Shiba-Inu News: Shib course can rise 17 times-analyst has a clear purchase recommendation

- Shiba Inu becomes attractive because the falling stock market offer and the increasing open interest allow a shib outbreak.

- According to experts, the SHIB course must overcome the resistance at $ 0.00003 in order to then increase up to 17 times-the chance is great and it can be worth it.

Shiba-Inus Token Shib is at an important point in its market development, since technical and onchain data indicate an outbreak. A cryptoanalyst says that the meme coin is now being traded within a defined “purchase zone”, supported by increasing open interests and historically low stock market offer.

These developments and positive course forecasts have made Shib on the subject of dealers and analysts. However, the strength of the rally remains uncertain and depends on the general market behavior and technical confirmations.

Cryptoanalyst cryptoelites has sketched a 17-fold rally for Shiba Inu, provided that certain technical threshold values are achieved. According to the forecast, Shib must first keep the support near a descending trend line that has defined its latest trade structure. The next important level at the 0.618 Fibonacci retracement mark is $ 0.00003.

Analysts assume that the token could be ready for an upswing if he successfully breaks through this resistance and sticks to it. A price increase to $ 0.00021 would mean a 17-fold increase of the current market value of $ 0.0000123, while a 14-fold rally Shib would take around $ 0,00018. However, both scenarios require increased demand and a corresponding market development.

Börsen offer sinks strongly

Santiment data, a provider of blockchain analyzes, show that Shib’s offer has decreased sharply in the past few weeks. This is usually seen positively in situations like this, since the owners gradually transferred their token into wallets that are less likely to use for sales.

But the quantity of the Agege is limited. Therefore, there can be a shortage if the demand increases. Such patterns were observed in several old coins in front of a price rally, especially for those who are widely traded due to the volume and support from the community.

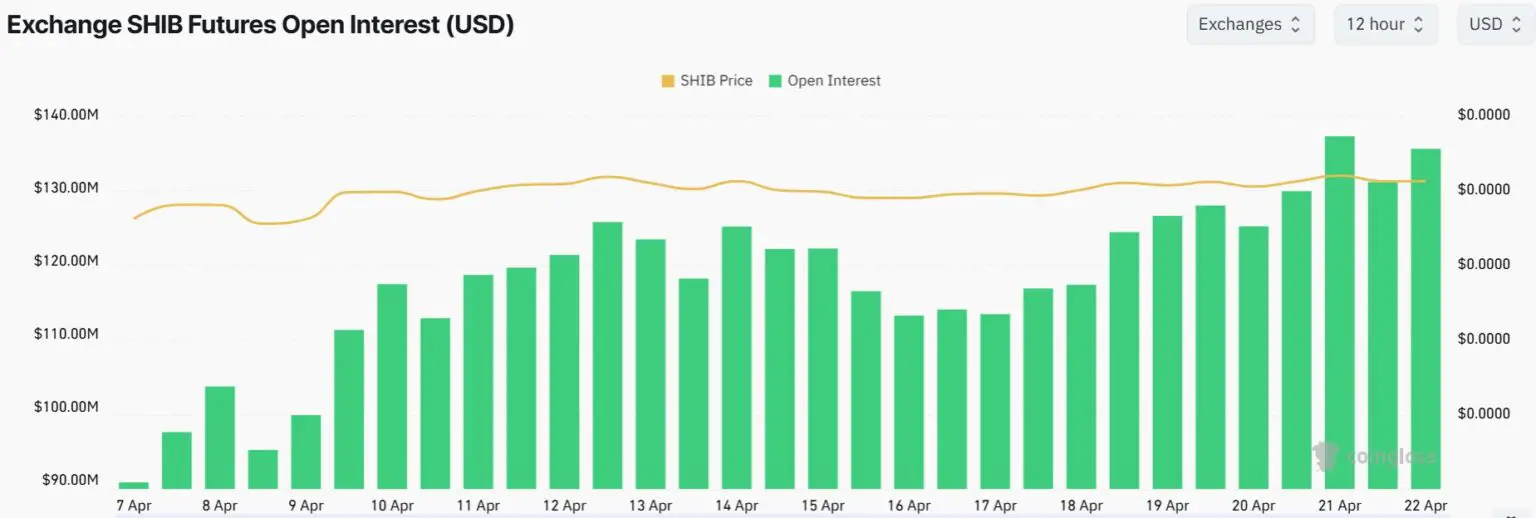

Increased open interest signals dealer trust

Another important key figure that attracts attention is the increase in the open interest. According to the Coinglass, it has increased by 43% for the Shib Futures contracts in the past two weeks. This indicates that more dealers respond to levered positions and rely on short -term volatility or directional movements.

Increasing open intzer nest indicates increased market participation and often precedes large price movements. However, this also increases the susceptibility to sudden liquidation events, especially for strong setbacks. Therefore, the data for the open intzerest support the upward trend, but also indicate the potential for increased volatility in the near future.

However, the analysts pointed out that the $ 0.00003 brand had to be passed to confirm the new direction of the upward movement. As long as this level is not reached and held, it remains a forecast.

At the same time, the changes in the entire cryptom market will also affect Shib. Token like Shib react more sensitively to the general condition of the Bitcoin market and especially to the amount of liquidity.

No Comments