- The upexi crash came after a SEC permit that allowed the resale of all shares from the capital increase of Solana of $ 100 million.

- Fears of dilution and the exit from insiders led to the crash, although Upexi holds almost 600,000 SOL shares.

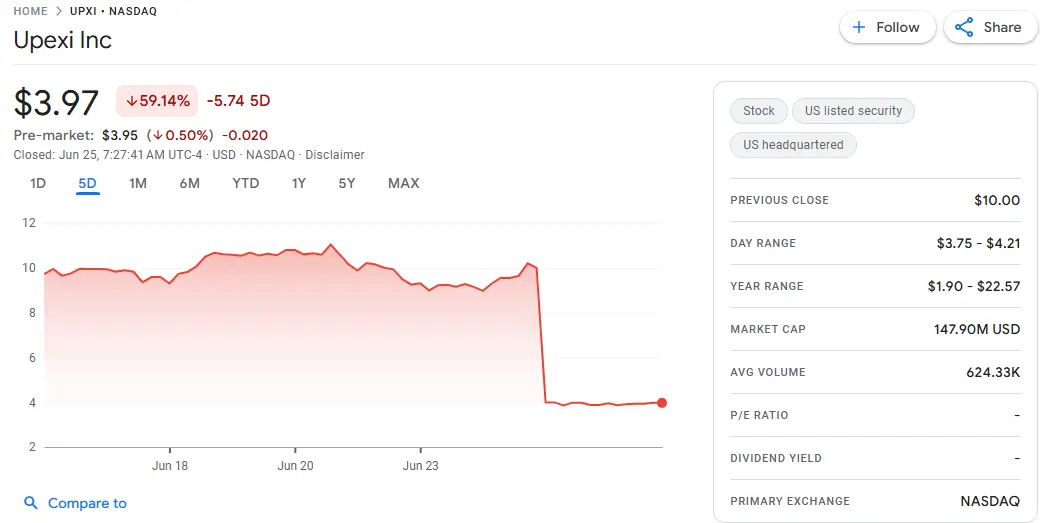

The shares of Upexi Inc. fell by over 60%on June 24, 2025 after the company submitted a registration for resale at the SEC. Registration allowed investors to sell all stocks from the company’s crypto-treasury increase in April.

Dealers reacted to the fear of dilution and possible sales pressure Large institutional owners. The crash illustrates the risks associated with crypto treasury positions in small cap shares.

Upexis S1 application triggered the mass exodus of the investors

On June 24, 2025, Upexi submitted his registration declaration at the US stock exchange regulator SEC, which Sale of 43.9 million stocks and pre -financed option certificates.

The stocks were originally issued in April as part of a capital increase of $ 100 million at a price of $ 2.28 per share. The money was used by Upexi to buy Solana token.

NEW: Upexi CEO says the company is doubling down on crypto

“With the change in Administration, it seemed like there was an opportunity in crypto after a lot of headwinds.”

Full quote from @theflynews

pic.twitter.com/B96XUL1Tmt

— Upexi (@UpexiTreasury) June 5, 2025

It was about 35.97 million ordinary shares and 7.89 million to pre -financed options bound stocks. The total volume registered corresponded to the entire float from the capital procurement of April. Upexi will not receive any proceeds from secondary sales, with the exception of around $ 7,890 if the pre -financed option certificates are exerted.

CEO Allan Marshall made it clear that registration only grants the owners the option for sale, but does not oblige them to do so. Nevertheless, the market expected a flood with stocks. Upexi opened this morning with $ 3.97 $ 9.25 at the end of yesterday’s trading day.

Conversion to the Solana treasury model

In April 2025, Upexi switched from a consumer brand business to a treasury model for companies geared to Solana. The company spent 43.9 million stocks to procure $ 100 million, expressly for the accumulation of SOL-TOKEN. The most important buyers included GSR, Delphi Ventures and Morgan Creek Capital.

Upexi had acquired around 679,677 Sol-Token by the end of May and thus became one of the largest Solana owners. The procedure is reminiscent of that of Microstrategy at Bitcoin. Upexi also started earning staking premiums with its SOL stocks.

Despite the strategic realignment, questions arose about the time of insider purchases. Reports show that CEO Allan Marshall and other managers only acquired shares a few days before the announcement in April. Although this is legal, such a timing has triggered concerns about corporate management and transparency among investors.

Market reaction

The share of the stock was decomposed by 62 % in the middle of a wider volatility in crypto stocks. Analysts noted An that the resistance to such a large block caused an offer shock on the market. Upexi’s small cap status tightened the price movement, and limited liquidity increased the downward trend.

Cantor Fitzgerald Had set a price target of $ 16 for Upexi and referred to the upward trend of Solana as a financial infrastructure within the chain. However, the combination of insider sales, a volatile token market and the sudden change in the business strategy led to a severe slump in mood.

In the meantime experienced Solana Even drastic developments. The Blockchain introduces the Firedancer validator client to improve the pace of the process and reliability. It also introduces confidential transfers and extends the computing capacity to 60 million computing units.

The institutional interest Solana is growing and the CME futures volume reaches a record of 1.75 million contracts. The opening of the Solana economic zone (SEZ KZ) in Kazakhstan has further increased visibility.

Status from June 25, 2025 becomes Solana Between $ 134 and $ 145 before an important resistance at 151. Upexi now holds 597,000 SOL tokens worth more than $ 100 million. Nevertheless, the SEC report and the insider activities triggered a wave of retail sales and a renewed debate about crypto treasury models in companies.

No Comments