- The initial applications for unemployment benefit and the inflation data make the new direction of the BitcoIN course expect for one month, because they depict the current economy.

- Sales of private property affect the mood in the cryptom market, since investors routinely observe this important market towards new trends.

This week, crypto dealers are concentrated US economic indicatorsthat affect Bitcoin and the wider space of digital assets. The most recent US inflation data shows how the upcoming data for work, production, services and real estate will influence FED policy and the risk of risk to investors.

The cryptoma market reacts strongly to macroeconomic data that influence interest rates and growth expectations. The four indicators this week are the initial applications for unemployment support, the PMI for the service sector and the processing industry as well as the sales of existing houses.

Unemployment statistics

The initial applications for unemployment support (initial jobless claims) state the number of newly requested unemployment support. This labor market indicator is an important indicator for the economy and the Expectations at The Fed policy. The data from Thursday will show whether the labor market is strong or weak.

Economists expect 232,000 applications, a slight increase compared to 229,000 last week. An increase in applications could indicate a weakness in the labor market, which would reduce the likelihood of tightening by the Fed and boost crypto prices because investors are looking for locks. If the claims are below 229,000, that would be a sign of economic strength, which would strengthen the US dollar and put Bitcoin and other risk systems under pressure.

The demands have been constant in the past few weeks, and despite the trade voltages, there has been no stress on the job market. Crypto retailers will observe this number closely, as it could make volatility and USD strength in advance of the next Fed decisions.

Inflation rate for service sector and processing business

The inflatinos rate for the service sector and the processing industry, both of which are published on Thursday by S&P Global, provide monthly snapshots of US economic activity in key sectors. Values over 50 indicate growth, while values under 50 signal a shrinkage. This data provides information about the economic dynamics and influence the risk mood on the cryptoma markets.

The inflation rate for the service sector includes sectors such as transport, finance and hospitality. In April the value was 50.8 and thus signaled moderate growth. The consensus for the May Inflatiosrate is 50.8, whereby a decline can trigger less than 50 Bitcoin course jumps because it indicates economic weakness.

The inflation rate for the processing industry reflects the Health of the industrial sector widerthat has recently come under pressure through tariffs and supply chains problems. In April the value was 50.2, which means a slight decline. The May forecast of 49.8 indicates weakness. A result of less than 50 can trigger crypto purchases because the economic concerns increase. However, a value of over 50 could strengthen the dollar and dampen enthusiasm for crypto-assets.

Sales of private properties

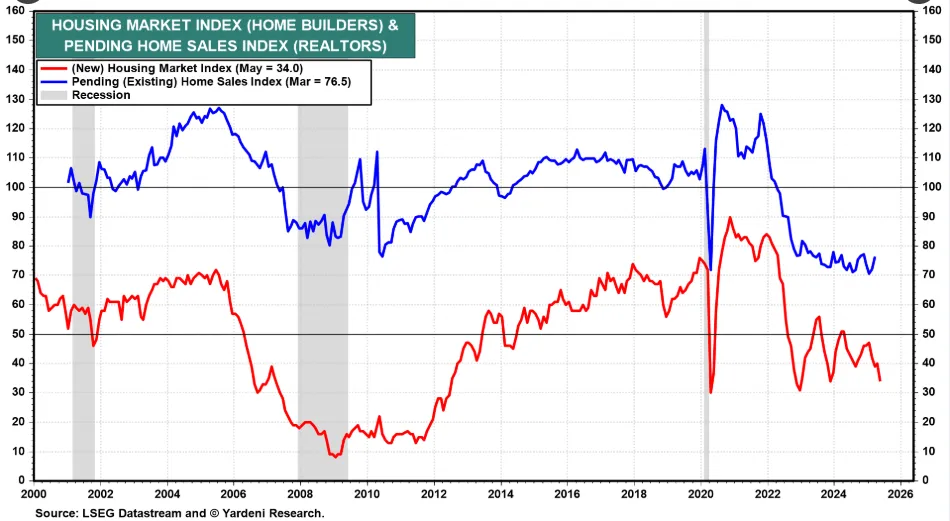

The Report on the Private sales of homes in April are published in expectation of falling sales. The National Association of Realors assumes that sales will decrease from 724,000 to 700,000 in March. The indicator reflects consumer confidence and the condition of the real estate market and thus indirectly influences monetary policy and the market mood.

A severe decline in home sales could increase the fears of an economic slowdown and increase the attractiveness of Bitcoin as security. High mortgage interests and tariff -related pressure burden the demand for housing and increase this effect.

If the sales stabilize or exceed the forecasts, this could strengthen the US dollar and reduce the appetite for crypto assets, which signals more stable consumer confidence. Dealers and investors will carefully observe this data in order to obtain indications of wider economic trends.

Bitcoin is currently being traded near $ 104,871, which corresponds to a decline of 0.45% in the last 24 hours. The market faces a resistance around the $ 106,000 mark, where it previously formed a double top. Setbacks near this area are still normal because the buyers are looking for burglaries to get in. A breakthrough over $ 110,000 mark could trigger a new upswing, but the market movements could depend on the economic data published this week.

Crypto investors will follow the US economic indicators carefully this week because they influence the expectations of the US Federal Reserve, the strength of the US dollar and the streams of risk systems. The data will influence short-term volatility and determine the trading strategies on the Bitcoin and cryptoma markets.

No Comments