- According to experts, a recession of the US economy on the Bitcoin market would act as a catalyst.

- The Bitcoinur is currently $ 82,110.36 after crashing from his February high.

A recession in the USA could BTC course course significantly although analysts predict that this could serve as an important catalyst. The Bitcoin course moves at $ 82,100 and thus declined sharply from its earlier highs of over $ 90,000 in February. In the past few months he has experienced considerable volatility and has been in between $ 80,000 and $ 90,000. Market analysts attribute this to broader economic concerns and a changed investigation.

Despite the downturn of Bitcoin, the most important US stock indices have shown a mixed performance, which reflects the general economic uncertainty. The S&P 500 has increased by 1.07 %, while the Nasdaq rose by 1.71 %, while the NYSE recorded a slight decrease of 0.41 %. These market shifts indicate that investors weigh up the risks in view of the growing concern about economic loss.

BlackRocks Bitcoin-Strategie

Robbie MitchnickHead of the Department of Digital Assets With black skirtis of the opinion that a recession in the USA could unexpectedly promote the spread of Bitcoin. He argues that if the traditional markets falter, investors could turn to Bitcoin as value preservatives. This view is in contrast to conventional opinion, which cryptocurrencies often consider risky in times of financial downturn.

ICYMI: BLACKROCK GLOBAL HEAD OF DIGITAL ASSETS ROBBIE MITCHNICK SAYS “A RECESSION WOULD BE A BIG CATALYST FOR BITCOIN”

— DEGEN NEWS (@DegenerateNews) March 19, 2025

The decentralized nature of Bitcoin makes it an attractive alternative to traditional financial systems during economic instability. Investors often look for assets that offer protection against inflation and currency devaluation, and Bitcoin fits into this role. With increasing fear of recession, the attractiveness of Bitcoin could increase as a “digital gold” and attract more institutional and private investors.

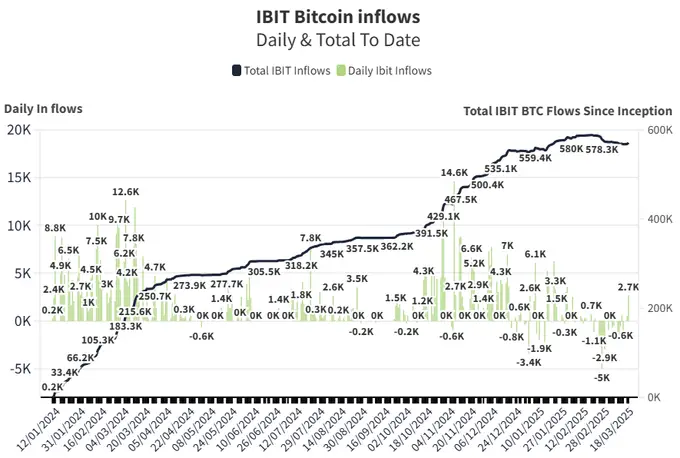

On March 19, 2025, Blackrock took a remarkable step and bought 2,660 Bitcoin for his Ishares Bitcoin Trust (go). This was the biggest Bitcoin purchase in a single day for Ibit in six weeks.

Since January 2024, the Bitcoin stocks of Blackrock have risen from 33.4,000 to 580,578.3,000, which reflects a continuous accumulation. The company has strategically increased its commitment through constant tributaries, with occasional sales. Despite the market fluctuations, Blackrock continues to expand its Bitcoin portfolio and thus underlines its commitment to cryptocurrency.

Those: X

The daily inflows fluctuate into the IBIT, with a peak of 14.6,000 being achieved at the end of 2024. While there were minor drains on some days, the general trend indicates a persistent interest.

When writing this article, the BTC course rose in 24 hours earlier to 3 % to $ 86,242. In addition, sales rose by 54.36 %, which indicates that the bulls can also dominate the BTC market in the coming hours.

No Comments