- The recent negative financing rates of Solana indicate a declining mood among the dealers, although a short squeeze or cheap messages could trigger a course jump.

- A shift in the institutional interest towards Solana could strengthen confidence in the network, let the course rise and support a return to the level of $ 180.

The price of Solana (SOL) came across serious resistance after a recovery of a low of $ 125 at the end of February. While this relaxation led to the fact that Sol remained 50 % behind its all -time high of $ 295, four very important factors should ensure that the token falls back to the value of $ 180.

1. Resuscitation of Solana Onchain activity

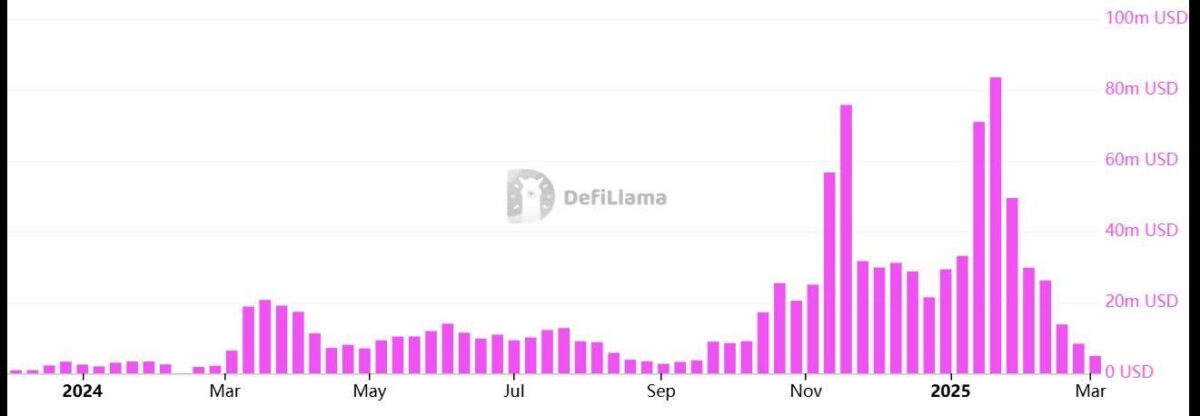

The Solana network has experienced a slowdown in important categories such as liquid staking, decentralized stock exchanges and NFT marketplaces. The network fees have dropped by 73% last month, which indicates lower user activity, reportedDefill .

The active addresses on Jito, the largest Liquid Staking platform in Solana, have dropped by 56% in the past 30 days, while Magic Eden, one of the most popular NFT marketplaces, recorded a decrease of 38%. Save (formerly Solend), a lending protocol, also lost 42 % of its active users.

In comparison, Base, the Ethereum’s Layer 2 network, only recorded a decline in active addresses by 2 %, while the main chain from Ethereum recorded a decrease of 17 %. If Solana can reverse this development and bring out new activities again, the catalyst could be for a price recovery.

2. New Leverage demand for Sol-token

The market mood is often expressed by the demand for lever effects, in particular by the use of eternal concepts. In the past three days, Sol’s financing rate was negative, which indicates that empty sellers pay for the maintenance of their position, as mentioned in our previous report. The rate of -0.01 % every eight hours is not atypical, but reflects a lack of trust among the dealers.

A replacement in long positions can trigger a price increase, especially if empty sellers are surprised by surprising messages-such as the listing of a Spot-SOL ETF in the United States. A short squeeze under such circumstances could accelerate the rise from Sol to a higher price level.

3. Agency of MEV bot activity

A minority of users had a disproportionate influence on the transaction fees of Solana. It was reported that 95 % of the network fees are generated by only 1.3 % of the users, especially from market-making companies such as winter masses and MEV bots (maximum extractable value).

These bots take part in techniques such as sandwich attacks, with which they construct outstanding shops on decentralized stock exchanges to make a profit. Such activities have increased volatility and braked organic growth. If the Solana network makes improvements that suppress the supremacy of MEV bots, it has the potential to create a better environment to promote long-term participation.

4. Solana course will increase through institutional investments

A large institutional investor, World Liberty Financial, has bought several cryptocurrencies such as Ethereum (Eth), Wrapped Bitcoin (WBTC), Tron (TRX), Chainlink (Link) and Aave (AAVE). Nevertheless, it showed no interest in Sol.

This is remarkable when you consider that the official Trump (Trump) Memecoin was introduced to Solana. If World Liberty Financial invests in Sol, this could indicate that the investor optimistically assesses the future of the network, which would drive up prices.

If the activity on the chain, the demand for leverage, the behavior of the MEV bots and the institutional investments improve, the Solana Prize could gain momentum. This could help to recover the SOL course to the level of $ 180.

No Comments