- Dana White praised VeChain’s long-term vision, although VET price is currently struggling – but investors remain cautiously optimistic.

- White is an entrepreneur and president of the Ultimate Fighting Championship UFC, a mixed martial arts organization in the USA.

UFC’s Dana White praises VeChain’s long-term vision as VET suffers setback in November, combining the strong convictions of a major sports personality with a month marked by waning strength. White said VeChain is its only digital asset, boosting confidence in VeChein despite weak activity in derivatives markets.

"The only crypto I own is VeChain"

– Dana White, President and CEO of @ufc.Strategic, long term vision is one of the most critical aspects of success.

Keep building for the future. $VET pic.twitter.com/209epn7Pk5

— VeChain (@vechainofficial) November 13, 2025

White praised VeChain’s long-term planning and highlighted the steady progress the project is making. His comments came during weak market activity in November and highlighted dwindling traders’ confidence. Prices moved only moderately, but VeChain focused on long-term targets rather than daily fluctuations that cause short-term swings.

After VeChain published White’s comment, interest grew, although VET remained much lower than before the October plunge. Weekly gains rose over 20%, bringing relief to some holders. Seasonal trends suggest November could improve, but traders remained cautious and avoided adding further positions in recent sessions.

Market often rebounds after November rally

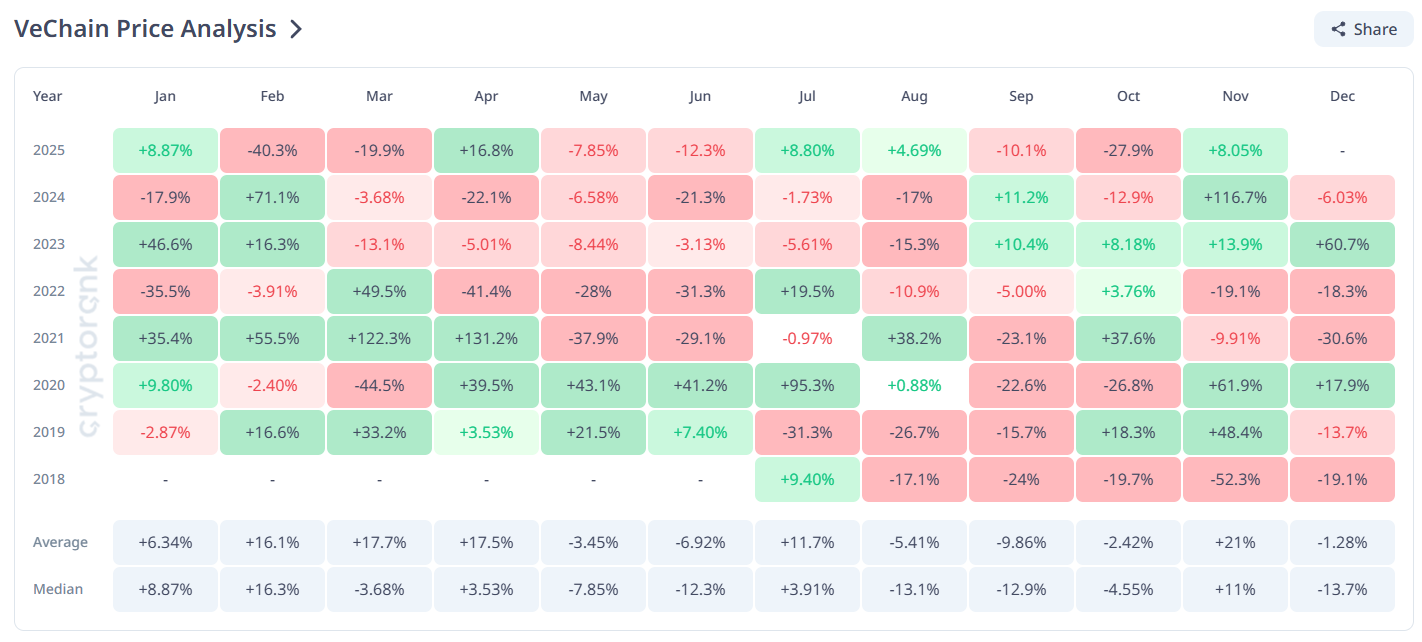

Historical figures show that November has produced higher median and average profits over the past seven years. With median returns around 10.9% and average returns around 20.9%, some investors are watching current trends with cautious hope. This pattern often leads to quieter periods, giving long-term investors a feeling of steady growth.

December produced a different pattern, often reversing previous progress. Markets typically fall after November gains, showing that recoveries can fade toward the end of the year. Investors have often been feeling uneasy in recent weeks, worried that the market will pull back after recent sharp rises instead of continuing its upward trend.

Open interest fell drastically in October and remained flat for over a month. Traders avoided new risks, which limited profits. When positions remain weak, upward moves often lose strength, especially in uncertain market conditions.

Price can reach 0.0185 dollars

At the time of writing, VET is trading at around $0.0159, slightly below its previous level of $0.0170. Traders see a steady downward trend in recent price movements. If VET clears the next resistance, the price could rise towards $0.0185, which would mark a small rebound after yesterday’s sharp and extended decline.

A move towards $0.0185 would represent a small intraday gain that would mitigate recent weakness and bolster hopes for stability in the coming sessions. Market sentiment depends on buyers maintaining their momentum near resistance as a stronger push will require even more activity from traders in the derivatives markets.

Failure to overcome resistance indicates weakness. If the price falls below $0.0157, it could decline towards $0.0147, putting pressure on recent gains. A loss of nearby support could disrupt the normal November trend and increase concerns about market sentiment heading into late 2025, leading many traders to remain cautious overall.

Traders watched the market volume closely and waited for confirmation before changing their positions. More active participants often push prices in a clear direction, especially near key barriers. Observers monitored the flow of orders to see early signs of renewed buying ahead of a steady rise.

VET price faced a pivotal moment as both seasonal optimism and uncertainty were felt in the market. White’s comments sparked interest, but investors need more to feel confident. The next trading days will reveal whether VET can rise above resistance or fall lower as cautious trading continues to influence its movement.

No Comments