Solana wants to go to the Nasdaq league-will the SOL course go over $ 200?

- The consensus upgrade proposed by Solana is suitable to make the project a NASDAQ competitor by preventing transaction scensorship and improving trade efficiency.

- In view of the increasing Dex volume and the regulatory changes, Sol could crack the $ 200 brand if the confidence of investors continues to grow into tokenized shares.

Solana has announced a bold strategy to change the way securities are issued and acted by this time by targeting the domain of traditional stock exchanges such as Nasdaq and New York Stock Exchange. Since the interest in decentralized finance continues to increase worldwide, Solana’s efforts to expand the network could redefine the stock markets and change the mood of investors and the price dynamics around its native tokens.

The developers of the blockchain argue that the abolition of transaction scensorship and the improvement of the block order could position the network as a practical alternative to centralized trading systems, especially for the output of shares in tok form.

The latest proposal from Solana, who is led by the co-founder Anatoly Yakovenko and the AGA researcher Max Resnick, sees A new type of consensus with several simultaneous leadersbefore. In contrast to the current structure, in which a single leader node confirms transactions, this new approach would enable several knots to process blocks at the same time.

The idea has already received support from the industry. Dan Robinson von Paradigm described the concept as “impressive”, especially because of his potential, reducing transaction latency, which is of crucial importance for high -frequency trading and the fairness of the market.

Blockchain platforms obtain momentum on the stock markets

This change of strategy is not an isolated case. Other developments strengthen the growing role of Solana on the financial markets. Superstate, a wealth management company, recently introduced “Opening Bell” to issue and act a platform that makes it possible to issue and act to tasks to spend and act token stocks directly via Solana and Ethereum networks. According to reports, Robinhood is also trying to give EU investors access to US shares through decentralized systems such as Arbitrum or Solana.

With regard to the regulation, space for innovations could arise. SEC commissioner Hester Peirce brought the idea into play to create exceptions from traditional securities registration for blockchain-based trading platforms. If such exceptions are implemented, this could pave the way for a more comprehensive introduction of systems such as Solana in the stock area.

Price view reflects market expectations

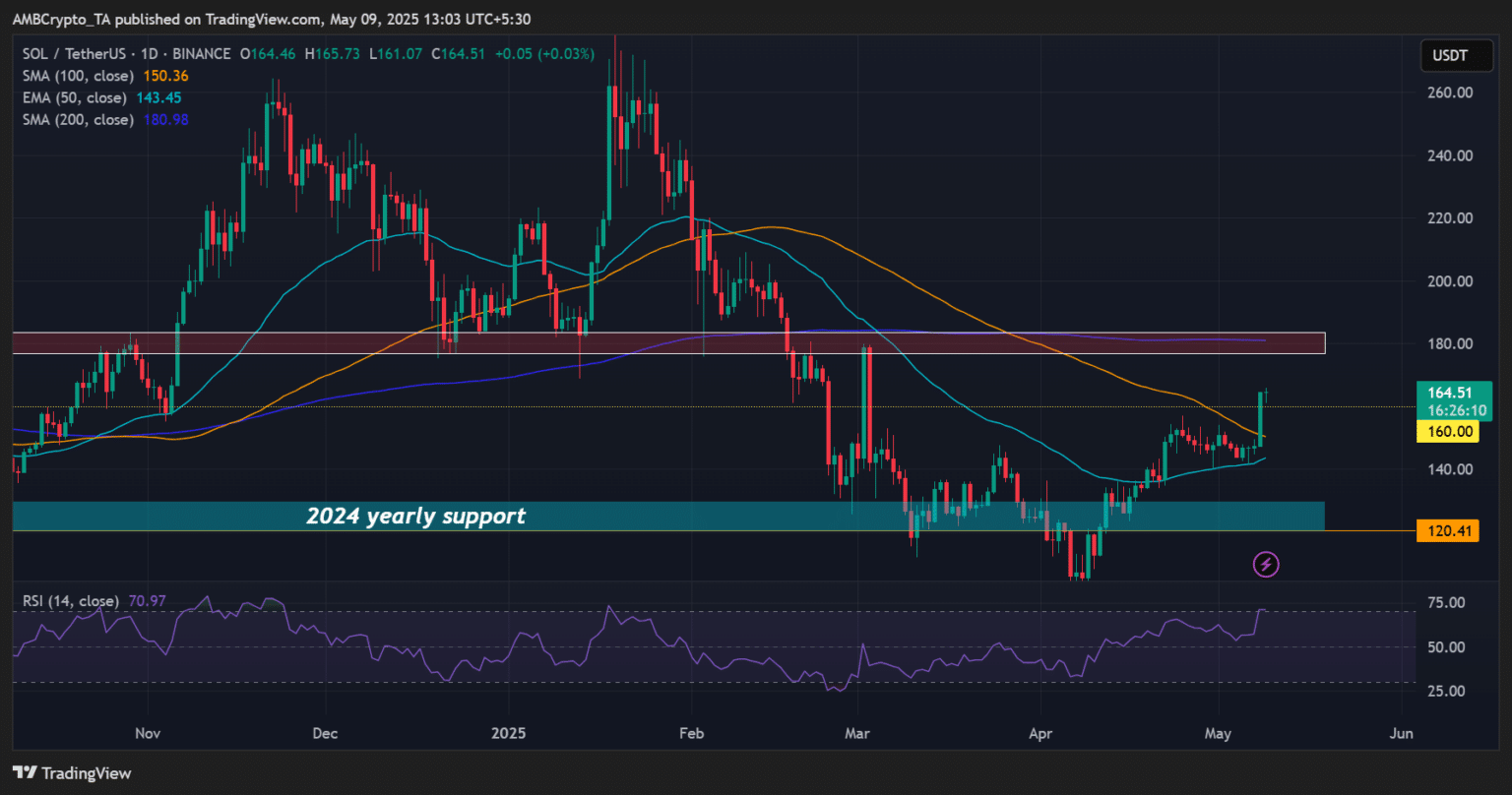

The optimism of the investors is obviously reflected in the course of Sol. At the time of the creation of this report, Sol broke the $ 160 mark, which is partly due to Bitcoin’s increase in the $ 100,000 mark and the increasing strength of the Solana ecosystem. According to Tracy Jin, COO of the MexC exchange, the cumulative decentralized exchange volume of the network has already exceeded $ 800 billion in 2025-a sign of strong liquidity and active participation.

According to Jin, if it can stay above the recently cracked resistance of $ 153, sooner or later could test the $ 180 mark. This is also the sliding 200-day average, a very important technical indicator. If the momentum remains at this level, a rally up to the psychological $ 200 brand could be triggered if the $ 180 mark is broken.

Solanas wider network metrics are still good. The Blockchain has listed a large part of the year 2025 among the daily active users and income. Since institutional tools are developed on the basis of the network and change the regulatory settings, Solana could be well positioned in order to attract both the traditional stock dealers and the crypto residents.

No Comments