- Bitcoin briefly exceeded $ 110,000 after ETF inflows and hoarding whales almost doubled sales in 24 hours with an increase of 29%.

- Short positions of one billion dollars could be dissolved, depending on the interest decision by the US Central Bank and the development of the USA/China trade.

Bitcoin skipped the $ 110,000 mark on June 10 and thus recorded its strongest performance this month. The rally comes because the volume of the cash tand and the derivatives rise.

Analysts now observe the important resistance near the all -time high of $ 112,000. While the mood turns upwards, caution remains due to the macroeconomic risks.

ETF inflows and hoarding whales are the engines of the upward trend

Bitcoin climbed from $ 110,587 from $ 105,600 on Monday and thus reached its highest level since May 23. On Tuesday he was traded at $ 109,387 after he had briefly exceeded the $ 110,000 mark. Loud TradingView-data Bitcoin is only 3% away from his current all -time high of $ 111,970, which was reached on May 22nd.

ETF inflows support the rally. The analysis company Socal reported tributaries of $ 386 million on Monday alone. The Fidelity Wise Origin Bitcoin Fund (FBTC) led the increase with $ 173 million and thus exceeded the Ishares Bitcoin Trust (IBIT) from Blackrock, which recorded $ 121 million. Over and beyond confirmed Strategy A Bitcoin takeover worth $ 110 million, which Buying pressure On institutional investors still increased .

On-chain signals show strong holding behavior. Loud CryptoQuant the centralized stock market reserves of 1.55 million BTC in July 2024 dropped to 1.01 million BTC on June 10th . This decline around 550,000 BTC indicates increasing long -term accumulation.

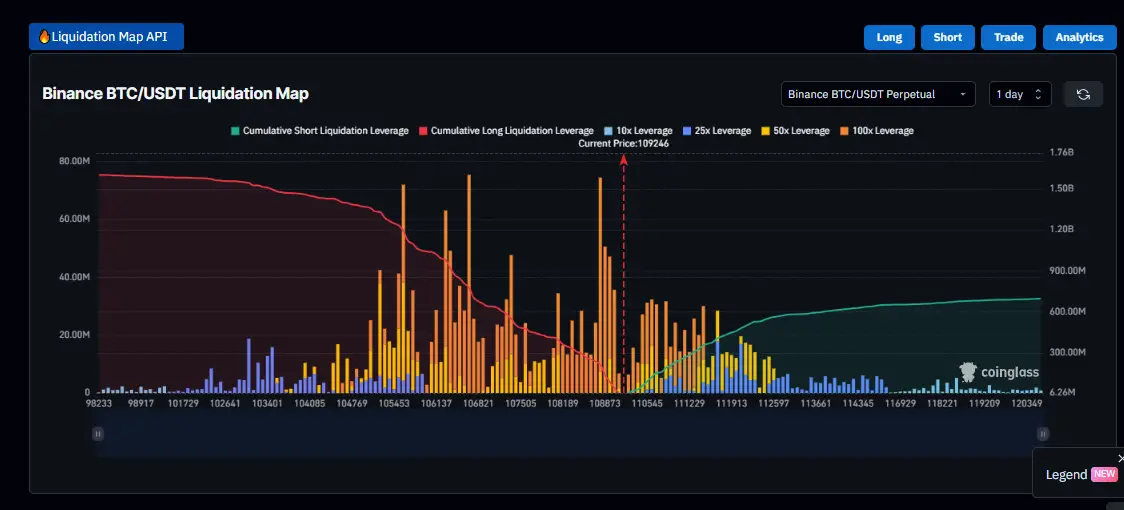

According to the data from Coinglass Could now be dissolved short positions worth around $ 1 billion if BTC has recaptured its all-time high.

In the last 24 hours, positions worth $ 203 million have been liquidated, with $ 195 million in short positions, which indicates a strong upward pressure.

Bitcoin sales and derivatives activity rise

The 24-hour trade volume of Bitcoin rose by 49 % and is now $ 60.24 billion. The ratio of volume to market capitalization is 2.71%, which shows intensive trade activity in relation to the market capitalization of $ 2.17 trillion. The open interest also rose by 7.3 % to $ 76.6 billion, which indicates that new capital comes onto the market.

Trading with derivatives doubled and rose by 113 % to $ 110.63 billion, which indicates a repositioning of the dealers. This development comes after Bitcoin had fallen near $ 100,000 last week before recovering. Analysts describe this as the strongest performance in June, which contributes to compensating for previous losses.

Despite the rally, the derivative metrics show that the dealers are careful. Not all participants are convinced of an outbreak, and some use options and futures to protect themselves against risks. This indicates a speculative than a participation supported by conviction, since many are waiting for the resistance to confirm a sustainable increase.

The analysts von Bitfinex found that long -term owners who bought to $ 78,513 are now facing a decision point during the break -in in Q1 2025. The price increase of 39 % since then has brought BTC to the profit zone. The report warned that sales in the current strength could lead to longer consolidation, similar to the Bitcoin high of March 2024 at $ 73,679.

Business shapes short -term prospects

The Bitcoin rally is also influenced by changing global macro. The trade talks between the USA and China were resumed on June 9 in London. How CNF reportedthe conversations focused on reducing tariffs and the relaxation of export restrictions in the areas of technology, minerals and agriculture. This improved the market mood and rose Bitcoin in early Monday trading from $ 105,600 to $ 107,800.

The dealers are now waiting for the US Federal Reserve’s interest decision on June 18. An interest rate reduction could give risk systems such as Bitcoin. However, some market participants remain in view of the uncertainties related to the persistent customs threats Carefully by President Trump.

Polymarket data Show a 60 percent chance that Bitcoin will reach $ 115,000 in June with a 31 percent probability that he exceeds $ 120,000. For a outbreak of over $ 150,000 this month, only a 3% chance is priced in, but the probability should increase to 38% by the end of the year.

Despite the optimism, Bitfinex analysts emphasized that without a larger structural or macroeconomic drive Bitcoin’s profits be stalled. The report emphasized that long -term investors could delay further trial attempts. The correlation with the stock markets also remains a limiting factor for the short -term upward trend.

The total offer of Bitcoin amounts to 19.87 million BTC, with a fully watered rating of $ 2.29 trillion. According to CoinmarketCap, the value has increased by 3.3% in the last 24 hours and 5.21% in the last 30 days.

No Comments