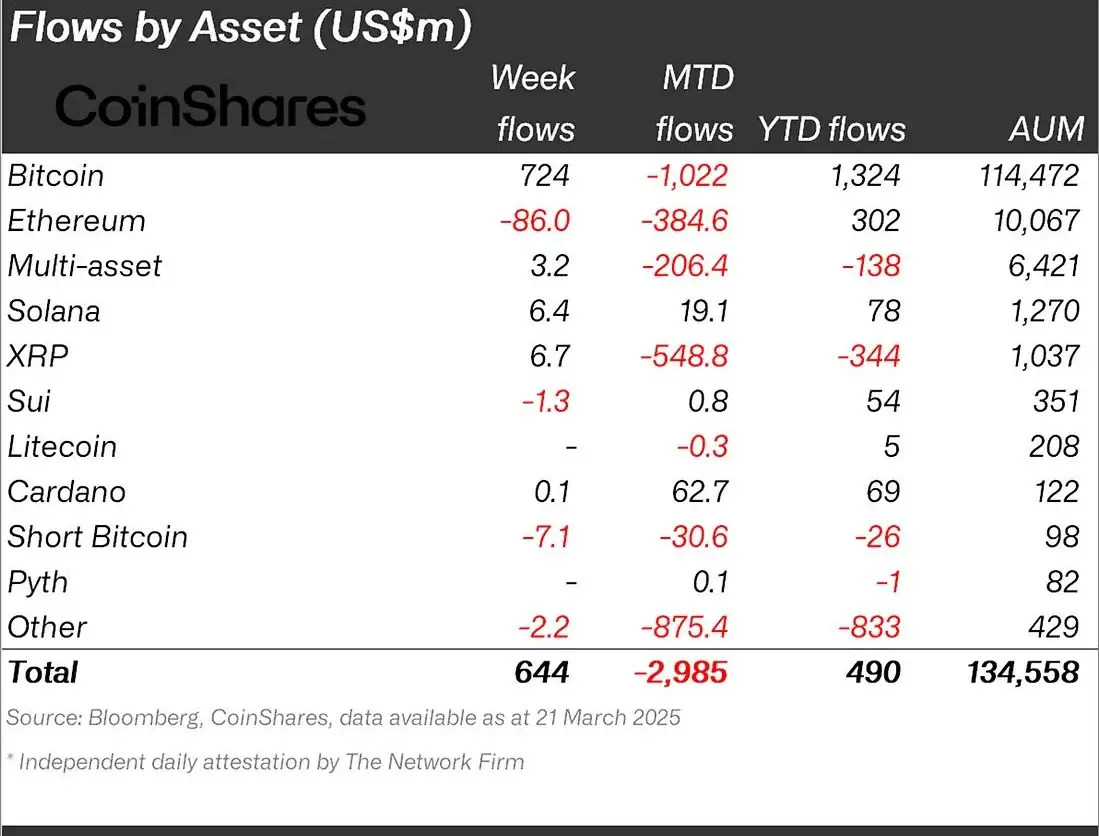

- After five weeks in a row, the third week of March was the first in which there were again capital inflows in digital assets instead of continuous drainage.

- In the weeks before Bitcoin lost $ 724 million, while Ethereum shook $ 86 million.

After five consecutive weeks, in which investors deducted their funds from digital investment products, there was an inflow of $ 644 million for the first time last week.

No small number in view of the strongly volatile markets recently. Most inflows went in Bitcoin. According to CoinShares It was $ 724 million.

The following table brings the access and drainage on:

Big comeback or quiet warning? Bitcoin’s double signals

If you compare Bitcoin with an old celebrity that is currently celebrating a comeback, he really caused a sensation this week. The strong influx of capital seems to be proof that investors gain new trust.

How CNF reporteda mysterious crypto wallet that had slept since 2016 was suddenly active again. A total of more than $ 250 million in Bitcoin were sent to two new addresses. Is this just the revival of an old asset, or is it a signal that insiders begin to act?

In addition, warns Asset manager VanEckthat the new wave of tributaries does not necessarily indicate a solid house. The company sees a pattern that should be paid – drains from institutional investors and a decline in the financing level. In the investment world, this could be a subtle warning signal that the speculative euphoria about Bitcoin begins.

Trust in Ethereum fades

On the other hand, Ethereum could not develop a similar swing. His investment products left $ 86 million. This is not just a question of numbers, but also shows the uncertainty of the market about a crypto project that was once considered the “future of the smart contracts”.

Although Ethereum has a strong foundation and many projects are based on it, an outflow of this size is a sign that trust has not yet completely recovered.

The market could see this as a moment of calm. But if there is no positive reports in relation to technology or acceptance in the next few weeks, it will take longer for Ethereum to turn the mood again.

Solana is considered by investors

Surprisingly seems Solana to win again. With an inflow of $ 6.4 million, the trend is not as strong as with Bitcoin, but it is a sign that investors start reorienting themselves. Solana had once broken down due to technical problems, but has recently improved his performance. Some have called a “new, more agile challenger” Solana will be the dark horse this year? Time will show it.

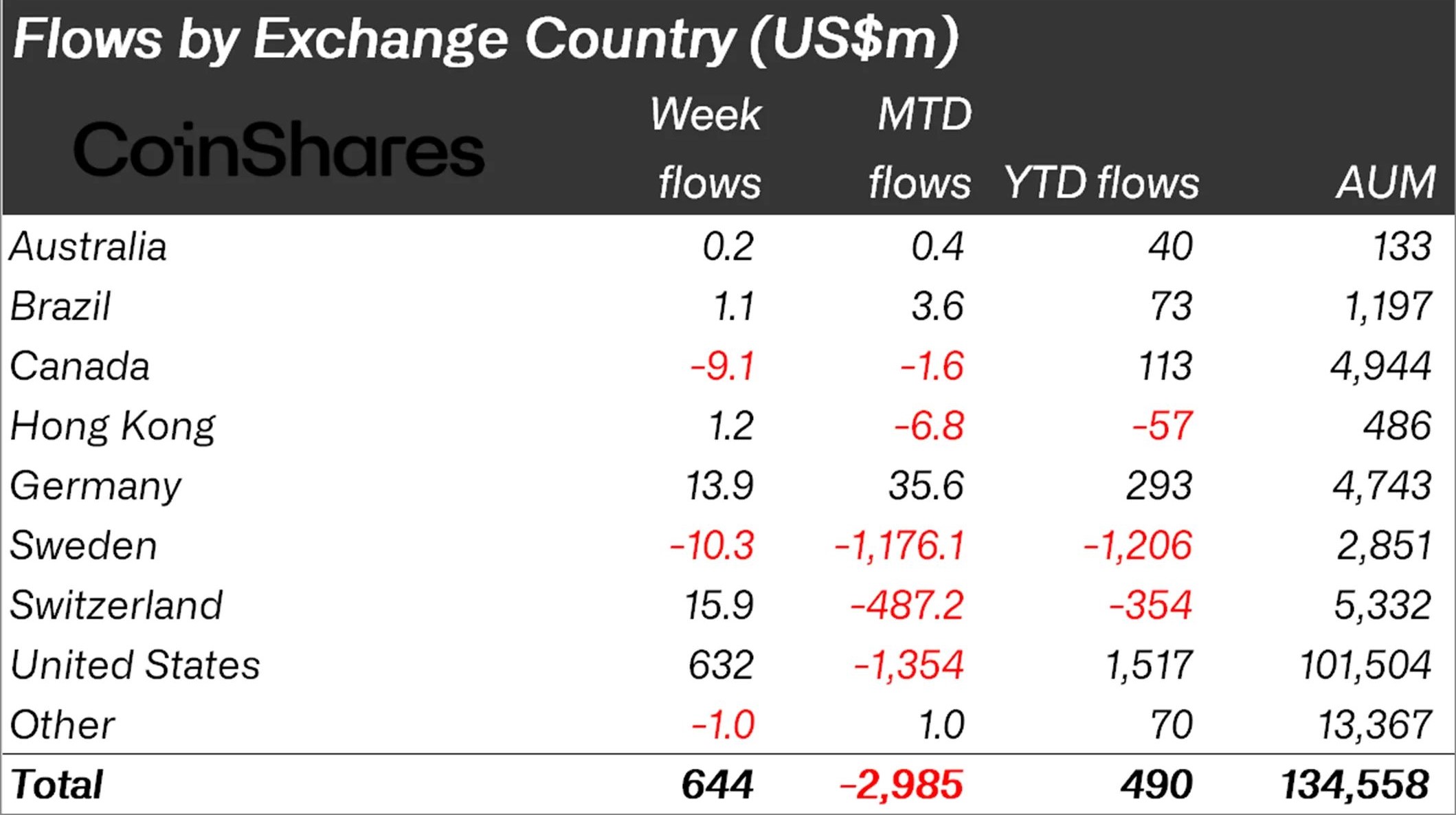

USA have the largest proportion of new market growth

Most new funds came from the United States last week, which contributed around $ 632 million. Switzerland, Germany and Hongkong pulled with, albeit to a lesser extent. The knowledge that wait is not an option if you want to be there on the next big deal seems to be spreading.

The following table brings up the inflows according to countries:

The crypto market is fast -moving, but the history of this week can be seen: the flow of money can be a snapshot of the market mood. But are we at the beginning of a housesee or is it the calm before the next storm? When Vaneck begins to speak of historical corrections and declining dynamics, you should be careful.

No Comments