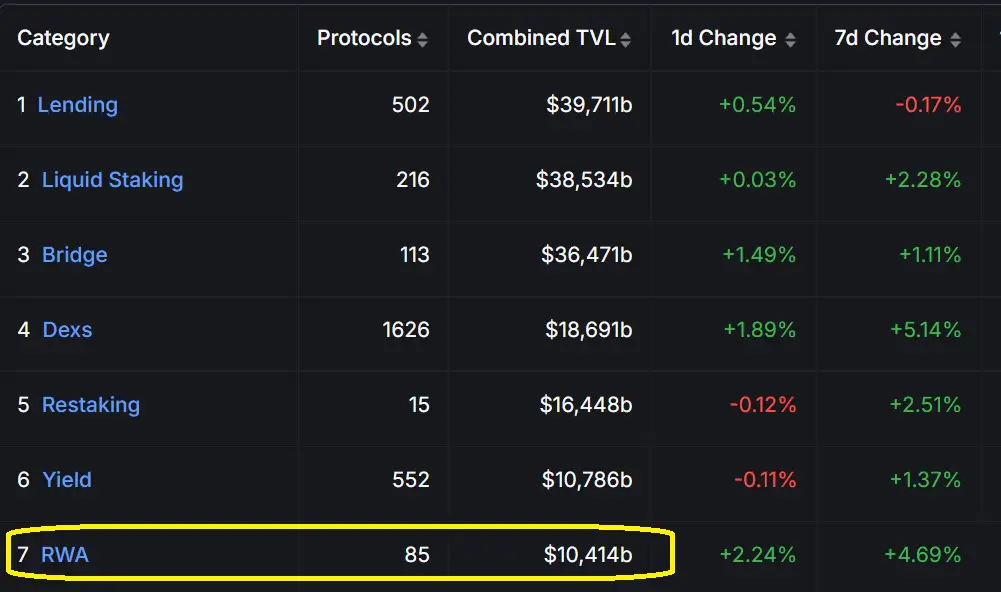

- The TVL of the RWA bound in Defi is now over ten billion dollars, with four protocols each exceed one billion dollars.

- The interest of institutions and the scalability of the blockchain are driving the RWA totization.

Sea Defill the TVL (Total Value Locked) has exceeded the Real World Assets in the decentralized financial sector $ 10 billion. This is a strong signal that “real world” and “crypto world” approach.

In the past, it felt like you want to combine two worlds that do not possibly match. Today we know: they fit.

This TVL tip is supported by large-scale projects such as Maker RWA, Blackrock Buidl, Ethena USDTB and Ondo Finance. Each of these projects has only exceeded the 1 billion dollar brand. If you compare this with a supermarket, these four actors would be the baskets of investors-full and heavy, which means that trust in the tokenization of real-world assets increases.

In addition, the attractiveness of Ethena USDTB also gives a different color. This stable coin is indeed unique because it is based on Blackrock’s money market funds and a strategy integrated in Usde.

And interestingly, the USDTB TVL rose by more than 1,000 % last month. Yes, this number is not a typo. It is like keeping a piece of paper under a fan – it flies up.

ZKSync is accelerating in the RWA race

How CNF reported, The second largest blockchain for RWA became a total of $ 2.03 billion after an explosive increase of 953.79 % within 30 days of $ 2.03 billion. At $ 4.12 billion, Ethereum is still at the top, but the speed of ZKSync is difficult to overlook. The attractiveness of the Layer 2 scalability, acceptance by large universities and various incentives that are supposed to attract new users help explain this success.

Imagine the whole thing like an car racing: Ethereum is the reigning champion that knows the route well, but ZKSync is the newcomer with turbos on all bikes. And yes, there is still a long way ahead of us.

2025 could be the year of tokenization

If you believe that this is just a temporary trend, take a look back on the article von The Australianthat was published on December 30, 2024. It states that the tokenization of assets in the real world will be one of the most important trends in the crypto industry in 2025. This process includes the conversion of assets such as real estate, intellectual property rights and raw materials into digital tokens on the blockchain.

With tokenization, assets that were previously difficult to act can be shared like a pizza – everyone can have a piece of it. This not only makes access easier, but also opens up new opportunities for more transparent and more efficient asset management.

The step of DTCC causes a sensation

Fascinatingly, the largest securities in the world, the Depository Trust & Clearing Corporation (DTCC), officially registered with the ERC3643 Association on March 20, 2025. This association is under the supervision of the ERC 3643 standard for permission-based real-world-asset token.

The procedure of the DTCC shows how serious the big institutions with the RWA is. Even if there have been critics in the past, everyone who still sees Defi as a dangerous experiment should rethink today.

Since the ERC-3643 standard is seen as part of its goal of creating a safer and more efficient financial system, the DTCC even openly expressed its support. Should an institute of this size enter the arena, confirmation for RWA seems to be undeniable.

A costly memory that security is still important

But not all news from the world of the RWA are as beautiful as the sunrise over the mountains. On March 21, a protocol for the restoration of RWA called Zoth was attacked by criminals. The result? A loss of over $ 8.4 million. Within a few minutes, the wallpers of the deployer were looted, converted into Dai Stablecoin and disappeared to other addresses.

This incident shows that although tokenization is becoming increasingly popular, the security aspect is still strongly neglected. It’s like a luxury house without a front door lock: it invites unwanted visitors.

No Comments