- Bitcoin fell as low as $86,074 on Sunday: thin liquidity, stops below $88,000 and a long flush accelerated the downward move.

- The trigger was a sudden jump in the shutdown probability on Polymarket; There were also high liquidations and a defensive stancees TradFi-Sentiment.

The Bitcoin price fell to as low as $86,074 on Sunday, January 25th, after hovering around $89,900 on Saturday and closing at just over $89,000 at the end of the day. The decline of around 4 percent over the weekend initially seemed like a classic “weekend flush”, but had clearly identifiable triggers from macro and derivatives markets.

Why did the Bitcoin price fall?

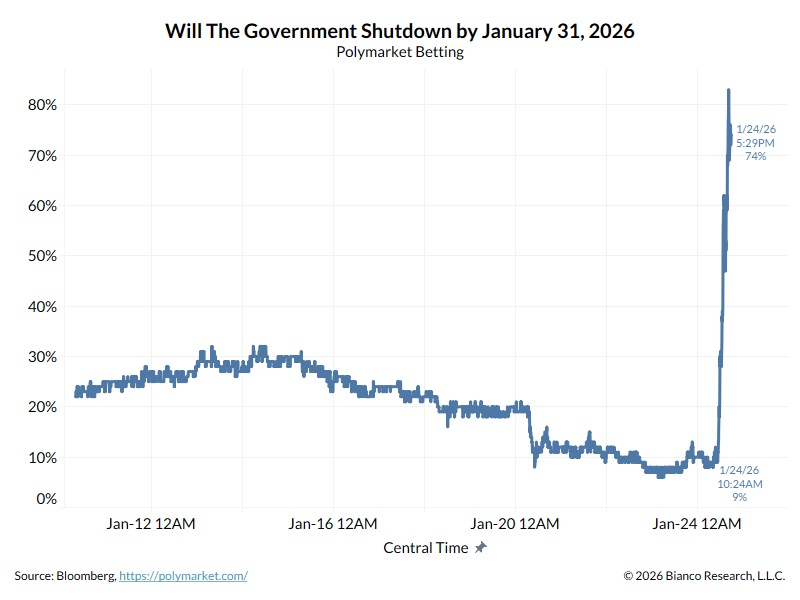

The trigger came from Washington: On Polymarket, the shutdown probability for the end of January jumped significantly within hours. On X, the jump was largely interpreted as a short-term negative factor for Bitcoin. Jim Bianco wrote:

“The chart below shows Polymarket’s bet on another government shutdown on January 31st. It has risen from 9% to 74% today in response to the Border Patrol shooting in Minneapolis. The thought is that this event could encourage Senate Democrats to block passage via filibuster (thereby shutting down the government) to defund ICE/CBP or significantly alter its current mission.”

To put it into perspective: A “Continuing Resolution” on November 12th ended the shutdown that had been running since September 30th, but it expires on January 30th. The House of Representatives passed the next budget step on January 22nd, in the Senate the passage was previously treated as a formality, “but now there are questions” as to whether the dynamic is changing; In addition, a major winter storm could delay return trips for senators and further compress the schedule.

Zerohedge (@zerohedge) wrote via X: “Bitcoin algos took 24 hours to receive news of the shutdown.” Lekker Capital CIO Quinn Thompson commented thereupon:

“I said the same thing yesterday and last weekend. That shows the apathy in [Bitcoin]that it takes so long to react to obviously bad news. In both cases, I had almost all day to short clearly negative news. Strange market behavior. Are there no sellers anymore?”

The news hit the typical weekend setup: thin order books and low liquidity. With the break of the $88,000 zone, stops took effect; There were also liquidations on the derivatives market.

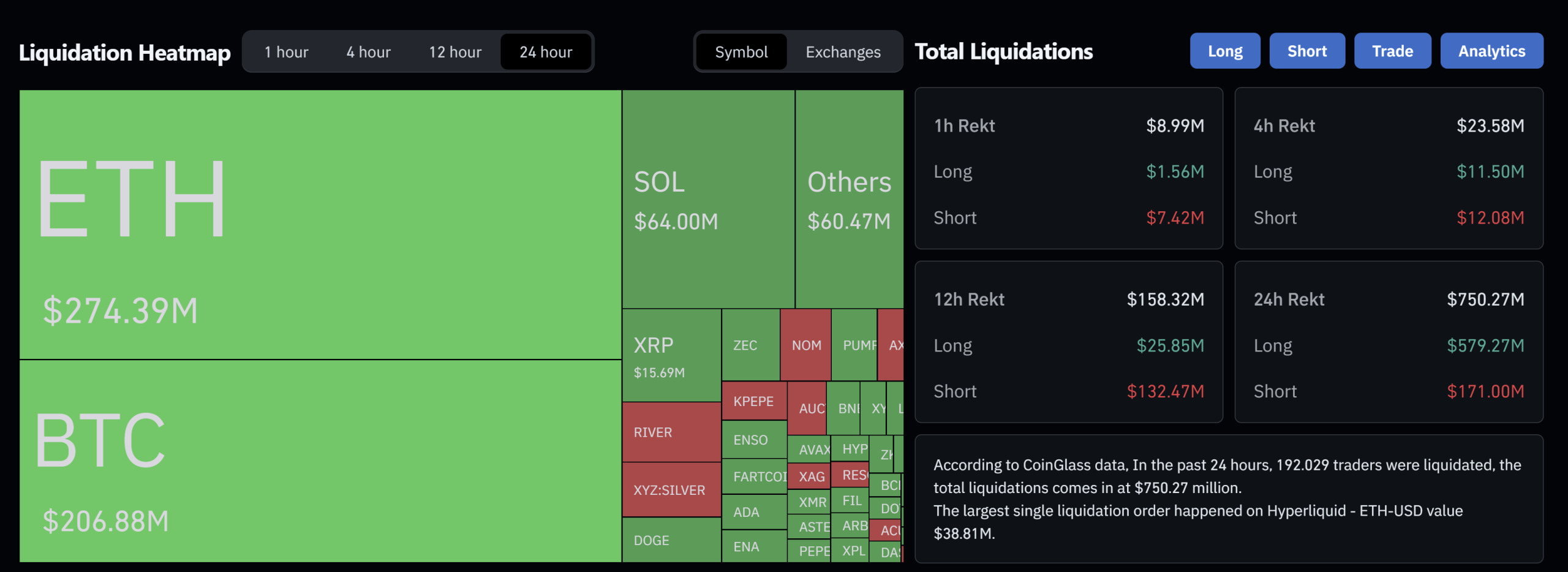

According to Coinglass, liquidations in the last 24 hours total $750.77 million, of which $579.27 million were longs and $171.50 million were shorts. This included $274 million in ETH, $207 million in BTC, $64 million in SOL and around $60.6 million in other tokens. A clear “long flush”: liquidations force sales, which act as market orders in the falling movement and drive it further.

At the same time, the sentiment on the TradFi markets changed: due to the uncertainty from the USA, futures weakened, gold benefited again and rose above $5,000 for the first time (another record high).

Added to this is a week full of market-moving events, including the market reaction to Trump’s 100% Canada tariff threat and the increased shutdown chances, the Fed interest rate decision and press conference on Wednesday, the quarterly figures from Microsoft, Meta and Tesla on Wednesday and Apple on Thursday and the PPI inflation data for December on Friday. In such “risk-off” moments, Bitcoin is often sold.

Bitcoin recovery sustainable?

This Monday there was a recovery to $88,424 (intraday high), but the setup remains fragile. The renowned German YouTuber Furkan Yildirim classifies the bounce as follows: “Futures-CVD (orange): recently flat/sideways – the derivatives provide little additional buying flow. Spot-CVD (gray): recently with a clearly positive slope – the bounce is carried by the spot market. Open interest: slightly recovered after the flush and sideways – cautious rebuilding, no aggressive risk-on.”

Yildirim names concrete conditions for short-term viability: He sees sustainability as “medium” and links it to continued positive spot CVD, controlled increasing open interest and ideally stable to neutral funding; If the spot CVD turns down or the OI rises when funding increases without price progress, the risk of a setback increases.

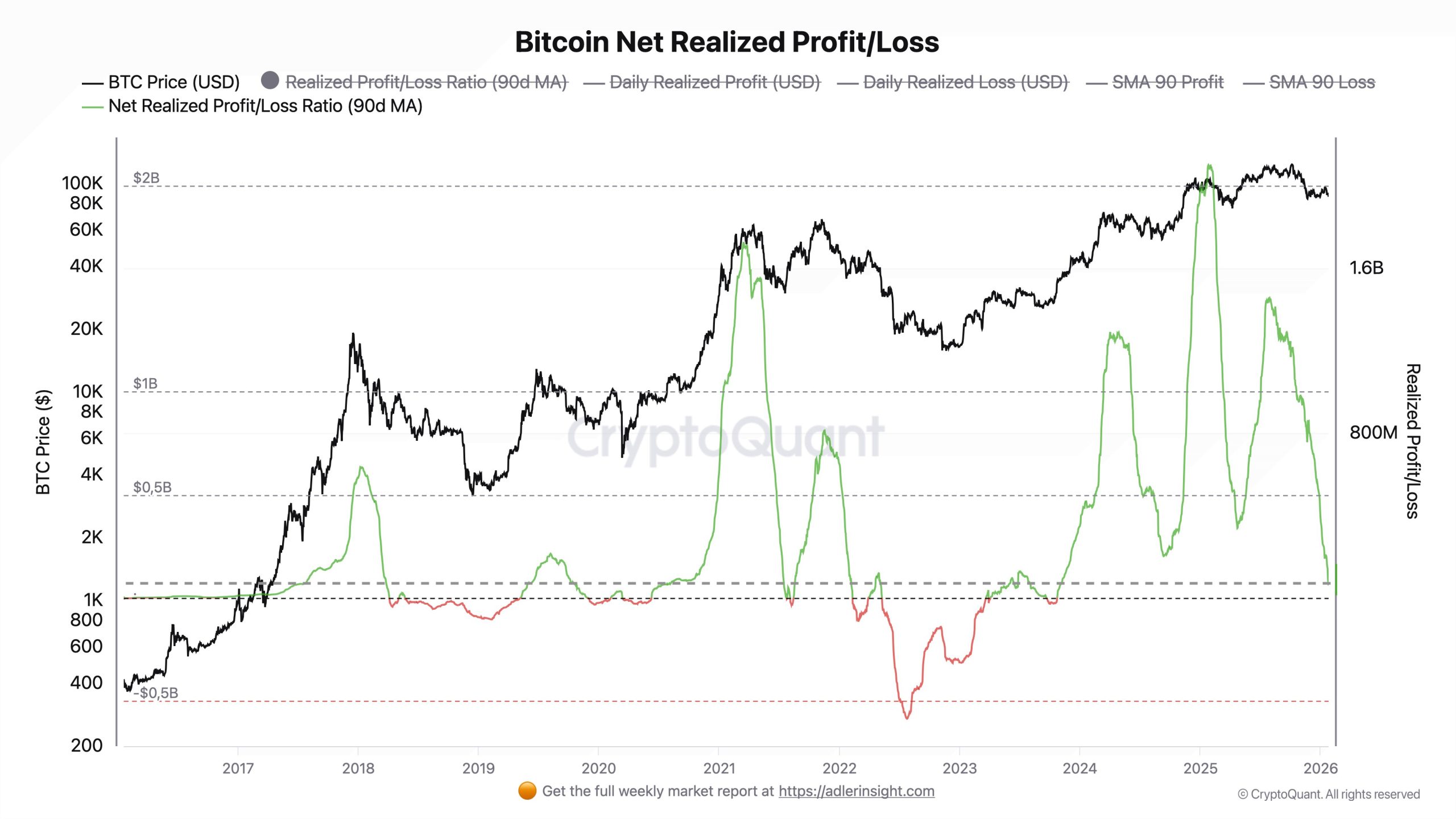

CryptoQuant Contributor Axel Adler Jr. points However, there is a warning signal:

“Net realized profit/loss has fallen by 97% and is back to zero. The last time this happened was in June 2022 – just before the collapse from $30,000 to $16,000. Large investors (whales) are still in the black (with a buffer of 25-80%), so there is no panic yet. However, the market is not supported by buyers, but by the absence of sellers.”

No Comments