- Ukraine plans an income tax of 18% and a military tax of 5% on crypto profits.

- Cryptoswaps are excluded and private trade is also not affected.

Ukraine abolishes the tax exemption from profits from crypto systems. A taxation of digital assets with a tax rate of 18% and a military tax of 5% are planned. The new taxes and levies are mainly due to the war,

Evaluation framework with detailed asset classification

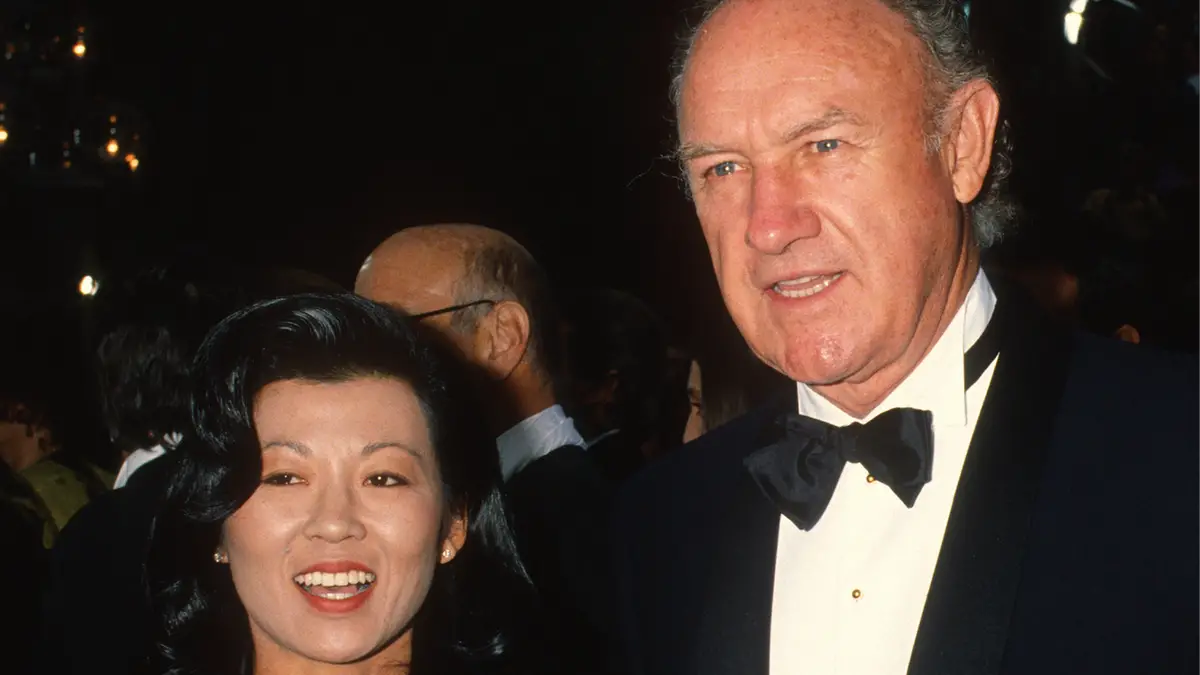

The head of the Ukrainian security and stock exchange supervision Ruslan Magomedow presented the new regulations. Companies that work with crypto transactions pay a corporation tax of 18%. There are reduced tax rates between five and nine percent on certain crypto transactions, depending on the classification of yield and the source of income.

Crypto-assets are divided into three groups:

- Stablecoins

- Commodities and value paiere

- NFTS and all other crypto values that do not belong to Group 1 or 2

Stable coating shops that are considered currency transactions are tax -free. Commodities and securities as well as all profits from assets in Grppe 3 are taxed according to their eternal classification.

The tax authority admitted that it is difficult to monitor all transactions with cryptocurrencies. The new tax system only applies to crypto exchanges between digital assets and Fiat currency or physical goods in accordance with the principle of the “Fiat Exit”.

Stay crypto swaps and stable coin currency transactions remain tax-free

Ukraine resembles its tax exemption for trading cryptocurrencies to that of Austria, France and Singapore to keep frictional losses in the trade in other countries as low as possible. Tax exemption brings relief for regular dealers who participate in decentralized financial activities. Transactions between crypto owners are excluded from taxation. The exchange of crypto assets in Fiat currencies or real goods triggers a taxable process.

The frame implements two different tax procedures, which are referred to as net and gross income taxation. With the net model, only the profits that remain after deduction of business costs are taxable.

As part of the gross income model, a fixed taxation applies to the total income regardless of the expenditure. This applies to stakeholder transactions as well as crypto mining and distributed drop programs.

VAT applies to both the use of digital currencies in payments and to processes of token modification. Several transactions are suitable for tax exemptions according to the EU VAT directive. The Ministry of Finance and the National Bank of Ukraine want to fully implement this framework by October 2025 and are based on the EU VAT directive.

No Comments