- After seven months of close consolidation, XRP is about to break out, with technical patterns suggesting the potential for an early strong price movement.

- Reduced levers and balanced bets on falling and increasing course indicate careful dealers.

XRP is approaching an important point because the course is on the edge of a long seven -month consolidation. Since technical indicators signal an upcoming outbreak and adapt retailers to their lever positions, the market expects a greater movement that could indicate the sound for the next phase of the old coin.

At the editorial deadline, XRP was traded at $ 2.14 and recorded a decrease of 0.02 % with a daily volume of around $ 2.5 billion. The narrowing Bollinger ligaments and a collapsing symmetrical triangular pattern indicate that volatility will soon increase, which could possibly trigger a remarkable price shift.

For more than half a year, XRP has been in a range between about $ 1.67 and $ 2.94. This consolidation reflects the general altcoin trends, in which many tokens were missing in despite the relative dynamics of Bitcoin. The analysis of the daily charts shows a closer Bollinger-band squeeze, a classic signal that the price could soon be out sharply into one of the two directions.

The upper Bollinger band is currently $ 2.31, and an increase over this level could trigger upward dynamics. Conversely, falling below the lower Bollinger band could lead to a rather declining development at $ 2.08. In order to complete the technical image, XRP has formed a symmetrical triangle in which the price presses towards its apex.

An outbreak over the upper trend line could catapult XRP in the direction of a target at $ 3.22, which would correspond to a potential rally of 41 %. If the course cannot maintain the support, this could lead to a decline towards $ 1.24, which would correspond to the bear’s bear’s goal.

However, the buyers remain reserved. The market thickness indicator shows a value of 45, which reflects the subdued conviction to drive XRP upwards. Until the interest in purchase increases, the token could continue to fluctuate within this consolidation range.

Leverage adjustments can affect the direction

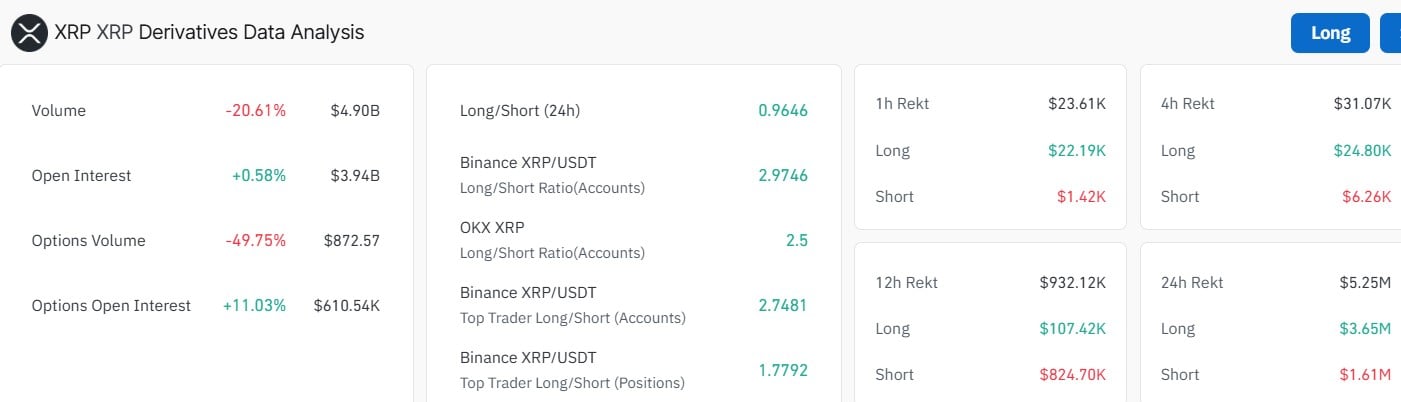

The latest data indicates that retailers have reduced their long positions in XRP, a factor that can influence price stability. According to Coinglass, the open interest of $ 5.52 billion in May fell to $ 3.94 billion in June-a decrease of almost 30 % in one month. This decline indicates that less outstanding contracts are bound to XRP futures, which could reduce the sales pressure caused by liquidations.

The relationship between long and short positions has also shifted to 0.96, which indicates an almost balanced relationship between Bullische and Bearish bets, with a tendency towards short positions. If the market mood changes quickly, a short squeeze could increase the price movements upwards.

External factors and market mood

The market participants attentively pursue developments in the legal dispute between Ripple and the US stock exchange supervisory authority SEC (Securities and Exchange Commission). A positive judgment could strengthen the trust of the investors and arouse new purchase interest, which could support a outbreak beyond the current consolidation.

Until such catalysts occur, the price movement of XRP is probably determined by the technical dynamics and positioning of dealers. The convergence of the Bollinger-Band Squeeze and the symmetrical triangular pattern underlines that the token is ready for a significant change of direction, but the outcome remains uncertain.

No Comments