- XRP is seeing significantly negative social media sentiment and is falling below the important $1.95 mark.

- The US spot XRP ETFs continue to report net inflows, although the chart picture is stressed in the short term.

Shortly before Christmas, XRP is in a classic area of tension: While social sentiment data has slipped significantly into the negative again and thus historically favors a rebound, the price has lost much-noticed support at higher time levels. In parallel, inflows into US spot XRP ETFs remain green.

XRP sees extremely negative social media sentiment

On-chain analytics firm Santiment has a chart on X dividedwhich shows above-average negative sentiment on social media towards XRP. Santiment commented on X on Thursday:

“XRP is currently experiencing significantly more negative comments on social media than usual. Historically, this pattern often led to price increases. When retail investors doubt that a coin can rise, an increase becomes significantly more likely.”

The point is not a price target, but a setup: If retail becomes significantly more skeptical than usual, the XRP price has tended to recover in the past.

XRP price slips below central support

Crypto analyst “Guy on the Earth” (@guyontheearth) focuses on the zone around $1.95. He writes via

This directly links the break of a “Rectangle” structure with a technical downside target of $0.90. At the same time, he makes it clear what condition applies to a short-term easing: a price above 1.95 US dollars.

“The goal is to get back above $1.95. We tested this earlier but were rejected and another lower high has formed. Only an attack to 1.95 and a close above (on any time frame now) would turn my short-term bias back to bullish.”

His time window is narrow: He says his “best hope” is that the month doesn’t lose the zone and that XRP gets back above $1.95 “in the next 9 days”. At the same time, he emphasizes the character of the move as structurally bearish: “The chart is bearish – that cannot be explained away.”

The article is also a guide for different risk profiles:

“If you feel uncomfortable with this breakdown, sell to reduce your risk to a level you are comfortable with. Then buy back as soon as there is a close above $1.95 on the daily chart (or on the time frame you trust) – then your percentage loss in XRP will be almost negligible. However, if we fall to $0.90, you would – on the invested capital – “We are looking at another 50% loss.”

For long-oriented buyers, he names staggered zones: 1.61 US dollars, 1.42 US dollars, then 0.90 US dollars and 0.75 US dollars as an “initial breakout”.

Despite the break, he still sees bullish elements: “And it’s not all bad! We’re less than four cents away from resistance, and there continues to be a massive bullish divergence on multiple time frames that can still play out. I still believe we can recover from here – and that this breakdown could be a capitulation, like in April.”

ETF flows remain green

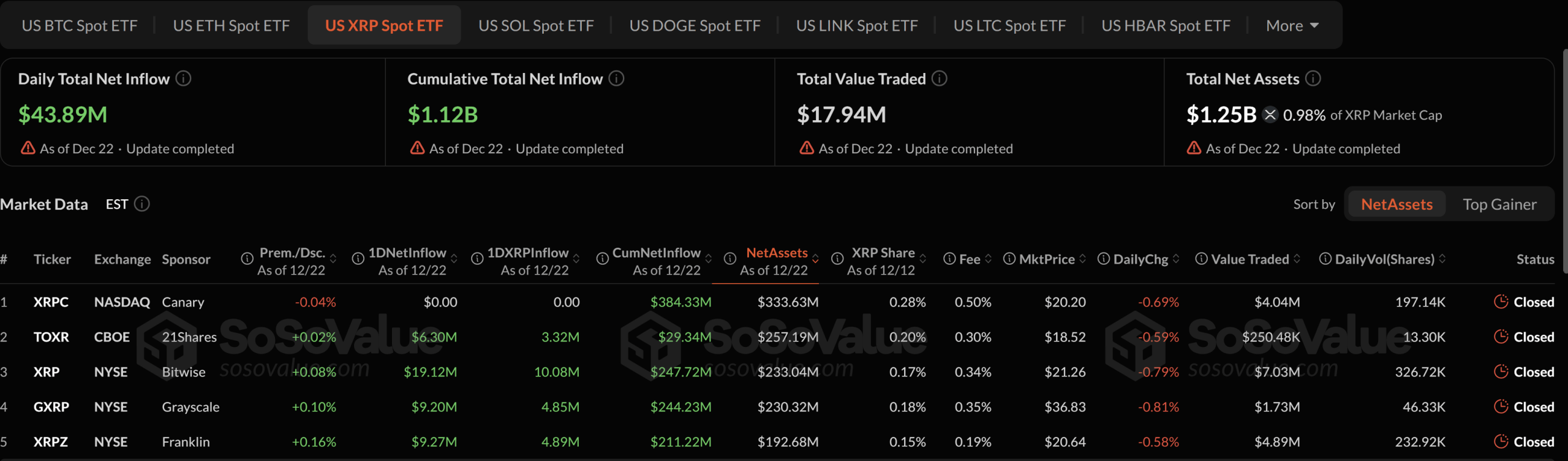

The third data point is the US spot XRP ETFs. After the brilliant launch of the XRP ETFs, SoSoValue data continues to show an uninterrupted series of ETF net inflows that have now lasted six weeks; Cumulative inflows are $1.25 billion and Cumulative Total Net Inflows are $1.12 billion.

Among the five spot XRP ETFs, Canary continues to defend the top position with $384.33 million in capital. In total, all ETFs have attracted a net capital of $93.57 million and $82.04 million, respectively, over the past two weeks. Yesterday, Monday, it was already 43.89 million US dollars.

At the time of writing, XRP was available $1.90 and therefore still below the important market price of $1.95.

No Comments