- World Liberty Financial bought Sei-token worth $ 100 million in order to increase its stock to 1 million.

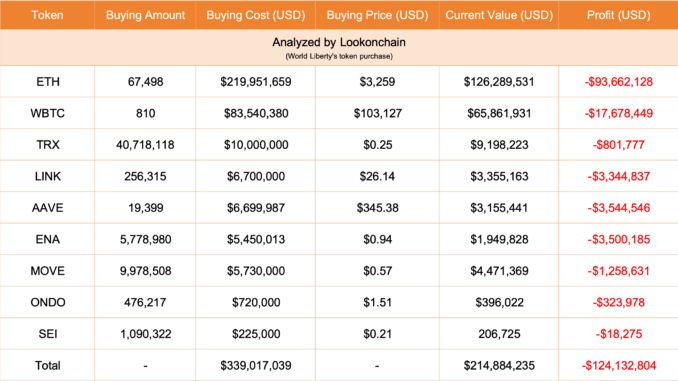

- The latest report shows that WLF has a current cumulative value of $ 21 million with a cumulative loss of $ 124 million.

World Liberty Financial (WLF), the decentralized financial platform associated with the family of US President Donald Trump, begins another wave of accumulation by buying 541.242 for $ 100,000 at an average price of $ 0.185. The total stock has increased to 1.089 million, which was acquired at cumulative costs of USD 225,000. Currently, the wide market liquidation and the pullback have reduced the total value of its stocks significantly to $ 207,000.

The latest acquisition was sufficient to trigger an increase of 7.5 % on the 24-course chart. It is currently being traded at $ 0.19 and is therefore significantly below his annual high of $ 1.14 on March 16, 2024. The course diagram shows that the value is about to break out of a descending triangle pattern, which indicates a short -term recovery.

According to data from Lookonchain, the current portfolio of WLF contains nine crypto tokens with a cumulative value of $ 214.8 million. However, it has a cumulative loss of $ 124 million. In the meantime, Ethereum (ETH) with a current value of $ 126 million remains the largest position, followed by Wrapped Bitcoin (WBTC), which is valued at USD 65 million.

A week ago, a digital wallet, which is connected to the WLF platform, bought ETH worth $ 10.1 million, WBTC worth $ 9.9 million and Move worth $ 1.68 million, as described in our latest blog post. According to Eric Trump, President Trump’s son, WLF Defi or Cefi wants to revolutionize the future of financial system.

Recent controversy around WLF

Recently, a platform called Blockworks claimed that World Liberty explored the exchange of Wlfi token worth $ 10 million with other crypto projects after discovering some movements on the chain. According to this report, this alleged sale should go hand in hand with a fee of 10 %.

However, WLF quickly made it clear that it does not sell token. According to her report, only assets for business purposes were reversed. In addition, the Defi platform explained that their regular movements are standard practices and serve to maintain strong, safe and efficient financial management:

“We carry out routine movements of our crypto stands as part of the regular treasury management, the payment of fees and expenses and to cover the operating capital requirement. To clarify this, we do not sell tokens – we only re -assign assets for normal business purposes. ”

In the middle of these controversy, the platform has announced the introduction of a strategic macroreserve for several assets. This should give the most important assets thrust. In addition, the creation of the WLF team should increase stability and serve as a robust financial backbone for the Wlfi token. Incidentally, WLF and SUI work together to strengthen the strategic reserve.

No Comments