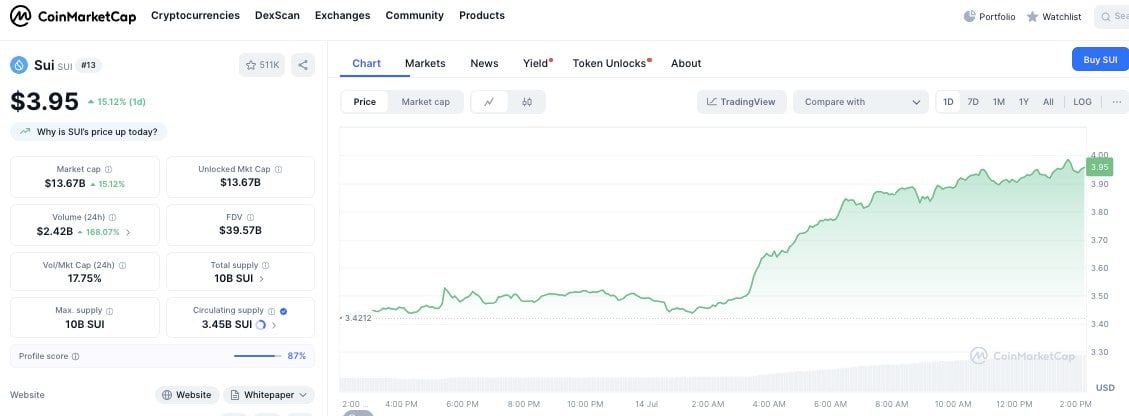

SUI turnover increases by 168% in 24 hours and triggered 15% course jump

- The SUI course rose by 15% to $ 3.95, while sales climbed by 168% to $ 2.42 billion.

- MacD and RSI suggest new momentum, but overbought levels indicate short -term consolidation.

Sui (SUI) recorded a increase in sales and course within 24 hours. The course increased by more than 15% to be $ 3.95 when writing this article. The movement was supported by an increase in sales, which according to data from CoinmarketCap rose by 168.07% to $ 2.42 billion.

The strong rally of the token brought him to the top performers on the market, which leads to a new interest from dealers who pursue the Layer 1 Blockchain ecosystem.

The course showed that SUI was relatively stable at $ 3.42 until the late evening of July 13th. Around 2:00 a.m. on July 14th, the token started to rise and exceeded the $ 3.60 mark at 4:00 a.m. The rally continued in the morning and tested the $ 4.00 mark before stabilizing at $ 3.95.

Despite short breaks and smaller returns, the upward trend kept firmly, supported by a constant demand and an above -average trading volume.

Market capitalization reacts to accelerated circulation

In addition to the price increase, the market capitalization of SUI also rose by 15.12 % and reached $ 13.67 billion. This assessment now corresponds to the unspecified market capitalization of the token, which indicates that a large part of the entire token offer is already in active circulation. The current inventory of circulating tokens amounts to around 3.45 billion tokens, which corresponds to about 34.5 % of the maximum inventory of 10 billion tokens.

The fully watered rating (FDV), which takes into account the entire possible offer from SUI, is currently $ 39.57 billion. The ratio of volume to market capitalization reached 17.75 %, which indicates high sales in relation to the assessment of the token. This ratio often serves as a measure of the liquidity and interest of investors and is considered increased when it is over 10 %.

Sui has now ranked 13th among all cryptocurrencies after market capitalization. This placement reflects a broader interest in scalable Layer 1 projects and can also match the expectations of ecosystem upgrades or planned token publications.

Indicators signal stable momentum but at the same time show risks

The indicators on the daily chart show that the upward trend from SUI continues. The MACD indicator (Moving Average Convergence Divergence) recorded an interest bullish crossover, whereby the MACD line exceeded 0.1152 and the signal line at 0.0415. The increasing distance between the two lines and the positive histogram indicate continuing upward dynamics and increasing purchase interest.

At the same time, the RSI (relative strength index) has risen to 72.50, with which SUI is in the overbought area. Traditionally, values over 70 indicate the potential for short -term correction. During strong upward trends, however, assets can remain overbought for a long time. The RSI has risen sharply from less than 40 in the past few weeks and thus underlines a significant change in mood on the market.

Turnover supports the price increase: around 22.6 million tokens were exchanged on the last day of trading, one of the highest figures this month. However, analysts warn that the dynamics must be preserved to avoid reversal.

No Comments