Weekly record 2025: Crypto inflows reach $ 3.3 billion-XRP disappointed

- Bitcoin led $ 2.9 billion and drove the crypto systems to a record of 10.8 billion a year.

- The 80-week series of tributaries at XRP ended with drains of $ 37.2 million and marked the largest deduction so far.

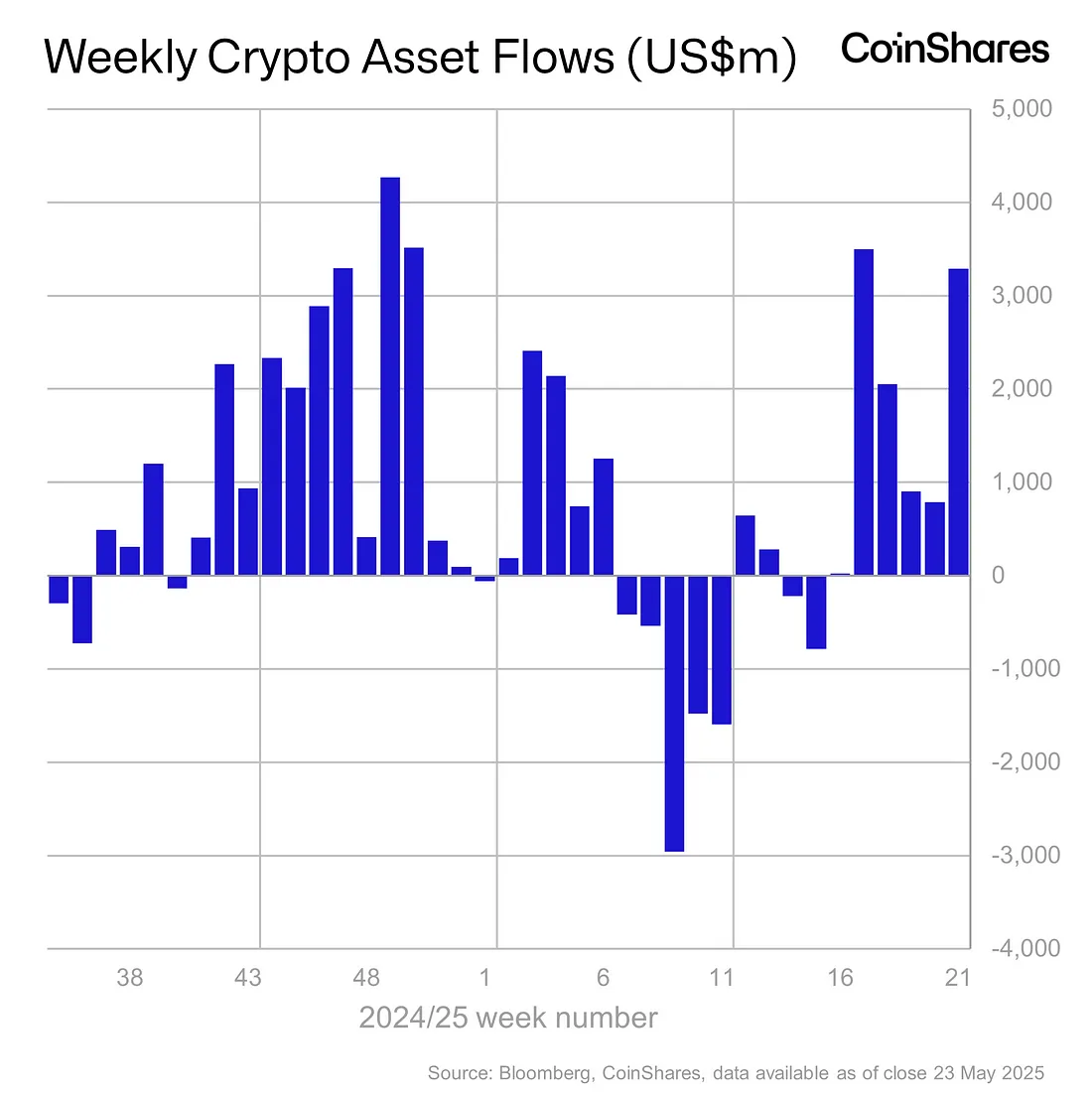

With a net inflow of $ 3.3 billion, digital investment products recorded another week with strong growth. This has brought the total amount of $ 10.8 billion since the beginning of the year (YTD), a new all -time high. Bitcoin recorded $ 2.9 billion in traces, while Ethereum received $ 326 million.

XRP recorded an outflow of $ 37.2 million and thus ended its 80-week series of successive tributaries. The increase marks six weeks with growth, since investors are still interested in cryptocurrencies despite the general economic uncertainty. Analysts attribute the increase to the fact that investors are looking for alternative systems in view of the volatility of the traditional markets.

Bitcoin dominates weekly inflow with an increasing institutional interest

Bitcoin was the leader with traces of $ 2.9 billion. This is almost a quarter of all previous tributaries in digital assets in 2024. According to market analysts, the increasing institutional demand and the price dynamics for the increase in capital allocation in Bitcoin are responsible. Short-Bitcoin products recorded tributaries of USD $ 12.7 million since December 2024, since some investors position themselves for possible setbacks according to the latest courses.

Also $ 326 million experienced a new interest with weekly tributaries. Ethereum has thus recorded the highest inflows for 15 weeks and extended his series of positive investment moods to five consecutive weeks. Analysts observed an increasing trust of the market in the fundamental data of Ethereum and the upcoming network upgrades.

80-week XRP Reupply phase ends-mood tilts

In contrast to the growths at Bitcoin and Ethereum, XRP recorded drains of $ 37.2 million. This ended an 80-week series of continuous inflows and was the greatest weekly drainage in XRP history. The reversal signals a change in mood among investors, even if no specific trigger for change was found.

At the regional level, the United States dominated the global tributaries and contributed $ 3.2 billion to the total value of the past week. Germany followed with $ 41.5 million, while Hong Kong and Australia recorded $ 33.3 million or $ 10.9 million. In Switzerland, investors used the price gains to secure profits, which led to outflows of $ 16.6 million.

The entire managed assets (AUM) for investment products with digital assets briefly reached an all-time high of $ 187.5 billion at the beginning of this week. Industry experts suspect that the increasing concern of US economic outlets-triggered by a recent downgrading by Moody’s and an increase in treasury returns-could have caused investors to diversify into digital assets.

Since investor behavior continues to change in times of economic instability, digital assets seem to be gaining in importance as a security and diversification tool. The continuing inflows underline a broader trend that institutional and private capital shifted to the cryptos sector in 2024.

No Comments