Vechain supports Blackrock competitor Franklin Templeton in the fund business

- Franklin Templeton opens his Benji platform for Vechain, with it Companies have broader access to tokenized funds.

- The decision fits into the long-term planning of F. Templetons multi-chain expansion strategy, not least because of the predictable costs.

Franklin Templeton has chosen Vechain to increase the reach of his tokenized money market fund and thus enter into an increasing competition in which Blackrock and Ondo are already represented. The new integration will enable Franklin Templetons Benji platform to operate on Vechain and companies that use this blockchain to give access to tokenized proportions of its $ 780 million US Government Money Fund (fobxx).

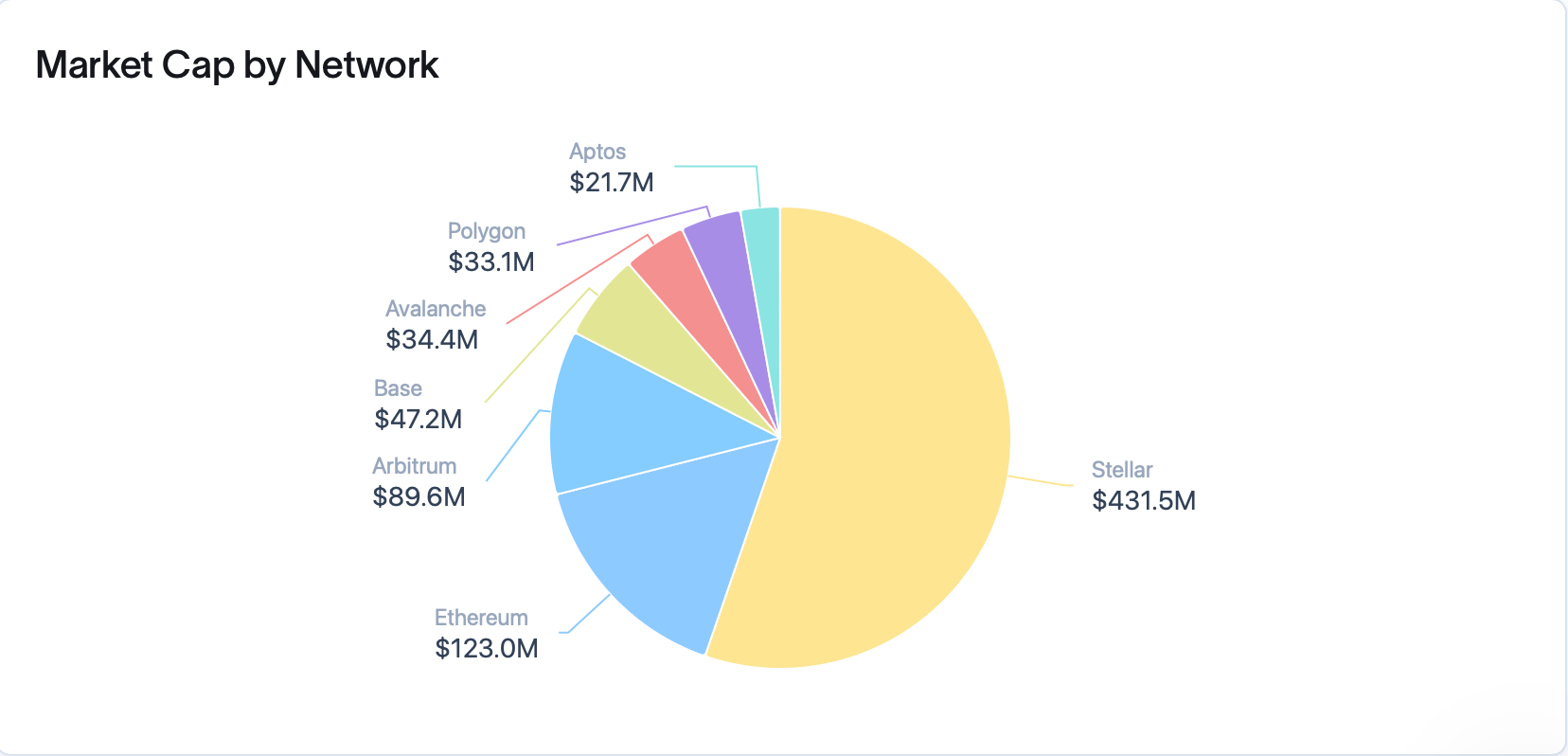

Benji offers tokenized access to FobXX, which is invested in short-term US state documents such as treasure change and repurchase agreements. Each Benji token contains a single fund share that is set to a stable value of $ 1. With this step, Vechain is part of a list of seven blockchains that are currently accommodating Benji, namely Stellar, Ethereum, Arbitrum, Base, Avalanche, Polygon and Aptos.

Although the TVL (Total Value Locked) With currently $ 1.61 million, Vechain offers some operational advantages that can be interesting for corporate customers. Due to the blockchain architecture, transaction costs are low and firm, which meets the requirements of institutional financial products such as money market funds.

Franklin Templetons Fobxx leads with 690 owners

Among the great actors in the area of tokenized state funds, Franklin Templetons Fobxx with 690 owners is a leader. Its competitor, the Blackrock Buidl fund, has a much larger market capitalization of $ 2.4 billion, but less than 100 shareholders. In third place is the Short-Term US Government Bond Fund from Ondo with a fortune of $ 709 million, which also has fewer than 100 users.

Most of Benji’s market capitalization of $ 780 million is no longer applicable to Stellar, which currently holds $ 431.5 million. Smaller shares do not apply to other blockchains such as Ethereum and Avalanche. The addition of Vechain aims to further expand access, especially for companies that want to start paying and treasury functions based on digital assets.

The VECHAIN partnership is also supported by other companies. Bitgo will act as a custody partner and ensure the safe handling of the digital fund shares. Keyrock, an investment company specializing in cryptocurrencies, will enable Benji users to trade in derivatives, which could increase the benefits of the platform for institutional actors.

The Vechain alliance is also supported by some other organizations. Bitgo will be the custody partner who is responsible for the safe handling of shares in digital funds. Keyrock, an investment company for cryptocurrencies, will offer trading with derivatives for Benji users, which could increase the functionality of the platform for institutional actors.

F. Templeton relies on tokenized funds-with initially low VECHIIN activity

The cooperation is described by Franklin Templeton as a way to diversify his sales model. An explanation of the company emphasizes the advantage of being able to serve institutional customers:

“It is a differentiated way to integrate tokenized money market funds into your payment and cash management options.”

It fits the more comprehensive strategy for building connectivity between blockchain systems and traditional finance. Although Vechain lags behind in total usage compared to other supported chains, Franklin Templeton’s decision signals a long-term plan to integrate corporate customers across various blockchain environments.

At the moment, the decentralized stock exchanges on Vechain show a limited commercial activity with a volume of only $ 36,221 in seven days. But Franklin Templeton seems to play a long-term game and tries to increase Benji’s benefits across several chains instead of only concentrating on short-term metrics such as TVL or Dex use.

No Comments