With the help of three forces, Ethereum controls the $ 2,000 price target after the upgrade

- The pectra upgrade increases Ethereum’s course prospects with low L2 costs and wallet smart contracts.

- Positive technical data and increasing inflows of whales position ETH for an outbreak of over $ 2,000.

Ethereum targets the $ 2,000 brand, supported by upcoming network changes and growing market optimism. The Blockchain is to receive the PECTRA upgrade on May 7, a development that, in the opinion of analysts, could be an important trigger for a continuing price rally.

In combination with cheap technical indicators and increasing trust among the large investors, the stage seems to be prepared for a potential outbreak. While retailers weigh up the effects of the macroeconomic signals and the latest trade talks between the USA and China, Ethereum again shows signs of dynamics.

According to analysts, Ethereum’s PECTRA upgrade is expected to moderate the blockchain considerably. The update introduces six blobs per block to reduce the Layer 2 transaction costs, and enables validists to consolidate up to 2,048 ETH.

In addition, EIP-7702 should enable Smart Contract functionality directly to Ethereum wallets. These functions are widely regarded as important steps to improve scalability and functionality and could improve the mood of investors. So there are currently three reasons that bring ETH forward again:

Reason 1: Key figures show positive momentum

Market analysts emphasize that the price development of Ethereum reflects an interest bully reverse pattern. The latest evening star formation near the $ 1,755 demand zone was followed by a V-shaped recovery. This movement brought ETH back to the 61.80%fibonacci retracement level at $ 1,835, which indicates strong buyer interest.

Technical indicators such as an interest bullish MacD crossover and an RSI that has recovered from the oversold area speak for a continuing upward movement. If ETH brings the $ 1,855 brand through, analysts see the next resistance at $ 1,949, with the potential to achieve the previous swing high of $ 2,100, which means an upward potential of 25 % compared to the current level.

Reason 2: Onchain data suggest coming Bullrun

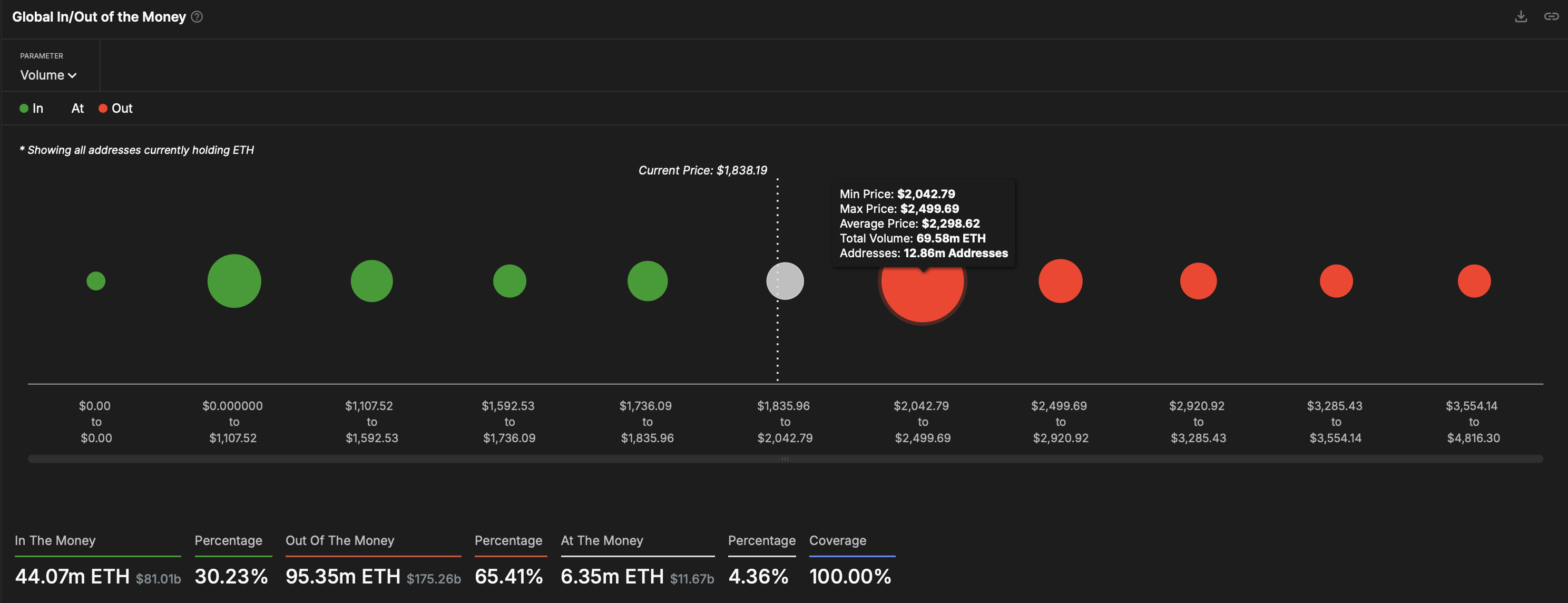

Ethereum’s on-chain indicators further increase the potential for an outbreak. The Global in/Out of the Money Around Price (GIOM) Data from Intothlock show that 13 million addresses bought 70 million ETH between $ 2,042 and $ 2,499.

This group of owners could create short -term resistance because they try to compensate for their losses. However, the support of around $ 1,794 marks remains Stark, where almost 7 million addresses hold 8 million ETH. This buyer concentration represents a critical price limit, which indicates that Ethereum could continue to rise if it approaches the $ 2,000 mark.

Reason

3: whales hoard again

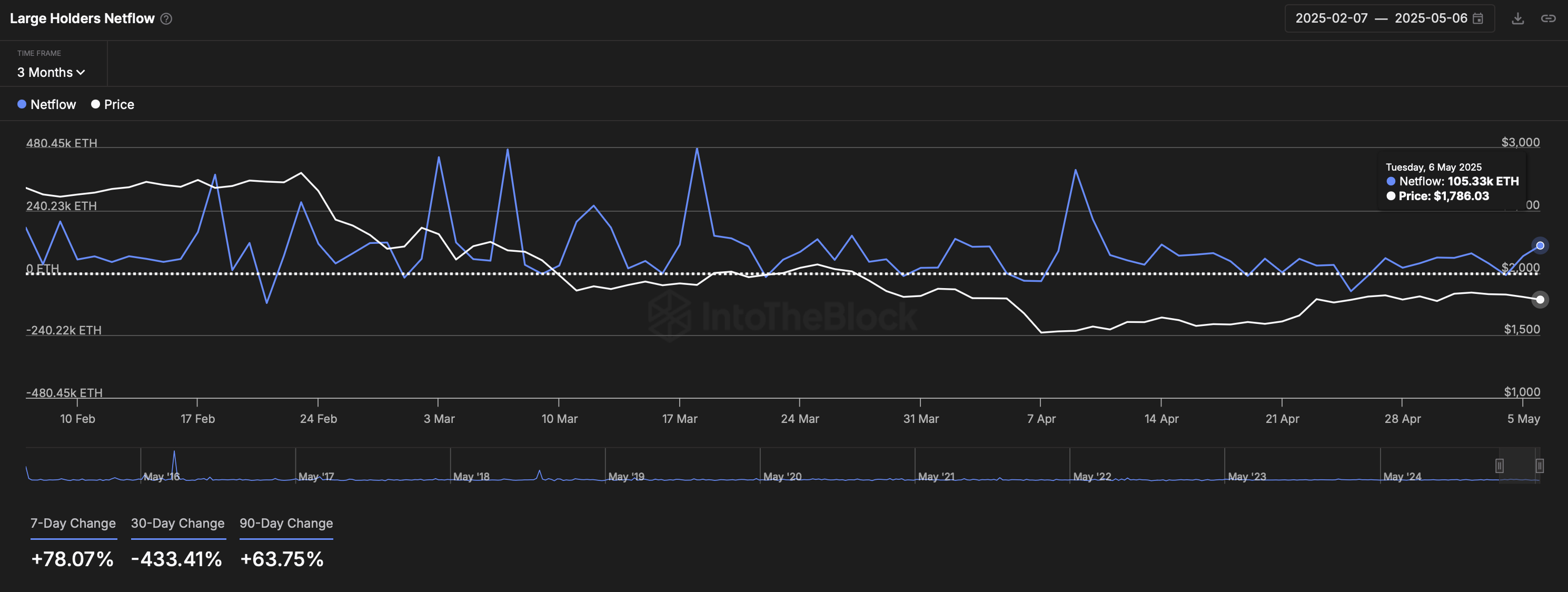

The trust of the great Ethereum investors has also grown significantly in the run-up to the PECTRA upgrade. The net inflow of large investors rose by 78.07 % between April 29 and May 6th and rose from 37.12k to 105.33k ETH.

These wallets, each with at least 0.1 % of the total ETH offer, usually represent institutional or long-term investors. Their increased activity is seen as a bullish signal that matches the positive technical and on-chain prospects.

Since the PECTRA upgrade is only a few hours away, the course of Ethereum depends on both the successful implementation of these improvements and the general market mood.

No Comments