The cryptoma markets also meet the economic data in the after-oster week

- First the good news: increasing uncertainty in the global economy could increase the attractiveness of Bitcoin as a safe harbor.

- The bad thing is: strong dollar signals could dampen crypto moment this week.

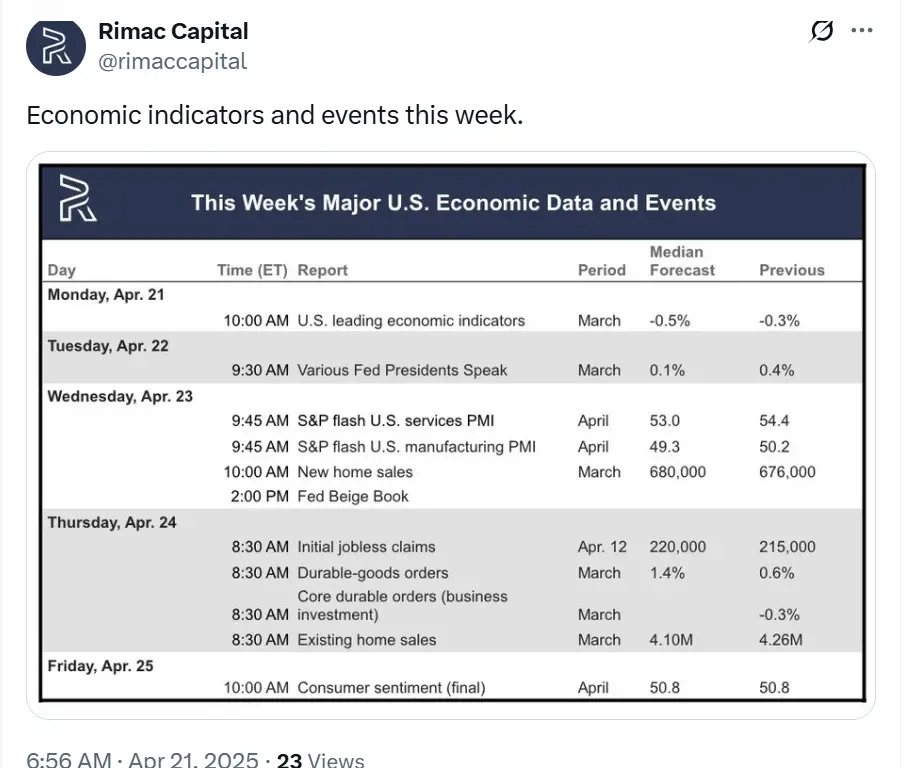

The cryptoma markets are nervous this week because a wave is expected from important US economic data. Data on consumer confidence, the shopping manager index and the labor market data can cause dramatic changes-and Bitcoin is right in the middle of it. Since Bitcoin is currently in a holding pattern, the data this week could be the AUSerer, which ends the calm.

Lei could show slower growth

The economic calendar begins on Monday with the Leading Economic Index (Lei) of the Conference Board, which should have a decline of 0.5 % for March. The six -month trend has improved slightly, but the monthly declines continue to show a weakening economy, weak consumer confidence and slowing down industrial activity.

For Bitcoin, this means that investors may withdraw from risky systems and to turn to traditional safe ports such as bonds. However, if the concerns increase the fragility of the financial system, Bitcoin could benefit from his image as a digital gold and attract capital that is looking for alternative value preservatives.

Shopping index The service provider can put the dollar strengthening BTC under pressure

The PMI report for the service sector is pending on Wednesday. The March value of 54.4 shows solid growth and another value over 50 would confirm the expansion in this sector. This would strengthen the US dollar, which is a headwind for Bitcoin because it makes other assets relatively less attractive. It would also reduce the likelihood of short-term interest reductions by the Fed, which was often a catalyst for crypto rally.

Shopping index of the manufacturing trade can indicate economic weakness

On the same day, the shopping manager index for the processing industry is published, for which the prospects are less rosy. The sector is weak and further weakness could renew the fears of a economic loss. This would trigger a broader risk reduction on the market and deduct the Bitcoin investors. However, a persistent weakness of the manufacturing trade could ultimately stir up the expectation of loosening by the Fed – a long -term plus for cryptocurrencies if the market flows to incentives.

Arrangements on unemployment support could trigger the fear of recession

The initial applications for unemployment support on Thursday will be another test stone. Although the initial applications have decreased in the past week, a surprising increase could trigger afraid of recession and trigger a sale in the event of more risky systems, including cryptocurrencies. However, another decline would indicate a strong job market and raise the general mood, which might even give Bitcoin a short -term buoyancy.

Consumer confidence as a mood barometer for the market

The consumer confidence expected for Friday will be the last part of the data puzzle. The atmosphere is near record lows and another bad value could end the interest in speculative systems such as cryptocurrencies. But even a small improvement in consumer confidence could restore the risk of risk and give the Bitcoin upward impulse because investors are looking for growth.

Since so many economic variables are involved, the cryptoma markets come under pressure, whereby each unexpected data could have a major impact on the dynamics.

No Comments