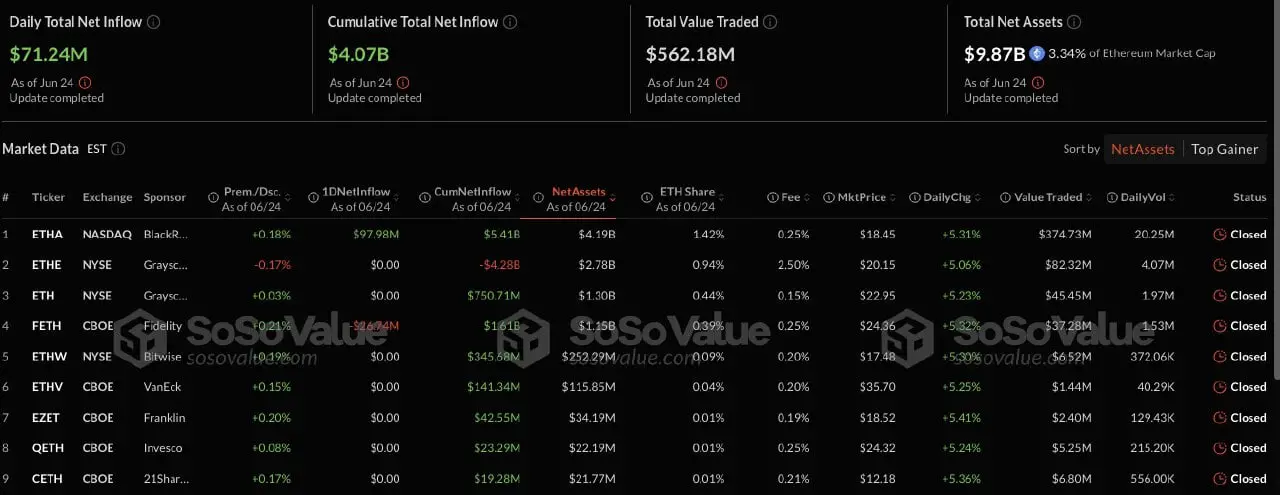

- Ethereum ETFs grew by over one billion dollars in just two weeks. Wallstreet institutions apparently invest in a large scale, and the Ethereum market is recovering.

- The Grayscale-ETHE lost $ 4.28 billion, since investors are increasingly prefering the cheaper spot ETFs with direct ethereum engagement.

Spot ETH ETFs in the USA have had net inflows of more than one billion dollars in the last 15 trading days, a round of their current value of over 4 billion. The increase shows a growing institutional interest in ether, since the market conditions improve and the fee structures remain competitive.

Investors show an increased commitment that is powered by the accumulation of Ethereum compared to Bitcoin and the growing acceptance of ETH-based financial products. With the form of 13F submissions upcoming in mid-July, market observers expect a confirmation whether large asset managers are expanding their commitment to Ethereum.

Blackrocks Ethereum-ETF, Etha, has proven to be the market leader with cumulative net inflows of over $ 5.4 billion. The net assets of the ETHA listed on the Nasdaq is $ 4.19 billion. The stock market -traded fund recorded a daily trading volume of $ 374.73 million, with 20.25 million shares recently changing the owner. On June 24, Etha’s market price rose by 5.31 % and closed at $ 18.45.

The Fidelity Feth ETF, which is traded on the CBOE, has a net assets of USD 1.15 billion with cumulative tributaries of USD 1.61 billion, despite a slight daily outflow of $ 26.74 million. The fund’s market price rose by 5.32 % to $ 24.36.

Smaller but larger tributaries also recorded the ETHW of Bitwise, the ETHV of Vaneck, the Ezet of Franklin, the Qeth of Invalco and the Ceth from 21shares, each achieving daily price gains between 5.24 % and 5.41 %. This width of the inflows across several products indicates a broad investor interest in Ethereum ETFs.

Ethe-ETF loses from Grayscale

While newer spot ETFs have tribes, the flagship fund of Grayscale has had to accept significant net drains of $ 4.28 billion since its laying on. Nevertheless, Ethe has a net assets of $ 2.78 billion and closed with a market price of USD 20.15, which corresponds to an increase of 5.06 % that day.

The drainage from the Ethe of Grayscalenkönnen can be attributed to the fact that investors shift to spot ETFs with lower fees and more direct engagement in the Ethereum Prize, as these products are gaining tensile force.

The other Ethereum-based product of Grayscale, ETH (Ticker ETH), recorded cumulative tributaries of $ 750.71 million. Its net assets amount to $ 1.3 billion, while the market price has increased by 5.23 % to $ 22.95. This data indicates that Grayscale’s offer in the changing competitive landscape of the Ethereum system vehicles has a certain resistance.

Growing appetite of the institutions

The net assets of all Ethereum ETFs are now $ 9.87 billion, which corresponds to about 3.34 % of the total market capitalization of Ethereum. This growing proportion illustrates the increasing institutional acceptance of Ethereum-related financial products. The timing agrees with the price recovery of Ethereum compared to Bitcoin, which could affect portfolio liabilities.

The trading volume and the participation of investors have also increased. On June 24, Ethereum-Kassa-ETFS alone recorded a net inflow of $ 71.24 million and a total trading value of $ 562.18 million. These numbers indicate a robust trade environment and an increased trust of investors in ETH-based ETFs.

No Comments