- The XRP price is up 24% in 4 days; Volume and liquidations indicate a short squeeze.

- The price increase is driven by $46.1 million in ETF inflows, risk-on sentiment and a bullish signal in the XRP/BTC chart.

XRP has gained around 24% in the past four days, making one of the most noticeable moves in the large-cap segment. The token rose more than 11% to around $2.40 in the last 24 hours alone, pushing its market cap to over $144.3 billion.

Tailwind from US spot XRP ETFs

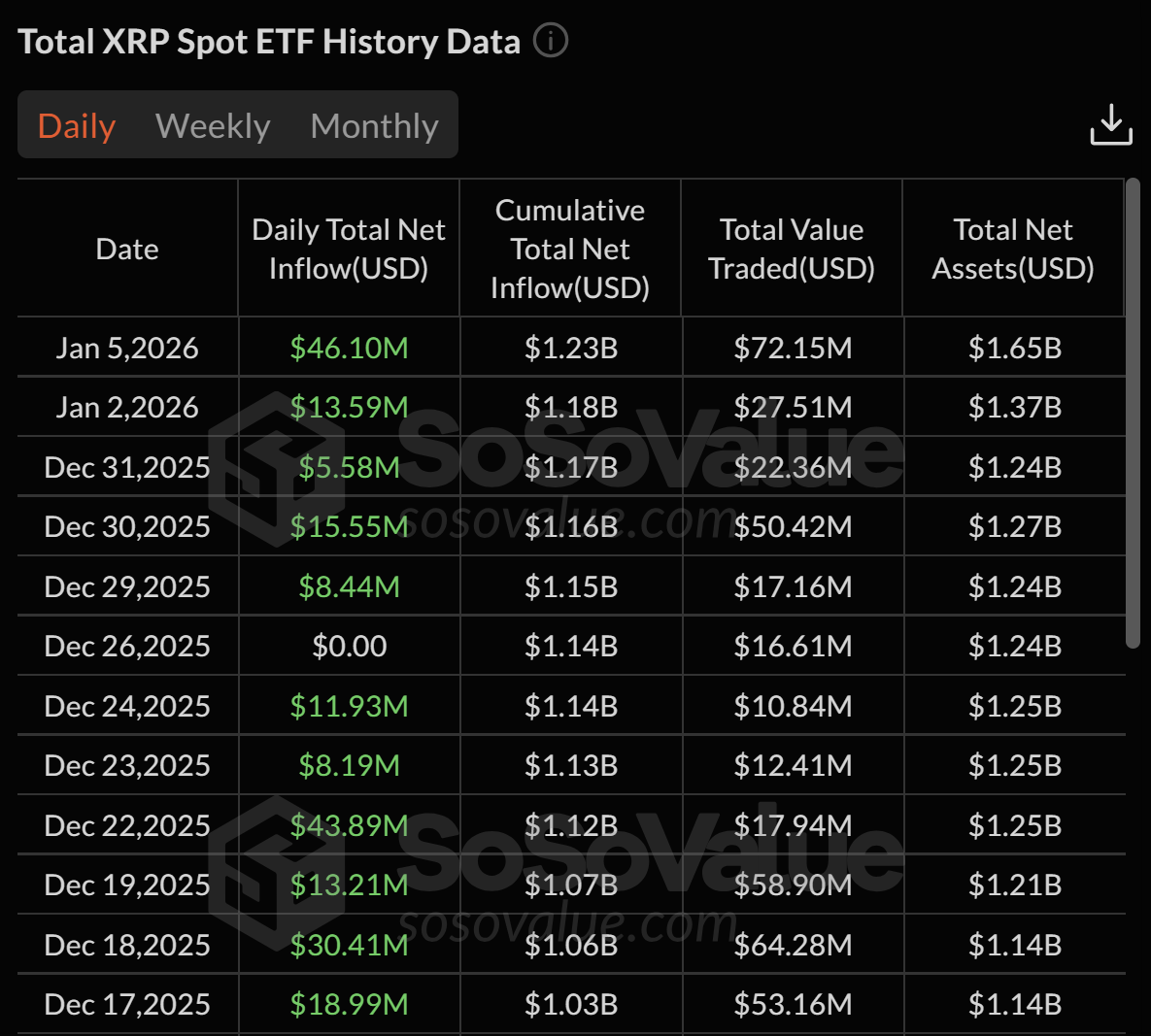

Apparently a central driver for the price rally was the increasing demand in the US spot XRP ETFs. According to SoSoValue, the ETF complex recorded net inflows of $46.1 million on January 5. This is the strongest day since December 3rd ($50.27 million) and the seventh largest day of inflows since the products launched on November 13th, 2025.

Cumulatively, net inflows rose to $1.23 billion and total net assets to $1.65 billion. Bitwise led with $16.61 million on January 5, followed by Franklin Templeton (XRPZ) with 12.59 million, Grayscale (GXRP) with 9.89 million, and 21Shares (TOXR) with $7.01 million.

Bitcoin is pulling the market along

At the same time, the mood in the entire crypto market changed over the weekend, with Bitcoin serving as the driving force. The reason for the sudden change in sentiment was the news that the US military had successfully completed an operation to arrest Venezuelan President Nicolás Maduro.

The following theory about US President Donald Trump’s strategy then became established in the financial markets: a freer supply from Venezuela’s oil reserves could cause oil prices to fall and thus depress inflation and interest rates. This is ultimately positive for risk assets like Bitcoin and altcoins. In this environment, XRP benefited disproportionately. Traders often see XRP as the leading token in altcoin rallies once BTC builds momentum.

Speculation returns

The data also suggests that risk appetite is noticeably returning. Spot trading volume jumped to $7.32 billion, up 144% in 24 hours, according to CoinMarketCap.

According to Coinglass data, there was also an extreme increase in the derivatives market: volume increased by 128.96% to $13.44 billion, open interest increased by 19.30% to $4.64 billion. The options market is particularly noticeable, with an increase of 558.66% in options volume (US$18.03 million) and 27.19% in options open interest (US$49.14 million).

At the same time, there were $31.96 million in liquidations, including 7.23 million from longs and 24.73 million from shorts. The imbalance suggests that a short squeeze not only accompanied the upward move but also reinforced it.

Bullisches Setup im XRP/BTC-Chart

Additionally, XRP continues to be one of the most talked about cryptocurrencies on X, with bullish predictions abound. Well-known crypto analyst Matt Hughes (“The Great Mattsby”) wrote yesterday on the XRP/BTC pair:

“Something incredibly bullish is developing on the XRP/BTC chart that hasn’t been seen in a very long time. It’s about to break out above the monthly Ichimoku cloud for the first time since 2018. That would mean that XRP will massively outperform BTC.”

Hughes had already predicted a bullish move on X on January 4th:

“XRP has had a perfect bounce at the 20-month moving average as the upper and lower bands continue to tighten – setting up the next explosive push higher. Crazy how many people are bearish on a key high-time frame support of all places.”

No Comments