- The OCC takes a first step to make it easier to access the bank for crypto companies by withdrawing certain fuele decisions.

- Finance Minister Scott Bessent had previously announced that he was working with the OCC to abolish guidelines that affect the crypto industry.

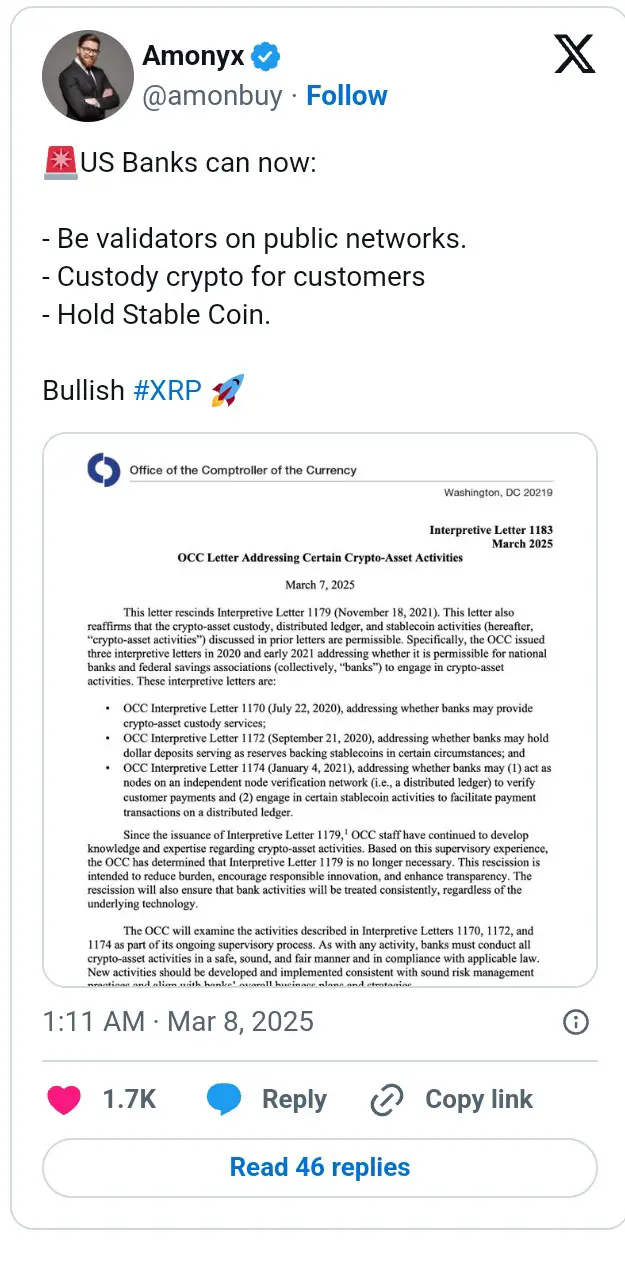

The Office of the Compotroller of the Currency (OCC) has moved in a recently published interactive letter from the agency’s politics regarding the engagement of banks in crypto industry.

Dem Write According to the custody of crypto assets, “certain stablecoin activities and participation in independent node verification networks for banks and permissible are permitted”.

When reviewing the publication, we found that the requirement for institutes that are supervised by the OCC was also withdrawn. Rodney E. Hood, Acting Compotroller of the Currency, said that the agency expects the banks to maintain their strict risk management controls in order to support the activities of new banks as well as those of traditional banks.

“Today’s measure will reduce the burden of banks for crypto -related activities and ensure that these banking activities are treated uniformly by the OCC regardless of the underlying technology. I will continue to work to ensure that the regulations are effective and not exaggerated and at the same time a strong federal banking system is preserved. ”

In the meantime, the OCC has withdrawn its participation in the joint explanation of the risks of crypto-assets and the joint explanation of the liquidity risks for banking organizations, which usually lead to weak points in crypto-assets. According to our research in 2023, these guidelines were published after the collapse of the FTX exchange.

Banks and crypto

During the bid administration, the OCC and other banking supervisory authorities pointed out the risk of representing digital assets for the financial system. However, the Trump administration has argued that these decisions have made the debanking of people and companies in the crypto ecosystem.

The President and CEO of the American Bankers Association (ABA), Rob Nichols, praised the decision and emphasized that the current measure of the OCC was a big step towards the inclusion of the banks in the rapidly developing cryptom market:

“The ABA has emphasized that this misguided policy, which has created an atypical standard for many product and technology ideas, is withdrawn. The banks play a decisive role in the ecosystem of digital assets that have the potential to be a catalyst for changes in traditional financial markets, and today’s OCC measures are an important step to enable this success. “

This announcement is also made against the background of President Donald Trump’s digital asset Summit. As indicated in our previous discussion, he gathered several crypto entrepreneurs to meet the members of his government.

During a publicly streamed part of the meeting, Finance Minister Scott Bessent emphasized that he would work with the Office of the Controller of the Currency and the IRS to withdraw all guidelines that have a negative impact on the market for digital asset.

Meanwhile, the Federal Deposit Insurance Corporation (FDIC) was criticized for the fact that it did not accelerate the participation of the banks in the Kryptomarkt. The Federal Reserve has not commented on banks and crypto, but its chairman Jerome Powell has already announced that the central bank will revise the guidelines. Powell has also confirmed his interest in digital assets because he compares Bitcoin with gold, as CNF reported.

In the meantime, this recent decision is expected to enable banks to actively participate in blockchain networks such as XRP Ledger. XRPL stands for a highly scalable and efficient blockchain that was developed for financial transactions at an institutional level. It is expected that a successful assumption will also have a major impact on the XRP course, which an upward trend was predicted in this cycle.

No Comments