The mood among Bitcoin, ETH and XRP traders is in the basement – improvement in sight?

- The low mood for the top cryptocurrencies may have reached its maximum – at least there are now tentative rumors of recovery.

- But speculators have exited while long-term investors continue to hoard, knowing the recovery will come – the question is: when?

The crypto markets have entered perhaps the most passive phase of the year, evidenced by the extremely poor sentiment among Bitcoin, Ethereum and XRP traders. Data from Santiment show that social media discussions around key digital assets have become very fearful, an attitude that some analysts say often precedes an upswing.

According to Santiment’s latest report, comments on Bitcoin are evenly split between positive and negative, while Ethereum sees just over 50% more bullish mentions than negative ones. However, XRP appears to be causing the most concern, with less than half of discussions on social media pointing to trader confidence.

Traders’ moods are fading toward crypto, which is welcomed news for the patient.

Bitcoin $BTC: Even bullish/bearish ratio of social media comments (significantly lower than usual)

Ethereum $ETH: Just over 50% more bullish vs. bearish comments (less than usual)

XRP… pic.twitter.com/ZY9RXUxKDK

— Santiment (@santimentfeed) November 12, 2025

The crypto market continues to be under pressure from ongoing market uncertainty, despite the end of the U.S. civil service shutdown and the shift to assets more directly tied to the economy and credit conditions.

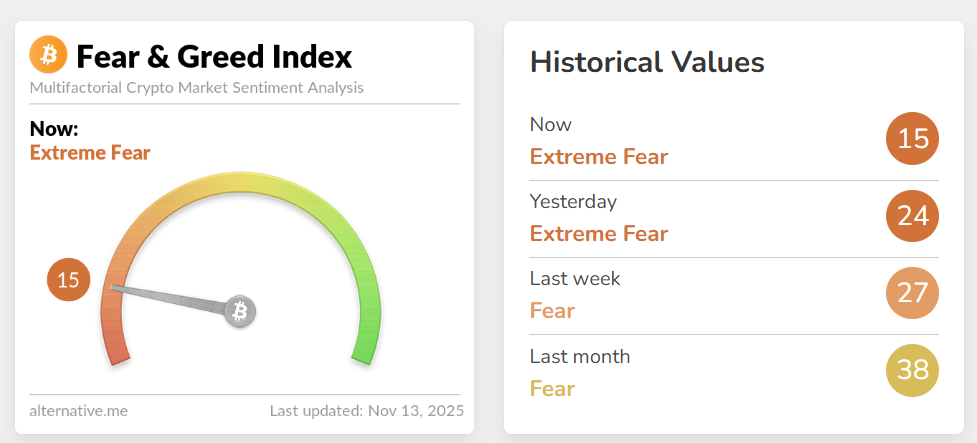

Fear Index at lowest level since March

The Crypto Fear & Greed Index, a widely followed measure of emotion in the markets, fell to 15, which is referred to as “extreme fear.” This is the lowest level since March, when a similar plunge preceded a short-lived rally in prices.

Joe Consorti, Head of Bitcoin Growth at Horizon, said that the level of fear is now at levels seen in 2022, when Bitcoin traded near $18,000. He explained that the atmosphere today is very similar to that time, with traders holding back and cutting down on liquidity.

Despite the market weakness, Santiment added that the fading optimism could be “welcome news for patients.” According to Santiment’s analysis, during such times money typically shifts from speculative transactions to long-term investments, setting the stage for a November run. Santiment explained:

“If the volume negatively impacts assets, especially the largest market caps in cryptocurrency, it is a signal that we are reaching the point of capitulation. As soon as retail sells, the main players scoop up the fallen coins and pump up the prices. It’s not a question of if, but when it will happen.”

Speculators are out – long-term investors are getting in

Samson Mow, founder of the Bitcoin technology company Jan3, shares this view. He argues that the bull run for Bitcoin has not yet begun, describing recent sales as being driven by newer market participants rather than early holders. Newer buyers are the ones selling, Mow said, adding that long-term investors are taking the opportunity to store more Bitcoin in their wallets.

Mow noted that much of the current selling pressure is coming from traders who entered the market in the last 12 to 18 months and are now withdrawing their money out of fear that the peak has been reached. Mow:

“These are not gut-level Bitcoin buyers, but rather speculators following the news.”

Santiment’s analysis suggests that the overall market structure will be strengthened for the next cycle as short-term holders continue to exit. The data trends suggest accumulation among holders who have historically supported price recoveries following fear spikes.

Mow agreed, noting that the coin’s transition into stronger hands is an encouraging sign for Bitcoin’s next phase.

“This cohort of sellers is also exhausted, and committed long-term investors have now taken their coins, which is always the best-case scenario. 2026 is going to be a big year. Plan accordingly.”

No Comments