Survey result: Paying with crypto becomes normal and brings cryptocurrency into the everyday life of people

- Everyday payments and AI are apparently the critical success factors for spreading cryptocurrency, but security and fees are the main problems.

- 37% of the crypto users believe that paying at the cash register decides on the distribution, while 35% AI see Ki as important for the future of cryptocurrency.

A recent report by ROOME emphasizes payments and artificial intelligence (AI) as the main catalyst for the next wave of crypto acceptance. The survey under 1,038 active crypto users in the United States and Great Britain showed that 37 % believe that payments (including stable coins) will advance the mass acceptance of crypto.

In addition, 35 % of users see KI as crucial for the future of cryptocurrency. However, important obstacles such as security, high transaction fees and interoperability problems remain.

Crypto payment in everyday life as a prerequisite for broad acceptance

Dem According to report the use of crypto payments in everyday transactions the way for the establishment of crypto assets and for a widely accepted Means of payment. Even more: 54 % of the users of digital currencies handle their transactions about payments in the real world, which not only indicates the growing interest of users in digital currencies as an investment instrument.

Stable coins, on the other hand, have become popular; 37 % of the participants stated to use them for payments this year, while it was only 20 % last year.

According to Mirna Barca, manager for payment products ReownCrypto payments must mimic the comfort of other modern payment products on the FinTech markets. A user should be able to carry out transactions without knowing how the blockchain works.

This is a somewhat more detailed type of user experience that now that the Area of theCryptocurrencies grows quicklyis needed . The problems with the transfer of cryptocurrencies to the real world, the simplification of transactions and integration into digital wallets will play an important role.

The role of AI on the way from crypto to the mainstream

34% of users consider AI to be an important factor for the general introduction of cryptocurrencies and the increase in their efficiency. However, there are still some doubts about the connection of technologies such as blockchain and AI.

While 29 percent of the respondents believe that artificial intelligence and cryptocurrencies will strengthen each other, 18 percent believe that cryptocurrencies will contribute to the progress of artificial intelligence.

The integration of AI and blockchain technology would be able to find a solution for several crypto-related matters, e.g. B. the automation of the purchase and sale of coins as well as risk analyzes and safety functions.

However, there is still skepticism about how the concept of blockchain can be combined and implemented in the future. The challenges will increase with the maturation of the area over time, so the developers have to develop other applications to facilitate the use of AI in Defi.

Main obstacles to widespread acceptance

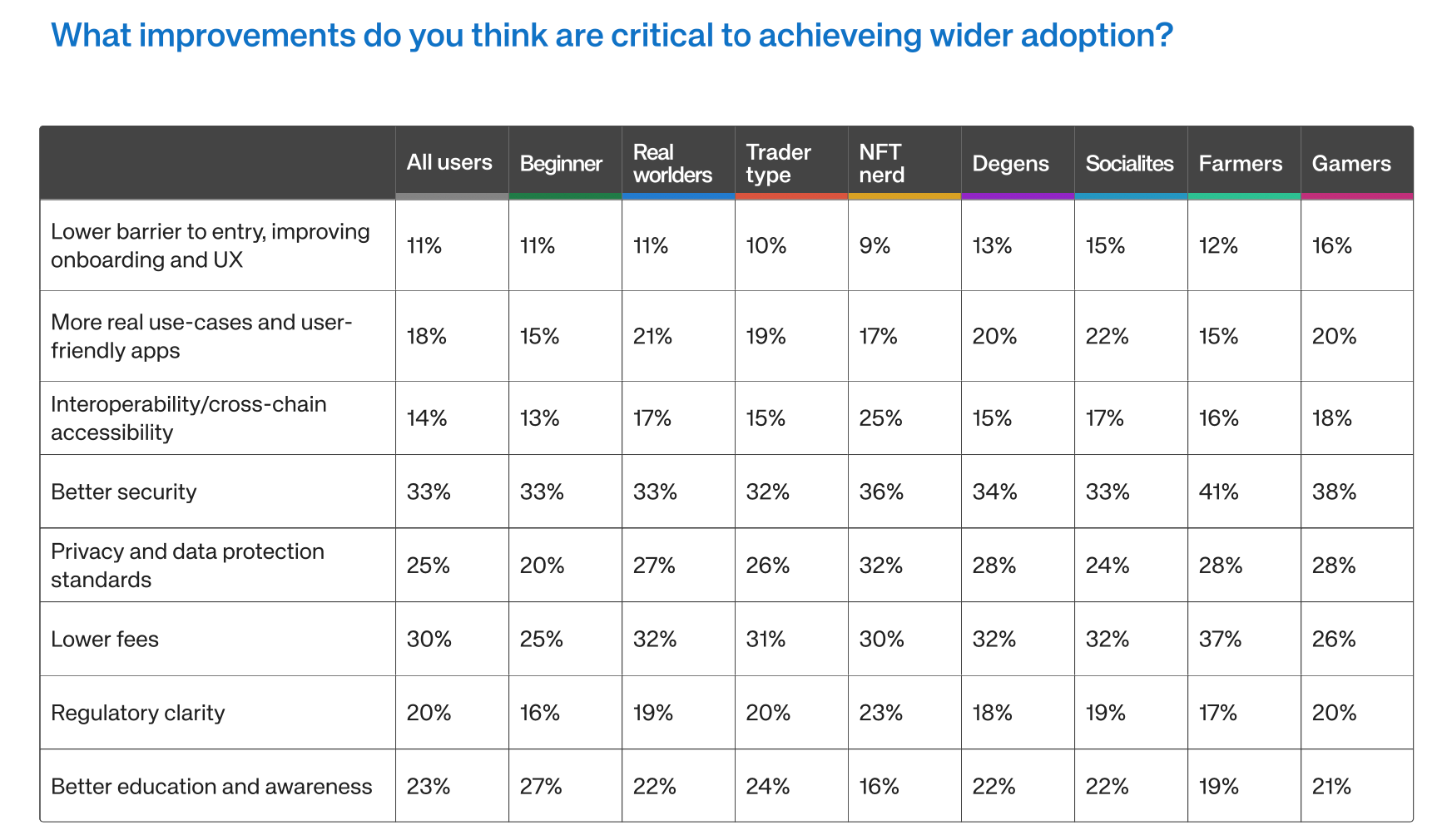

Despite the optimism in connection with cryptocurrencies, there are many obstacles that stand in the way of broad application. The REOMP report emphasizes the hurdles, whereby security comes first. 33 % of users believe that improved security is the key to broad acceptance. While confidence in security on the crypto chain rose from 50.5 % to 69 % last year, phishing attacks become a major problem that affects 21 % of users.

High fees are another major obstacle: 39 % of users do not continue to use cryptocurrencies. The report suggests that a reduction in fees could promote greater participation. 47 % of users mentioned interoperability as the main problem, although many are frustrated that there are no seamless interactions between different blockchains. The demand for solutions to these problems is clear, and the developers make crypto experiences easier, safer and more networked.

In addition to the technical challenges, regulatory progress is also considered crucial for acceptance. According to the Report of ROOD, 86 % of users believe that a clear regulation will promote the acceptance of cryptocurrencies in the mainstream. However, the uncertainty remains because the United States and Europe still work on its regulatory framework. The industry hopes that the latest efforts, such as the concentration of the SEC on cryptocurrencies and the European Mica regulation, will soon bring clarity. Marco Santori, Direktor der WalletConnect Foundation, sagt:

“We are in the last trains of regulatory uncertainty in the United States … The industry is on the threshold of regulatory clarity, but we are not yet at the goal.”

While cryptocurrencies are developing, the developers are asked to focus on real applications that eliminate these obstacles. In view of the growing interest in social apps and payments, there is a need for solutions that reduce friction losses that increase security and are cost -effective. Finding the right balance will be the key to reaching the general population and increasing the acceptance of cryptocurrencies.

No Comments