XRP course outlook: 71% Binance dealers are optimistic-Eric Trump heats Ripple-Swift speculations

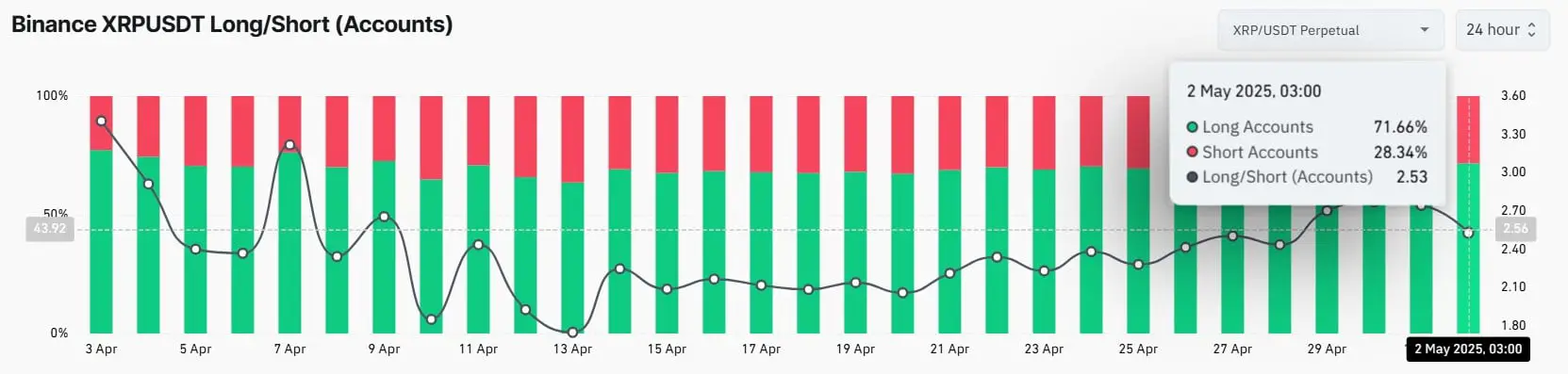

- 71 % of Binance dealers hold XRP long positions and expect an outbreak of $ 2.30.

- Eric Trump’s Swift comments heat speculations about a greater role of Ripple in international payments.

XRP started May and was traded between $ 2.19 and $ 2.25. Despite this slow development, the positive mood among the dealers is increasing rapidly. A wave of optimism followed Eric Trump’s recent statements that Ripple could possibly replace the Swift banking system. This renewed speculation prompted traders on large stock exchanges such as Binance to go into increasingly aggressive long positions for altcoin.

The value of XRP today is $ 2.19 with a slight increase of about 0.6 % within 24 hours.

Dealers bet on an outbreak

Although XRP has shown little exercise so far this month, the trade community remains unimpressed. According to the data from Coinglass, 71 % of the dealers are currently on Binance long positions for Ripple, while only 28 % have chosen shorts. This clearly interest bully imbalance underlines the strong expectation that the price could soon break out of $ 2.30 via the critical resistance brand.

The positive market mood is increased by the fact that the open interest of Ripple has increased to $ 3.75 billion, which reflects a significant increase in dealer activities and commitment. The open interest measures the total number of outstanding derivative contracts and often signals trust or concern, depending on the market context. In this case, the increase underlines the growing expectation of an outbreak.

However, the increased leverage also has a considerable risk. The latest price drop to $ 2.13 led to a liquidation echo of 1000 %, which destroyed numerous long positions. This liquidation wave produced a downward pressure on the market and showed how quickly the interest bullish atmosphere can turn into the opposite under volatile conditions.

Eric Trump’s Swift comments strengthen ripple moment

The optimism that surrounds ripple is not just a technical nature. At the TOKEN2049 conference, Eric Trump made headlines when he explained that the traditional financial system dominated by Swift “absolutely broken” he also claimed that cryptocurrencies, including those that are based on blockchain technologies such as Ripple, could soon replace Swift for international transactions.

His comments reflect similar statements by Brad Garlinghouse, the CEO of Ripple, who has long criticized Swift’s inefficiency. Garlinghouse has argued that blockchain is a more modern, cheaper alternative for cross -border payments.

As CNF reported, Ripple continues to press the introduction in global finance. The possibility of achieving a fraction of Swift’s daily transaction volume of $ 5 trillion could play a crucial role for XRP.

The dealers have taken note of this. The speculative narrative that Ripple connects to a Swift replacement has become one of the main reasons for the recent increase in XRP positions. The flat price movement of the old coin deceives over the growing excitement underneath, with technical retailers pay close attention to an outbreak of $ 2.30.

No Comments