- Despite the freezing of Grayscales GDLC-ETF through the SEC, Cardano remains optimistic, although strong derivative data should be the reason.

- Cardanos Ada rose 8.83% despite the new uncertainty, driven by good sales and a positive mood.

Cardano (ADA) has recently proven to be resistant in view of the market uncertainties and its price isin the last 7 days increased by 4.83%. At the editorial deadline, ADA was traded at $ 0.6067, compared to $ 0.5578 the day before. The latest price movement from Cardano can largely be attributed to an increase in the market mood.

The market capitalization of ADA has increased to approx. $ 21.46 billion after an increase in the commercial volume.

The increase in the 24-hour trade volume by 54.87 % to $ 1.08 billion shows the strong trust of investors in cryptocurrency. This increased commercial activity shows a positive view for ADA in the short perspective, with the possibility for further profits if the bullish mood continues.

In the broader context of the cryptoma markets, the recovery of ADA in the middle of a mixed market reaction comes to regulatory developments. Despite the suspension of the GDLC-Spot ETF approval by the SEC, the most important cryptocurrencies, including Cardano, were able to maintain their stability, which shows a strong fundamental confidence.

Preliminary SEC stop of the Grayscale GDLC-setback or chance for ADA?

Die Decision there sec At freezing the GDLC ETF approval of Grayscale, waves have hit the market. The SEC justified it with the need for a further review of the Grayscale proposal to convert GDLC into a spot ETF, which contains a mixture of five important cryptocurrencies, including Bitcoin, Ethereum, Ripple, Solana and Cardano.

While this regulatory break ensures uncertainty at short notice, it did not deter the price movement of Cardano, which rose by almost 8 % immediately after the message.

This stop will probably delay the ambitions of Grayscale to list the GDLC as a spot ETF, but the possibility of approval could still offer some positive impulses for ADA that make up 0.78 % of the ETF stocks.

Bullische derivate data indicate persistent ada optimism

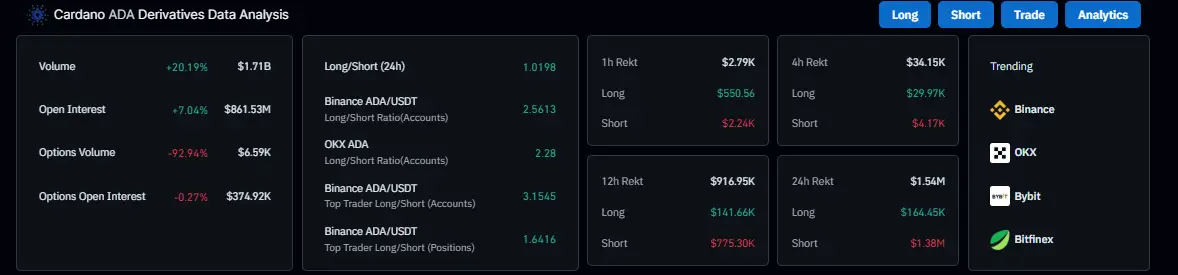

The data about the derivatives of Cardano indicate that the dealers are still optimistic. The Coinglass-Long-Short ratio for ADA achieved a monthly high of 1.10. This indicates that the majority of the dealers bet on an upward movement of the ada course. In addition, ADA’s open interest (OI) has increased by 7.04% to $ 861.53 million in the last 24 hours.

The technical indicators also support this upward trend. The relative strength index (RSI) tends upwards towards a neutral level of 50 and thus signals a decrease in the bear. In addition, the MACD indicator (Moving Average Convergence Diversity) recently showed an interest bullish crossover, which reinforces the positive mood in relation to the price movement of ADA.

The future for Cardano

The Cardano course is currently being traded within a falling wedge pattern, which indicates that Ada approaches a decisive level of resistance at $ 0.58. If ADA successfully breaks through this resistance, the cryptocurrency could possibly experience a rally in the direction of its upper trend line, which indicates a price target of around $ 0.73, which reached in June.

However, the market remains volatile, and ADA could experience a correction if it is not possible to break through this resistance. A setback could send ADA to the next support brand at $ 0.49, which means that retailers should remain vigilant in order to recognize any changes in market conditions.

No Comments