The ETF of XRP is more popular than that of Solana – but there is a catch

- The XRP ETF reaches a volume of $ five million in its debut and exceeds the From Solana around four times.

- Growing interest and further applications show that XRP is in the transition to a new, more important phase.

XRP makes headlines again, but not because of a change legal reasons, But because of the introduction of a leverage stock market traded.

The Teucrium 2x Long Daily XRP ETF opened On the NYSE Arca With a trading volume of $ 5 million on the first day of its listing. It is one of the top 5 percent of all new ETFs in relation to start performance.

The 2x ETF From Solana bumped into less enthusiasm and had a four -time starting volume than that Xrp-etf .

The investors interpret this when Clear indication that XRP is very much in demand again, especially those who deliberately enter into the risk.

But despite the Strong starts Is that Volume des XRP-ETF Compared to the introduction of the Ishares Bitcoin Trust (go) from Blackrock Value of $ 1 billion USD negligible.

Nonetheless indicates the demand for a stock market-traded fund based on XRP based on increasing institutional demand, in particular and The legal caseFrom Ripple is about to be a solution.

XRP ETF applications are increasing thanks to the now clear legal situation

The dynamics of XRP increases in all areas. Franklin Templetonone of the largest asset managers with an Aum (assets under management) Of over $ 1.5 trillion applied for an XRP spot ETF on the Chicago stock exchange.

Also Grayscale has climbed into the action And intends to convert its XRP Trust into an ETF subject to the necessary regulatory formalities.

This indicates that XRP as well as convinced as a practical trade and as a long-term investment instrument. Other investors should bald be expected because further ETF applications are to be expected.

It is similar on international level. In Brazil, the Hashdex XRP-ETF recently received approval for the listing on the B3 most important stock exchange the country. Dies Is an indication that The demand for XRP-ETFs is gaining internationally and not only in US markets.

XRP is about two dollars before the outbreak

XRP is $ 1.82 and is stable while it an important one Resistance at $ 2 targets. Dealers are waiting for this value, since an outbreak of this means a change in the market structure and might lead to a persistent house.

The price level of $ 1.82 has turned into a field of conflict between bulls and bears, whereby a significant demand is recorded just under $ 2.

The order books The large stock exchanges of Coinbase and Binance show more than 24 million XRP purchase orders in the range of $ 1.50 $ 1.82.

This tight cluster area Is a hint to ensure that dealers are able to to perform an outbreak up. If XRP falls back in the direction of $ 1.50, most expect the purchase pressure to hold the decline in chess and drive the rise.

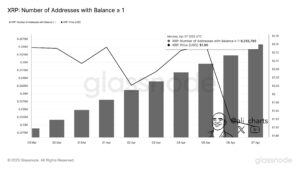

Apart from the course, the network expansion draws also A positive scenario. XRP currently has over 6.26 million addresses with At least 1 XRP credit the highest value so far. Dies Is an indicator For more and more people use the network, which documents the demand from the base.

Meanwhile, Standard Chartered has a significant price increase for XRP forecast. The bank assumes that the course 2028 will reach up to $ 12.50 and maybe even Ethereum will surpass in market capitalization. Your focus is on the Platz from XRP In international payment transactions As well as the RWA-Tickenization, two applications in which Ripple made considerably.

No Comments