- The XRP turnover rose by 30% to $ 2 billion, but the weak onchain activity signals reluctance.

- The XRP course could fall to 1.20, unless it is possible to overcome the resistance again at $ 2.15 and $ 2.36.

The XRP price is under pressure because it is fighting to stay above the critical values. It continues to act in a narrow band and the course does not correspond to the optimism that is otherwise widespread in the market, which is borne by the Bitcoin rise to $ 96,300.

Despite repeated attempts to regain higher levels, XRP is faced with a resistance at $ 2.36 and declining onchain activity. Since the number of active addresses also decreases, there could be a new questionable proximity to the lower support levels.

Course stagnated: Onchain indicators signal further downward trend

XRP spent most of the time in early May in a consolidation phase between $ 2.00 and $ 2.20. The sliding average of the 50- and 200-day line remain on the four-hour and weekly chart. The daily chart seeshowever declined because the price is below the 50-day average.

The data From Santiment, an enormous decline in the daily active XRP Ledger addresses show from over 612,000 in the first quarter to 40,000 in May. This is a sign of dwindling demand and lower activity. It weakens the liquidity and makes the price more susceptible to a downward trend.

Nevertheless, the activity of the whales is still available. Addresses that hold 10 million to 100 million XRP now control 12.32 % of the total offer compared to 10.91 % in early April.

Greater owner With 100 million to 1 billion XRP, 14.37 % check, compared to 14.14 % on April 1. This is an accumulation phase, large market participants expect good news, including a solution in the Ripple vs. Sec.

Another price slide under $ 2 possible

XRP is currently being traded by $ 2.17 and is therefore easy to increase during the day, but still faces several resistance. The asset remains under the 50, 100 and 200-day exponential moving average (EMA), all of which converge by $ 2.18 $ 2.20. The bulls have to convert these EMAs with support in order to strengthen the technical structure and pave a path towards the $ 3.00 mark.

The CMF has recently fallen below -0.05, which indicates increased capital outflows. Meanwhile, MacD and RSI confirm a declining interest bully momentum.

The RSI is 43.30, but shows signs of possible recovery. Nevertheless, retailers remain careful, especially after a price rejection at $ 2.30, which matches the 50%fibonacci retracement level.

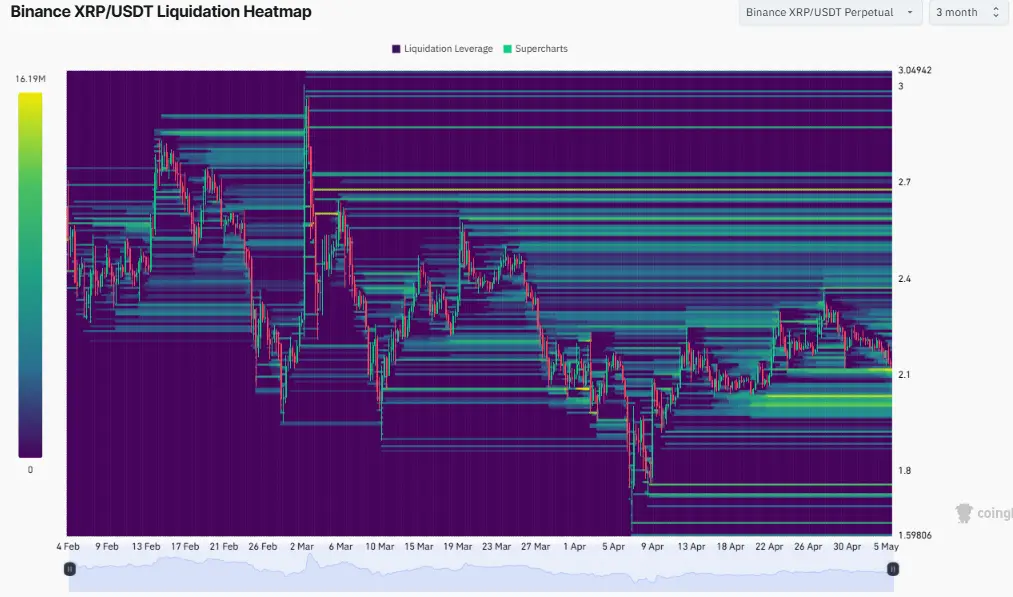

On the underside, the most important support levels are $ 2.11, $ 2.00 and $ 1.61. A degree under the 50-day SMA at $ 2.18 and the 100-day SMA at $ 2.06 could increase sales pressure. The $ 2.00 mark remains a psychological barrier, which is due to the historical liquidity concentration in the Heatmaps von Coinglass is supported. The $ 2.15 mark remains a liquidation bag, and a short-term sideways movement is expected before a crucial breakthrough is made.

XRP holds $ 2.15

The daily turnover has increased by $ 2 billion by $ 2 billion, while the course lost 1.17% in the last 24 hours. This is probably a repositioning because the consistent sales had stalled the upward movement in the previous week.

The attempts to relax from XRP are hindered by a low on-chain activity, in particular by a sharp decline in creating new addresses and stock market drains. This means that the market participants do not take strong positions and wait for critical updates for the legal situation of Ripple or to wider market movements.

The competent court of appeal recently decided a 60-day suspension of the appeal decision in the case of sec./.ripple. This is an important development in the lengthy regulatory saga. Ripple chief lawyer Stuart Alderoty commented on the situation in a video entitled “Crypto in a minute”. In it he asked:

“Why did the SEC withdraw its calling against Ripple? I think the real question is, why did you submit the case at all?”

Despite these legal developments, cryptocurrency remains $ 2.15. The bulls have to overcome the resistance above this area to support an upward movement. Otherwise, the price will fall to $ 1.50 $ 1.66 and possibly further to $ 1.20, which corresponds to a decrease of 45 %.

No Comments