- Redstone Solana releases areas for Defi with black skrack and Apollo funds.

- Solanas Defi TVL at 9.34 and the OPRN interest show the increasing trust of investors.

Solana has taken an important step to to welcome the traditional financial system in its decentralized system. Redstone, a leading Oracle provider, has its services now on Solana extended and enables that Real assets like that Biddled From black skirt and the ACRED-FondsFrom Apollo Part of defi.

Through the Cooperation With security and Wormhole Queries Can trustworthy off-chain data in the Centerpiece the On-chain-protocolFrom Solanabe integrated.

The change in these assets is not only a visual: the tokenized assets can also be operationalized in credit platforms and safe. Drift institutional, the The first platform that benefits from the technology will be on the Grand investors market turn around.

Through the secure Data feed From Redstone Do developers have the opportunity to Products to construct, With that Stable returns can be achievedthat represent real funds.

Security manages more than 3.6 billion dollars to tokenized assets and works with companies such as Apollo and Blackrock. They enable the transfer of reliable financial data to Solana, through which The process accelerates and The costs of the transaction reduce.

Solanas Defi-growth signals investor engagement

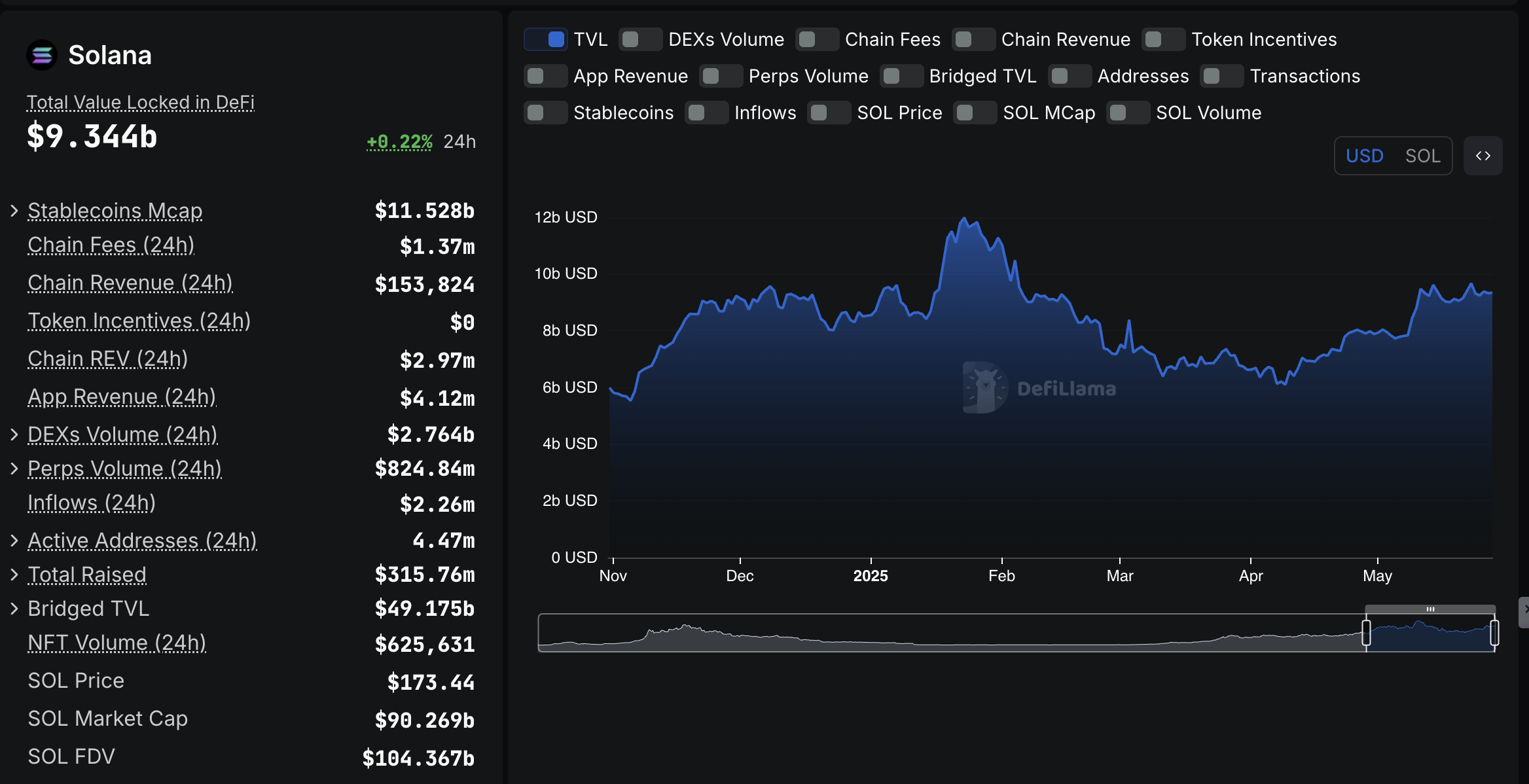

The defi system From Solana continued to gain strength what itself In the increasing TVL reflected. According to Defillama the TVL rose From Solana from $ 6.63 billion on April 1 to $ 9.34 billion in May, which around 28%.

The increase indicates the strong trust of the investors because the users store their SOL-TOKEN in smart contracts and thus The tokens out the available Offer take, whereby the Sales pressure is reduced.

The defi trend that users asset assets over a long Period hold ontois importantbecause he indicates two things: The trust in the network grows, and die Demand for decentralized return is high. Dies happens because the low transaction costs and the quick throughput of Solana are always a magnet for such activities and the blockchain feeds new capital into their protocols.

Sol Prize encounters resistance in a reserved market

Despite the positive fundamental data, the Solana price is still in the process of catching up with the psychological range from $ 164 to $ 185. At the moment Sol is being traded for $ 171.

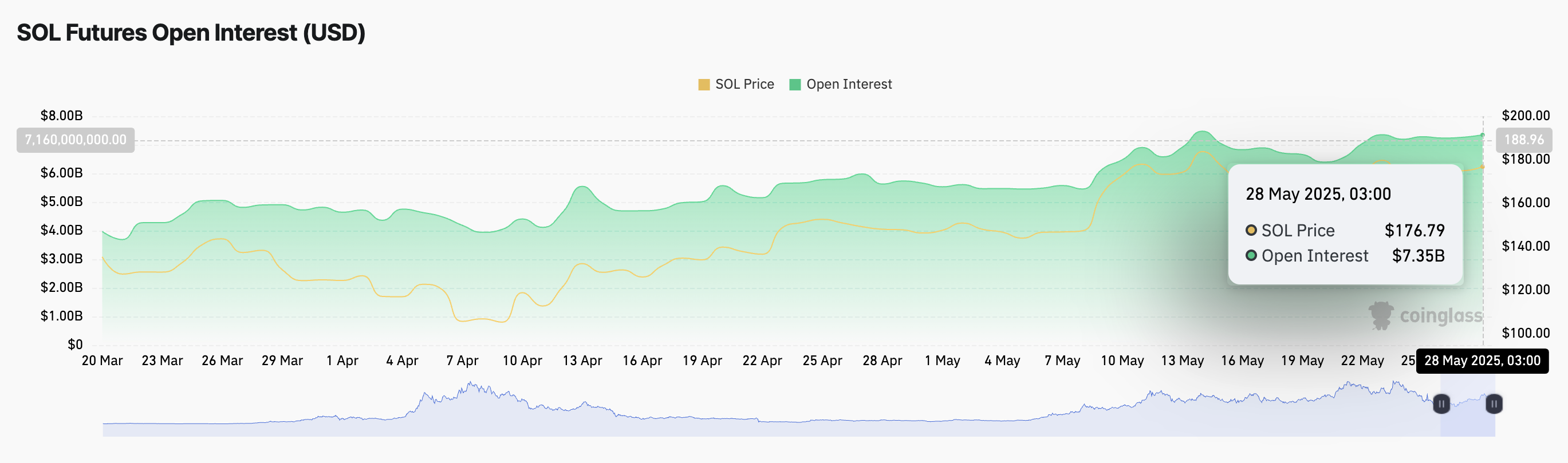

The open interest to Sol-Futures climbed from $ 6.4 billion a week ago to $ 7.35 billion. The interpret to that The dealers are still an optimistic attitude take. The futures trade volume is $ 9.4 billion, was means, that the market very is active.

Nevertheless, a breakthrough under the upward trend line or the important support at $ 164 would direct the course down. In such a case, the price levels of $ 159 and $ 140 would serve as a buffer for the bears.

A purchase signal The super trend indicator could be a sign of a trend reversal. Sol could experience a quick comeback and After breaking through the resistance 185 Again to head to $ 200 to reach this level that was tried at the beginning of April.

No Comments