to 19 %, the monthly loss to 22 %and the 90-day loss to 60 %.

In the critical analysis of the assets, the analysts found that Avax forms a symmetrical triangle pattern in which both buyers and sellers seem to be undecided on the market. In the meantime, a possible breakthrough via the upper limitation of the triangle could lead to a short -term price recovery. However, if it is not possible to stay above the current level, Avax could experience a deeper correction and find support at the lower point of the price curve.

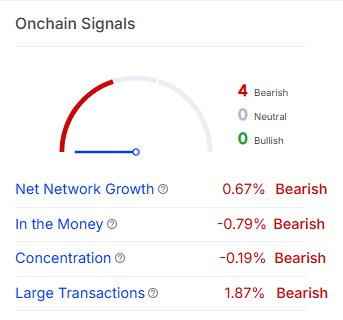

When examining the on-chain activities of the financial value, we found that Avax appears rather bearish than interest bullies, since network growth decreases by 0.67 %. In addition, the “in the money” metric falls by 0.79 %. Technically speaking, this means that only a few investors are in winning.

When examining other key figures, we found that the concentration indicator sits at -0.19 %. After the interpretation of our analysts, this means that the distribution of the token has hardly changed. In the meantime, the WAL activities have also decreased significantly. The data show that large transactions have decreased by 1.87 %.

The Avax Onchain activities

A look at the in/out-of-the-money diagram shows that 80.09 % of the addresses that hold AVAX records a loss, which confirms the declining market situation. When the value was still noted at $ 19, only 5.98 % of the addresses were in profit. According to analysts, the recent decline under $ 19 indicates that many investors could be tried to sell to reduce their losses.

Avax’s weak performance can be attributed to the last quarter of 2024 after the value recorded a significant increase. In December the value crashed and lost all profits achieved in November.

As of February 21st, the value of 31 % has been in the minus over the course of the year, while its market capitalization was $ 10.56 billion. According to our market data, AVAX has decreased further during this period, since market capitalization is currently $ 7.48 billion, while profits have decreased by 51 % since the beginning of the year. In the meantime, an analyst identified as a kaleo predicted on November 11 that the value would reach $ 50 in the following two days.

However, the disappointing development of avalanches did not prevent the enthusiasts from remaining optimistic. Avalanche recently became the third-fashion-named RWA token in social media, just behind Chainlink (link) and Hedera (Hbar). According to the data, AVAX was mentioned 7420 times.

Avalanche was also mentioned as the next cryptocurrency that could benefit from the US crypto strategy, apart from BTC, ETH, XRP, ADA and Sol. As CNF reported, it was said that the asset was one of the few tokens that were produced in the United States, has an ETF application and belonged to the projects whose representatives took part in a meeting in the White House. Previously, he was one of the few RWA assets with the greatest social commitment in February-CNF reported.

No Comments