Solana-News: Sales increase in the first quarter-Defi-TVL and fees decrease

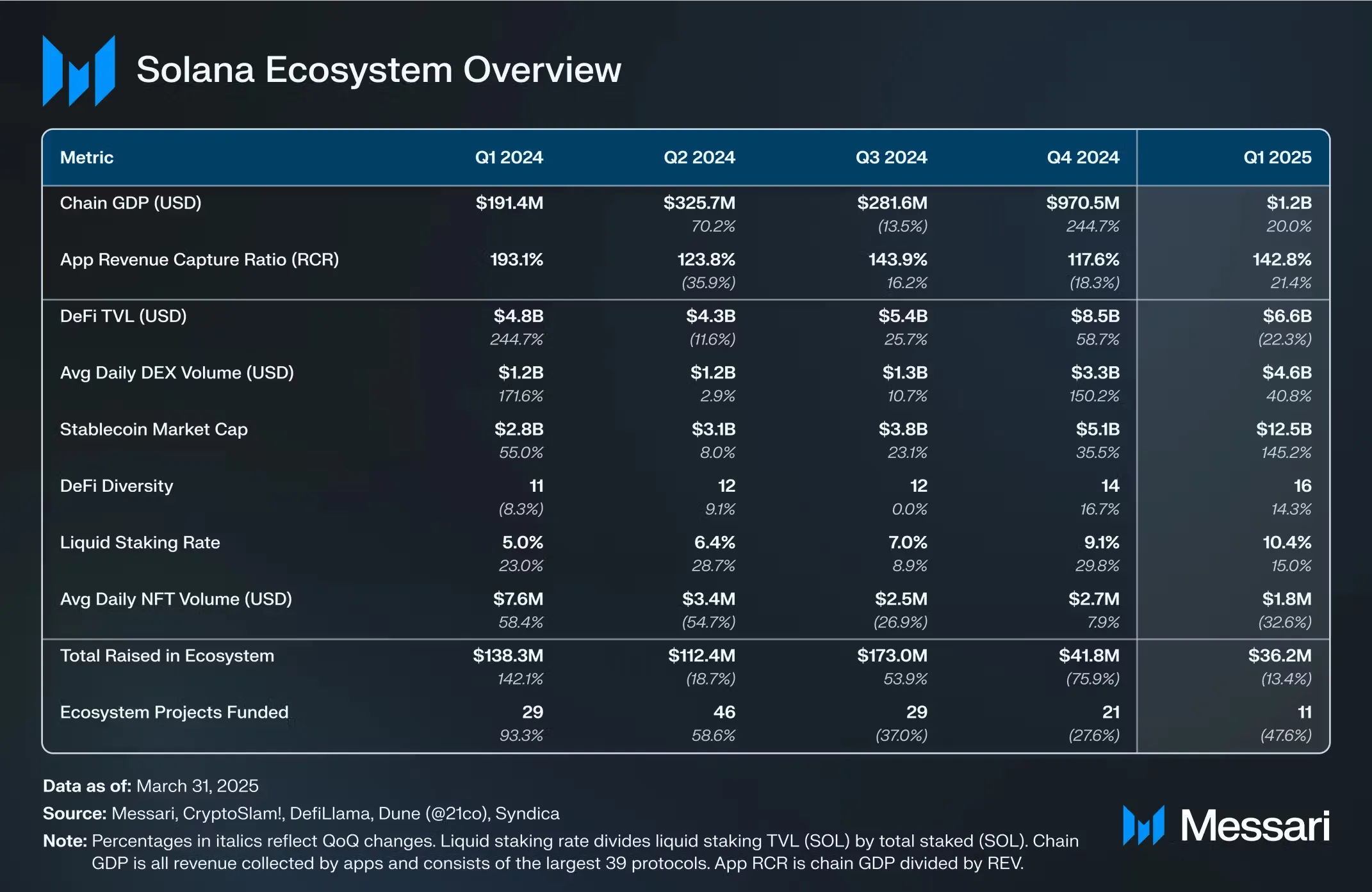

- Solana’s app turnover reached $ 1.2 billion in the first quarter 25, led by Meme Coins and Wallet demand.

- However, the Defi-TVL on Solana fell by 64 %, although the StableCoin market increase to $ 12.5 billion.

As CNF reported, Solana solidifies its position in the crypto room with record-breaking dapp in the first quarter. But the increase in application demand comes, while defi activity and transaction fees decrease sharply. Despite system growth, the massive decline in the TVL (Total Value Locked) means that investors are still careful. As Solana can withstand this mixed performance, the key for its long -term growth will be. At the editorial deadline, Solana was traded for $ 161.86, a decline of 5.39 % in the last 24 hours.

Booming app sales through meme coins and wallet demand listed

According to a current report by Messari, Solana achieved a dapp sales of $ 1.2 billion in the first quarter of 2025-an increase of $ 970.5 million in the previous quarter. This has been the best quarter of Solana for a year, and January alone made 60 % of total sales. The growth reflects the new interest in Solana applications, especially Meme Coin Trading, Dexs and Cryptocurrency Wallets.

The chain bip on Solana grew by 20% in the quarterly comparison. Source: Messari

Messari attributes sales growth to the competitive advantages of Solana: low fees and high speeds. Pump.fun was the highest sales application, which brought in $ 257 million and cited the meme coins. The introduction of the Trump-Meme coin on January 17 led to an enormous increase in the commercial volume and further increased the income of the app. However, the report also points to the negative effects of the fast growth of pump.fun.

As CBF reported, Phantom was in second place with $ 164 million in sales and is still a central tool for customers who interact with Solana’s defic and NFT services. Photon was in third place with $ 122 million, an increase of 13% compared to the previous quarter. These applications show that Solana services are used in all customer segments.

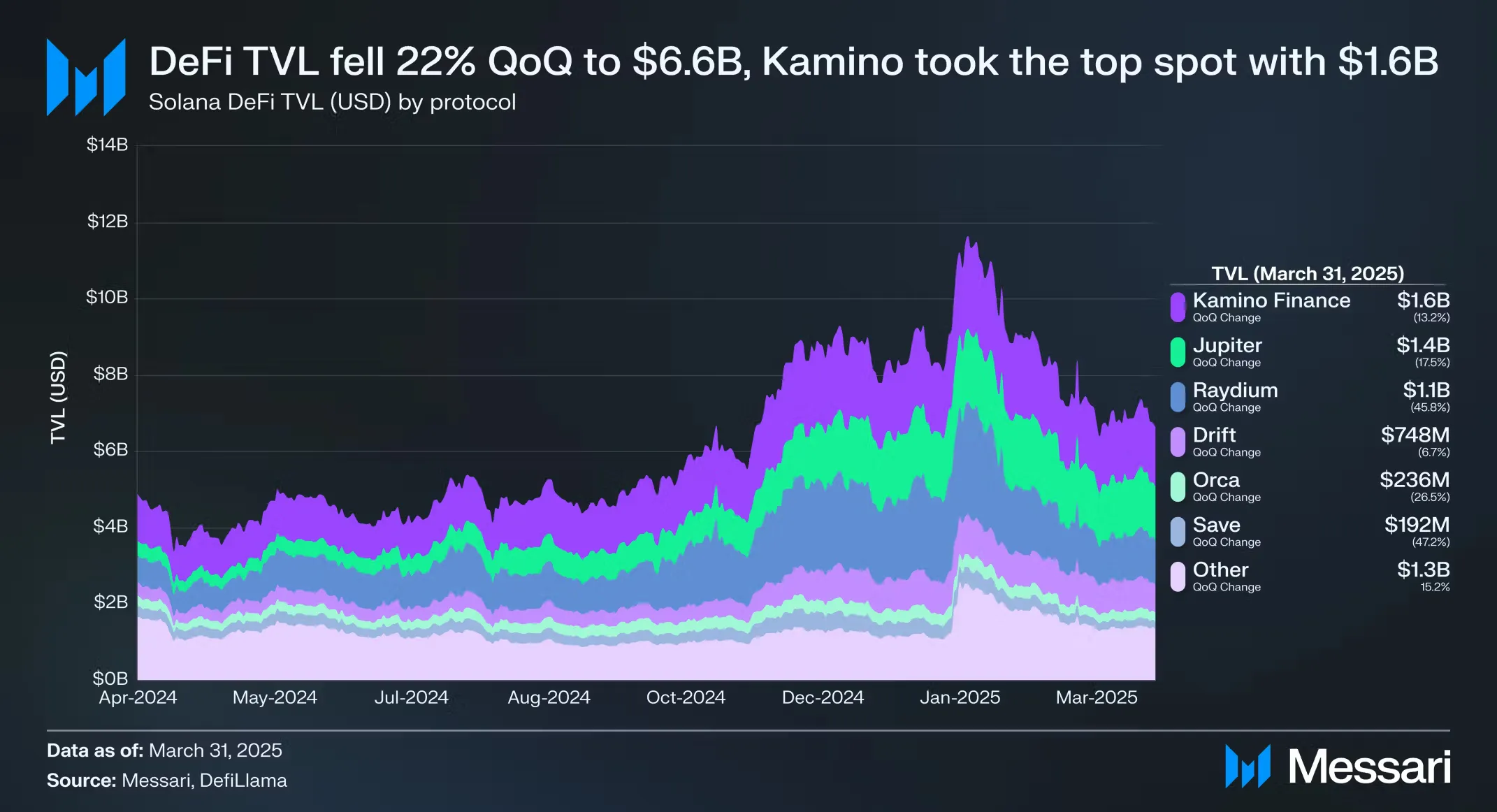

Severe decline in the Defi-TVL contrasts with stable coin increase

While the app revenue skyrocketed, the Defi TVL on Solana fell by 64 % to $ 6.6 billion. According to the report, this is due to market volatility, whereby capital from Defi flows into stable assets. Nevertheless, the stable coin use on Solana grew by 145 % in the first quarter of 2025 to $ 12.5 billion (USDC), which rose by 148 % to $ 9.7 billion, four times more than USD. Usdt also recorded a growth of 154 % to $ 2.3 billion. This shows that investors switch to less volatile assets in a wider market.

Solana TVL fell by 22 % in the quarterly comparison. Source: Messari

The transaction fees also dropped this quarter. The average fee was 0.000189 SOL or $ 0.04, a decrease of 24 % compared to the previous quarter. This was a key factor for user acquisition, especially for high-frequency applications such as Meme Coin Trading, Defi and NFT platforms.

Despite sales of $ 1.2 billion, the massive decline in Defi TVL is a major problem. Analysts say that the growth of Solana depends on whether it is possible to reconcile its performance-oriented app ecosystem with the restoration of the trust of the investors into its defi infrastructure. The way to the future could be to maintain the StableCoin acceptance and to keep the transaction costs low.

As the results of Messari show, Solana is at a crucial point that is characterized by high performance in key areas, but is challenged in other areas by volatility.

No Comments