Zcash is gaining momentum: $1.13 billion in derivatives – increasing open interest

- ZEC price exceeded $630 after a turnover of $1.94 billion, and the number of long positions is increasing – a clear upward trend.

- The daily RSI reaches 83 and the MACD signals buying. Traders are eyeing support at $511.41 but remain uncertain.

Zcash rose sharply on Monday and broke $630 as derivatives markets witnessed historic activity. Open interest in futures reached $1.13 billion, showing strong buying interest. Traders are closely watching price action as momentum builds from last week’s big gains, reflecting strong bullish sentiment and confidence among market participants.

Zcash continues to see increasing trading activity and derivatives markets show strong investor engagement. Traders have taken their long positions to monthly highs, reflecting optimism for further gains. Analysts believe that steady demand for futures can support ZEC’s recovery, while technical indicators point to likely near-term price targets.

Retail investor activity also contributed to price momentum, pushing ZEC above recent support levels. Keep an eye on the market as high participation can sometimes lead to short-term declines. However, traders are overall positive with more buying than selling, showing strong confidence in the cryptocurrency’s upward movement.

Traders invest $1.94 billion in ZEC – open interest increases

At the time of writing, ZEC is trading at $631.69 and is up 3.81% in the last 24 hours. The market cap is $10.29 billion, and traders exchanged $1.94 billion worth of shares today, which is about 19% of the market cap. The circulating supply remains at 16.3 million coins.

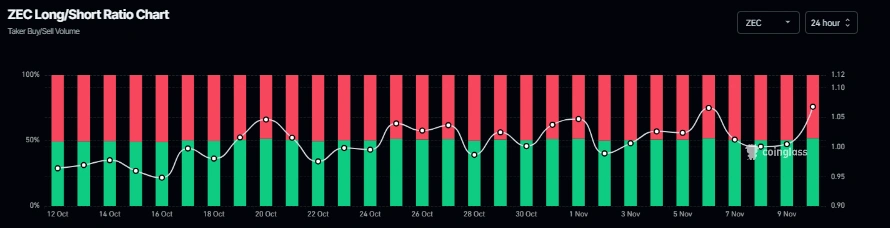

The long-short ratio for ZEC is currently at 1.06, hitting a monthly high. More traders are opening long positions in anticipation that prices will continue to rise. CoinGlass shows that rising interest in open futures signals new money flowing into the market, adding to the current bullish momentum.

ZEC has gained around 47% in the past week, showing strong investor interest. Buyers held support near $578.53 over the weekend, helping prices continue to rise. If this momentum continues, traders expect ZEC to reach $750 in the coming sessions and test key psychological resistance.

ZEC RSI hits 83 as buy signal triggers rise

The RSI value for ZEC has reached 83 on the daily chart, putting it above the overbought region. The MACD indicator gives a buy signal with green bars above the zero line. Analysts expect these stocks to continue their upward trend, with signs of a short-term correction.

Activity in the futures market suggests that institutional and retail traders remain active. Investors continue to pour money into derivatives, with open interest at $1.13 billion. This steady investment could drive prices higher. Increasing participation could boost profits, but if traders take profits too quickly, market sentiment could change and lead to corrections.

Should ZEC suffer a setback, daily support lies at $511.41. Traders see this as an opportunity to buy on a short-term decline. Holding above $630 is key to maintaining momentum. A fall below this level could mean a temporary slowdown in the upward movement.

No Comments