- Strategy – formerly Microstrategy – acquires another 6,911 BTC for $ 584 million and thus increases its total stock to over 500,000 bitcoins.

- The company acquired 6,911 BTC between 17 and 23 March 23, giving around $ 584 million at an average price of $ 84,529 per coin.

With this recent purchase, the entire Bitcoin reserves from Strategy exceeded the 500,000 mark, which strengthens the position of the company as the largest Bitcoin holder. The investment coincides with a new institutional interest in Bitcoin and an increased inflow in the stock market -traded funds (ETF).

When writing this article, the Bitcoin course was $ 88,267.89, which corresponds to an increase of 3.87 % in the last 24 hours.

Strategic expansion of bitcoin assets

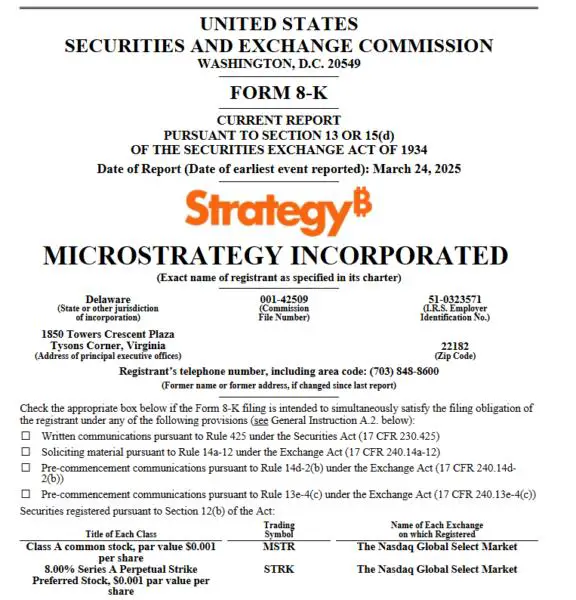

According to the routine division at the US stock exchange supervision SEC of March 24, Strategy has increased its Bitcoin stocks to a total of 506,137 BTC with the recent acquisition. The company’s total investment now amounts to around $ 33.7 billion, with the average purchase price per coin was around $ 66,608, including fees and costs. This strategic accumulation underlines Michael Saylor’s conviction of Bitcoin as a value preservation means.

As CNF reported, the purchase was followed by Michael Saylor’s recent hints about an important Bitcoin acquisition. On March 21, Strategy announced the issue of his latest tranche of preferred shares, which was sold at $ 85 per share with a 10 %cupon.

It is expected that this offer will generate around $ 711 million in income, which further strengthens the company’s financial position. Analysts see this recent purchase as part of Strategy’s ongoing efforts to use market lows to accumulate Bitcoin.

Effects on the market and outlook

The time of investing strategy fits the global economic concerns, especially the fears of a trade war that could affect both traditional and digital markets. Nicolai Sondergaard, a research analyst at Nansen, noted that the ongoing customs concerns could put the markets under pressure until at least on April 2. He added that the market mood could improve if customs -related uncertainties are solved in the coming months, which could give risk systems such as Bitcoin.

As already mentioned, the mutual tariffs of President Donald Trump should come into force on April 2, although former statements by Finance Minister Scott Besser indicated a possible delay. Market observers believe that a solution to these customs concerns could have a positive effect on Bitcoin prices, from which the considerable stocks of Strategy would benefit.

Strategy’s investment approach has enabled the company to benefit from the increasing Bitcoin demand, which is driven by institutional interest and ETF inflows. Since Bitcoin is traded over $ 87,000, the recent purchase price of Strategy from $ 84,529 per coin indicates possible short -term profits.

Analysts predict that the extensive Bitcoin reserves from Strategy could continue to gain value, especially since the limited range of cryptocurrency continues to attract institutional buyers.

The most recent acquisition of Strategy underlines the continued company for Bitcoin accumulation as a central financial strategy. With more than 500,000 BTC in its reserves, Strategy’s brave investment approach continues to make headlines in the crypto landscape.

No Comments