XRP whale activity increases because institutions accept the Ripple Ledger

- The accumulation of whales signals increasing trust in the long -term value and benefits of XRP.

- The global expansion of Ripple continues despite legal disputes and strengthens the financial role of XRP.

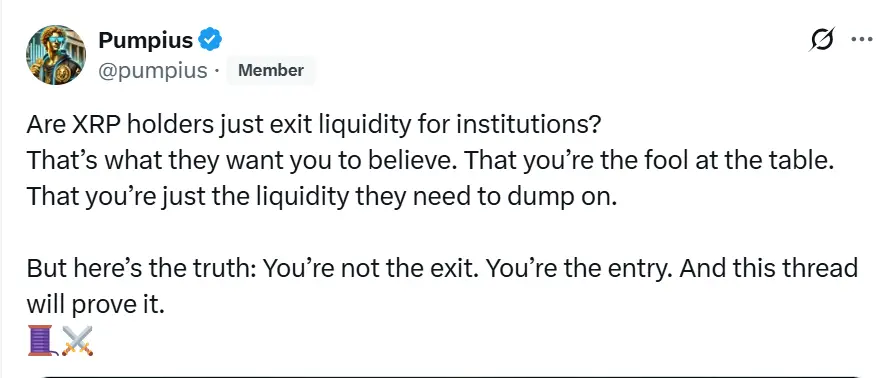

A bold claim by Pumpius causes excitement in the XRP community. While skepticism about the future of XRP is growing, Pumpius turns the script and says that small investors are not the exit liquidity for institutions, but rather the entry point to a new financial regulations.

With on-chain data and global trends on his side, his argument questions long-cherished beliefs in the crypto area. XRP is back in the spotlight, not as a speculative asset, but as the basis of greater financial change.

Whales piling up, do not sell

According to Pumpius, the indicators on the chain show consolidation of the whales. Instead of getting out of the market, large Wallets are piling up. It refers to increased wallet activities and increasing liquidity, especially in Asia and the Middle East. These patterns are not a distribution, but a strategic accumulation by companies with high market capitalization.

Pumpius says that XRP owners have been preliminary that they only deduct liquidity for larger players. “”That is what they want to believe you“, He says. But he says that the data tells a different story – one of trust and long -term positioning. The wallet activity has increased, and liquidity flows into it.

Ripple continues to grow despite legal problems

Pumpius also points out that, despite his legal dispute with the US stock exchange supervisory authority (SEC), Ripple Labs continue to work on his products. He realizes that Ripple has not stopped operating. Rather, the company has made new global partnerships, expanded its on-demand liquidity corridors (ODL) and launched pilot programs for token.

Despite the regulatory uncertainty, Ripple also attracted the attention of great financial institutions. Mounting by the International Monetary Fund (IMF), the Bank for International Payment Compensation (BIZ) and various central banks are listed by Pumpius as proof of the growing legitimacy and the influence of ripple. These are signs that XRP is more than just a token – it is a financial protocol.

A signal for holding or getting out?

Pumpius’ core message is clear. He claims that XRP is not just a speculative asset that can be repelled with a profit. Instead, he sees it as a fundamental element in a changing financial ecosystem. His point of view? XRP holders are not left behind-they are early adopters.

Pumpius advises those who question their position on the market to remain steadfast. In view of the institutional interest, the increasing global application cases and the adjustment of the data on the chain, he believes that XRP approaches a crucial point in acceptance. The debate continues, but for the moment Pumpius has rediscovered the discussion about the development of XRP and the role of the community.

No Comments