World’s largest bank requested approval of the stable coin “Jpmorgan dollar”

- JPMorgan wants to promote its financial services with its own stablecooin and is likely to find a corresponding new regulation when admission.

- Despite the anti-Bitcoin posture of its boss, the bank is driving the development of blockchain tools and crypto loan safety.

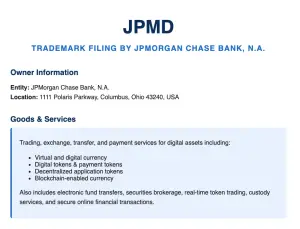

JPMorgan Chase handed over On June 15, 2025 at the United States Patent and Trademark Office (USPTO), an application to protect a new platform called JPMD. It is a digital financial service that includes trade, exchange, payments and the issue of digital assets. The application was accepted for processing, but must still be submitted to a examiner for further examination.

The brand registration includes potential offers from the JPMD, such as B. Help with brokerage and electronic money transfer. These indicate that the bank is preparing to expand its role in the area of online financing. After their granting, the applicant ensures the exclusive use of the registered logo or name for selected products or services.

This step follows the increasing commitment of JPMorgan in blockchain-based transactions. So far, over $ 1.5 trillion dollars have been handled with JPM Coin via the Kinexy platform, formerly Onyx. This stable coin is 1: 1 on currencies such as the British pound, the euro and the US dollar.

JPmorgan goes into the StableCoin race

The submission of JPMorgan follows the measures of the Senate at the beginning of the month, where the senators adopted the law Genius (guiding and establishment National Innovation for Us StableCoins) with 68 to 30 votes. The adoption of the law is a historical, cross -party attempt to achieve national regulation of stable coins. It will now be coordinated and discussed in its entirety before being forwarded to the House of Representatives. When the law is signed, it goes to ratification on the desk of President Donald Trump.

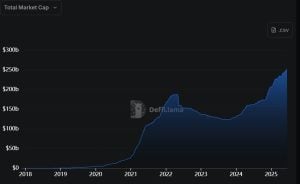

According to Defillama, the entire StableCoin market amounts to $ 251.85 billion. Tether is at the top at $ 156.3 billion, while the USDC of circle holds $ 61.3 billion. These numbers indicate a rapid increase in use and interest, which could explain the time of the application to JPMorgan.

JPMorgan also prepares to accept crypto ETFs as loan security. The first to appear on this list is the Ishares Bitcoin Trust (IBIT) from Blackrock. This step is possibly part of a more comprehensive crypto -based lending initiative.

JPMorgan checks the feasability of the stable coin of a banking consortium

CEO Jamie Dimon is still skeptical about Bitcoin, although he has admitted that blockchain technology in financial institutions could be used. In a recent CNBC interview, he compared Bitcoin with cigarettes and said that he would not personally invest in Bitcoin, but respect the right of others to do so. He repeated his view that Bitcoin has only a limited legal use and is often associated with criminal transactions.

Despite these personal beliefs, Dimon supported the use of blockchain in banking. His company already has experience with blockchain transactions. With the introduction of the JPMD, another product could be included in this list if it is successfully approved.

In the meantime, JPMorgan reports on a common stable coin with other large US banks, including Bank of America, Wells Fargo and Citigroup. This project is currently still in the initial phase, but has the potential to change the role of banks in the digital financial system.

No Comments