- The XRP course decline goes hand in hand with a increase in sales, which indicates position adjustments.

- Despite the decline, analysts go out from XRP towards five dollars or more.

The Ripple XRP showed signs of increasing tensions in the markets when its course fell by 3.95% in 24 hours and leveled off at $ 2.09 by Friday evening. Despite the decline, sales increased by 28.6 % and reached $ 3.32 billion. This type of increase with a drop in price could indicate that retailers adjust their positions in the run -up to the flaring legal dispute over Ripple.

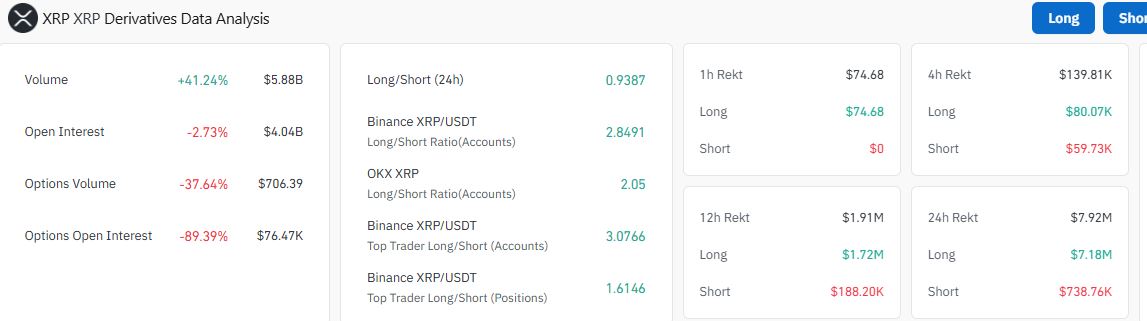

In the same period recorded The derivative market a decline in the open interest at XRP by 2.73% and fell to $ 4.04 billion. Such changes can sometimes be a sign of a lesser trust between the dealers or a slowdown in market participation. In the meantime, the OI-weighted refinancing sentence remained constant at 0.0059%, which indicates a relatively balanced mix of expectations between those that battle at short notice for and against XRP.

Yesterday, $ 7.92 million were also destroyed by liquidations, with the majority of them-around $ 7.18 million-came from long positions. This pattern shows that many who expected a price increase, got offside during the sudden decline, while empty sellers seemed better positioned with only $ 738,760 of liquidations.

Ripple swift cooperation possible-retailers expect XRP course increase

CNF reported that Ripple’s judicial examination of the US stock exchange supervision SEC has moved towards a solution, which led to speculation about possible steps that XRP could connect to the cross-border messaging network from Swift. There is no confirmation yet, but the dealers have adjusted to a possible connection that could make headlines.

A look at the Technical Setup of XRP shows that the coin is just under its exponential, sliding 50-day average at $ 2.20. An increase over this value could set the course for another attempt to reach the high of June 16 at $ 2.30, followed by a possible increase to $ 2.60. On the other hand, if it breaks under the 200-day average, XRP could fall under the $ 2 and tend towards the support brand of $ 1.90.

The relative strength index (RSI) for XRP is now slightly over 40, a neutral value that indicates that there is still upward potential, especially if the purchases increase again. Nevertheless, the MacD indicator shows a bearish crossover because the MacD line has fallen below the signal line.

Analysts see an increase after again overcoming critical threshold

Some analysts are still confident that XRP could face a dramatic upward movement. According to Xforceglobal, the recent decline in the token has “created the prerequisites for faster upward movement”.

The analyst pointed to the 0.618 fibonacci level at $ 2.00 as a trigger value for a new test and shared a diagram based on the Elliott wave analysis, which sees an outbreak goal at $ 5.

Cycle Target is $20-$30.#XRP‘s internal wave counts for the flat scenario is dragging too long on the medium timeframe that makes me want to narrow it down even more.

This could actually set the stage for a faster bullish route to the upside once the pullback finishes. pic.twitter.com/282avir8jI

— XForceGlobal (@XForceGlobal) June 21, 2025

In an earlier analysis, Xforceglobal made a bold prediction that says that XRP could reach between $ 20 and $ 30 in the current cycle. This corresponds to the view of Egrag Crypto, which used Fibonacci extension projections from a symmetrical triangle to predict XRP levels between $ 8 and $ 27.

If so, the upward trend will be strong, especially since the token is currently trading by $ 2.09.

No Comments