- With the integration into the TAS Network Gateway, Ripple now has a foothold in the European financial infrastructure.

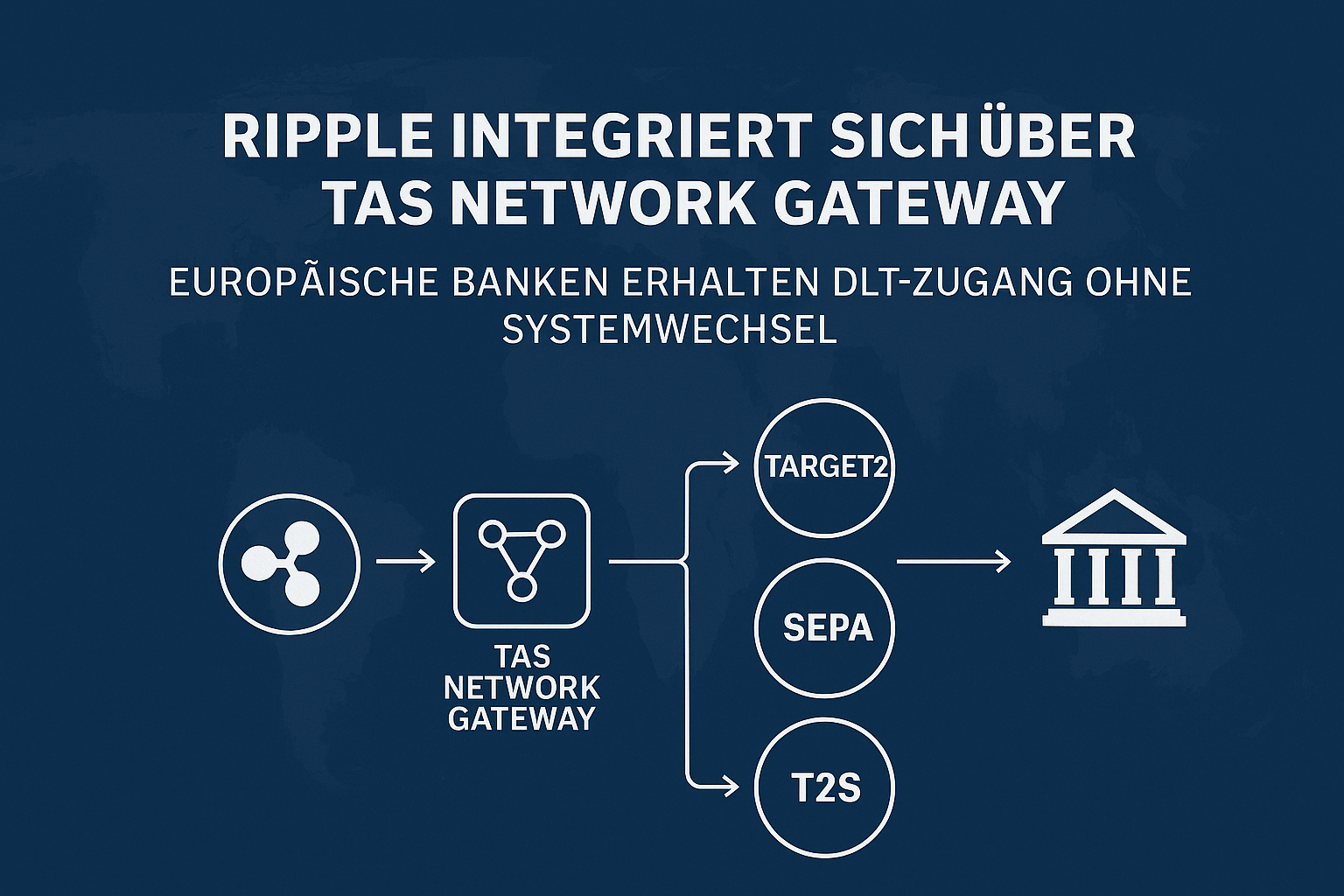

- This means access to the TARGET2, TIPS, SEPA and T2S payment systems, a step that goes far beyond just payment processing.

The integration of Ripple into the TAS Network Gateway opens up new access to the European financial market infrastructure, which directly affects banks, their customers and existing Ripple partners.

The connection between TAS and a DLT‑based settlement layer like Ripple creates a technical and regulatory bridge that was previously missing. For the DACH region, this is a step that goes far beyond pure efficiency gains.

Access to the central EU payment systems

The TAS Network Gateway has been a central element of the European banking architecture for years. It connects banks to TARGET2, TIPS, SEPA and T2S and takes care of routing, ISO 20022 conversion, security certificates and regulatory checks.

With Ripple, this infrastructure is being expanded for the first time to include a DLT-capable settlement layer. Banks can use Ripple-based transactions without having to adapt their own core systems or go through new regulatory certifications.

For end customers, this means fast, transparent and cost-effective payment processing, especially in international traffic. Processing becomes easier to plan, status information becomes more precise and liquidity bottlenecks can be avoided because banks require less pre-financing.

Advantages for Ripple customers and fintechs

Ripple customers also benefit directly. The TAS Gateway gives you access to the most important European payment systems without having to develop complex bank connections yourself. This reduces integration costs, shortens time to market and creates regulatory connectivity, which often represents a high barrier to entry for fintechs.

At the same time, Ripple is strengthening its position as an infrastructure provider that not only enables international payments, but also embeds itself in the core processes of European banks. The combination of DLT settlement, compliance functions and direct connection to the ECB infrastructure makes Ripple a relevant player in the emerging RWA market and DLT-based financial market infrastructure.

The European context

Europe is modernizing its payment and settlement systems. DLT-based settlement models, digital central bank money experiments and the harmonization of ISO 20022 standards are central building blocks of this strategy. The integration of Ripple into the TAS Network Gateway fits exactly into this development.

It enables banks to use new technologies without endangering existing systems and allows Ripple to prove itself as a reliable partner in a highly regulated environment. For the market, this means the merging of the traditional financial world and the world of distributed layer technology.

No Comments