US economic data for February: Possible shock waves for the crypto industry

- The US economic reports this week, including retail sales and new applications for unemployment support, could significantly influence the mood of investors and the cryptoma markets.

- Mixed signals from the data on housing and the applications for unemployment support could affect the attitude of the FED and impair the risk to risk for speculative systems.

For the financial markets, there is a crucial week in which several important US economic data are published. These reports could have a significant impact on the cryptocurrency market. The first important report, the US individual trading index, will be published on Monday and offers a snapshot of the trends in consumer expenses.

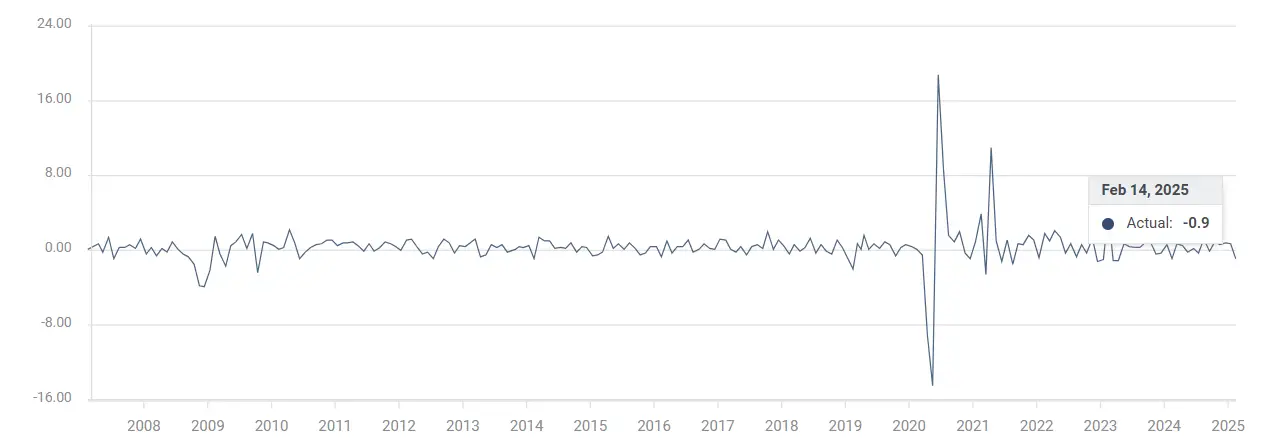

Retail sales broke heavily in January. But you assume a relaxation. Better retail sales could improve the mood of investors, but the US Federal Reserve could also persuade to maintain a tighter monetary policy.

Higher consumer expenses often signal economic strength, which can increase the willingness to take risks and capital in volatile assets such as cryptocurrencies. However, if the Fed sees strong sales as the reason to keep interest rates high, this could dampen the enthusiasm of investors for speculative systems.

Housing market with contradictory signals

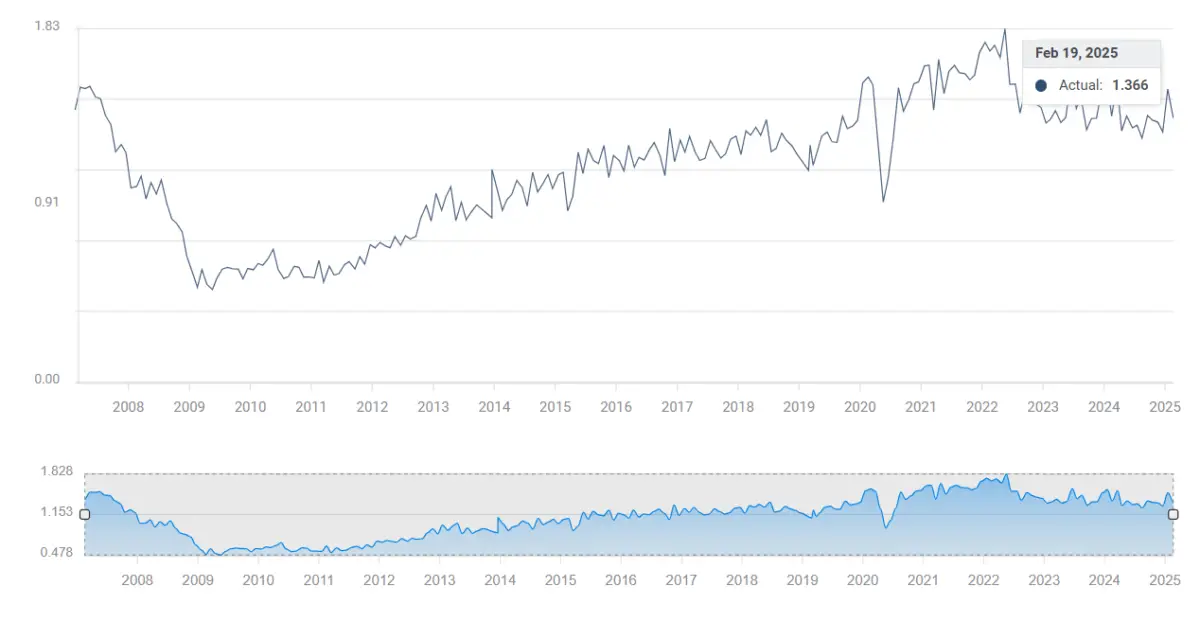

On Tuesday, the US Housing Starts Index will provide information about the condition of the real estate sector. The index measures the number of new housing projects and thus provides information about economic stability. In January, the housing construction gear from 1.515 million to 1.366 million, which arouses concern for slowing down.

The expectations of the analysts are different: the consensus predicts a slight recovery to 1.375 million, while Teforecast expects a further decline to 1.34 million. An increase in housing construction could be a sign of the resistance of the economy and promote investments. However, stronger numbers for housing construction could also heat speculations about future interest rate increases, which could have a negative impact on riskier markets such as cryptocurrencies.

The open market committee of the US Federal Reserve (Federal Open Market Committee, FOMC) is also come together on Tuesdayto advise on monetary policy, and an interest rate decision will be made on Wednesday. Experts assume that the FED will keep interest rates constant, but unexpected steps or statements could shake the trust of the markets.

Unemployment figures and real estate sales

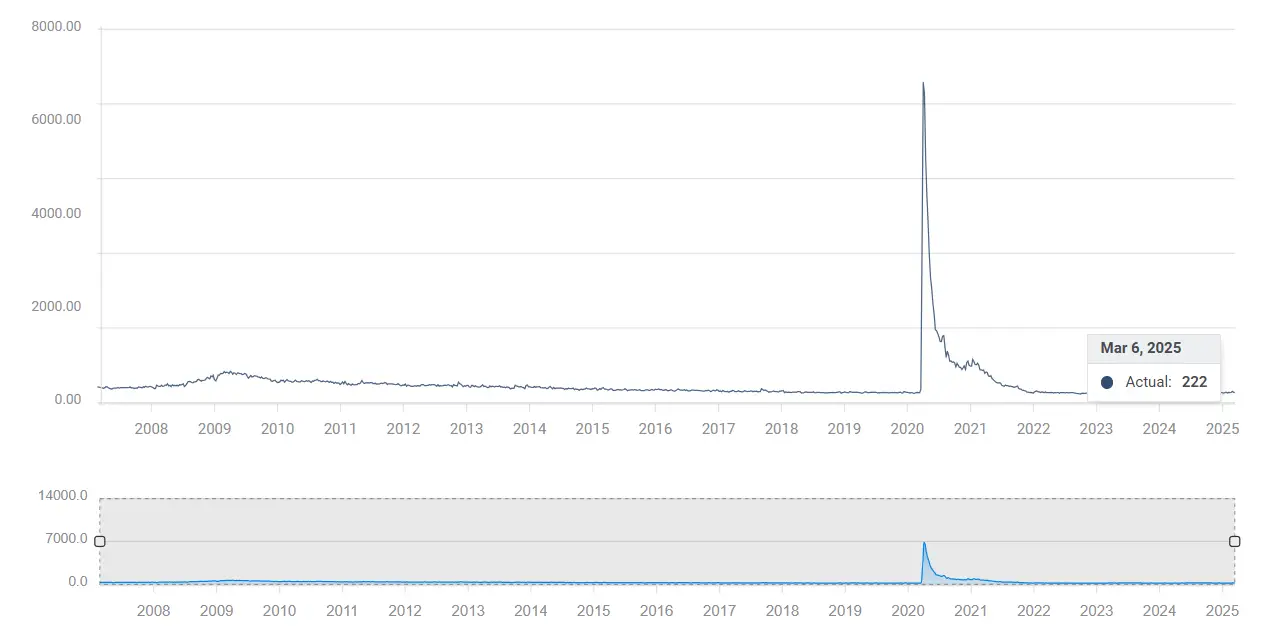

The US index of the first applications for unemployment support, which is to be published on Thursday, will provide information about the employment situation. At the beginning of March, the first applications for unemployment support from 222,000 to 220,000. The market consensus expects a significant increase to 224,000, while Teforecast predicts an increase to 225,000.

If the number of applications for unemployment support is higher than expected, this could indicate a weakening labor market. This could weaken the trust of investors in the traditional markets, but also reduce the pressure on the US Federal Reserve Fed, to keep interest rates high, which could support the cryptoma markets.

In the meantime, the US index for sales of existing houses will also give an insight into consumer trust on Thursday. The report for January showed a decline from 4.29 million to 4.08 million home sales based on the year. Analysts expect a further decline to 3.92 million, which increases the concerns about economic cooling.

If the home sales go back, this could indicate that consumers are reserved for larger purchases. This could affect the general market mood, also in the crypto area, where the optimism of investors often correlates with the economic situation.

No Comments