- After the conflict between Israel and Iran, Solana fell to $ 141.59 – a week -after decline of 15.56%.

- Double-floor and flag patterns as well as the optimism for the ETFs indicate recovery and further increase to up to $ 241.

The solana course gave in strongly on June 13 and fell to $ 141.59 in the middle of a general market sale after the Israeli air raid against Iran. It was the deepest stand for more than a week and was 15.56% below the weekly high of June 11th.

During the course, there are some technical patterns and positive odds for the approval of ETFs that could indicate that the decline will not stop.

The charts from Tradingview Show a double floor formation at $ 141.92 with a neck line at $ 169. If it is confirmed, such a constellation can lead to a rally up to $ 190. This number results from the difference between the height of the neck line and the underside, which is $ 27, plus the price of the neck line. The same price of $ 141.92 was released on June 5, which gives the formation more power.

A flag formation can also be seen on the daily chart, which is often preceded by the resumption of an upward trend. The flag’s decline began on May 12, while the origin of the flag mast goes back to April 7th. If the outbreak is made near $ 160, the price target of this flag formation would be around $ 241, which corresponds to the length of the mast.

Solana rose by 96% from 95 to $ 187

Such global shocks initially let the Solana course collapse, but afterwards it recovered sharply again. In April, according to Trump’s statements about the declaration of freedom, the Solana course had dropped to $ 95.4 and then increased by almost 96 % to $ 187. In 2022, the FTX fiasco had an even greater decline than the price fell to $ 9.10, and then increased to almost $ 300 again this year.

In the initial phase of the Covid 19 and Russia Ukraine crisis, cryptocurrencies such as Solana were sold, but recovered strongly in the following months. The previous relaxation gives the current housesee a certain credibility, especially when you consider that the markets are already in the process of discounting the current conflict risks.

The latest decline led to Solana’s refinancing set to 0.009 %, the lowest level since June 6th. The refinancing sentence is an indicator that reflects the expectations of the dealers; A decline usually indicates a declining mood. In the past, however, Solana prices have increased after such a decline in the refinancing rate.

Six billion dollars ETF revenues are expected in the first year

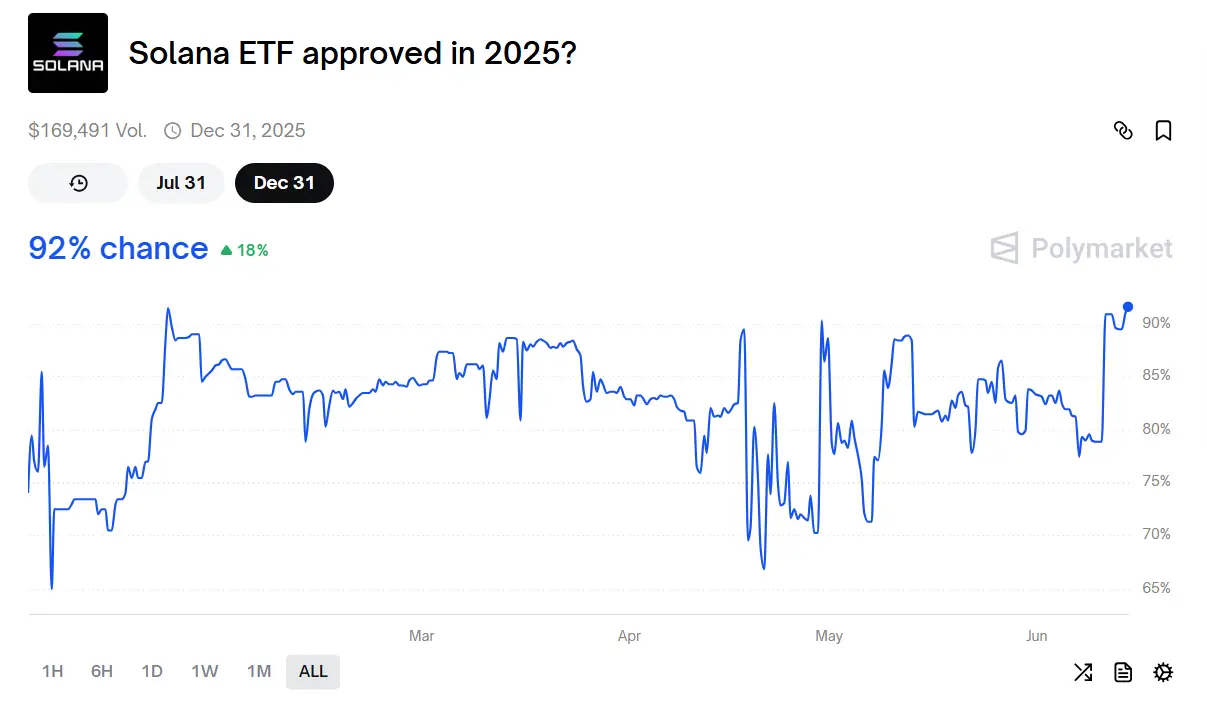

The most important development that future course development can influence is the increased probability of approval of a Solana ETF in the United States. The probabilitythat this approval is granted lies at 92 %according to the assessment of polymarket dealers with an impressive track record, which also includes forecasts for election results.

The optimism gained momentum after the registration of the Investco Galaxy Sol ETF in Delaware had appeared, as stated by Solid Intel. This step is seen by market observers as a sign of larger institutional investments in Solana.

JPmorgan predicts that a stock market -traded fund for Solana would generate sales of $ 6 billion in the first year alone. That would be almost twice the 3.5 billion dollars that Ethereum ETFs have accumulated since the start in September. The potential for regulated access from mainstream investors to Solana is seen as an important support factor for the future.

No Comments