Ripple CEO reveals existing partnerships with central banks-XRP plays the leading role

- Ripple expands his business by maintaining relationships with central banks from several countries, even if parts of this expansion are not disclosed towards the public.

- The settlement of the SEC conflict gave Ripple the necessary legal basis in order to inform the public about this type of new business alliances.

Ripple CEO Brad Garlinghouse has announced several global partnerships with central banks, but information about certain business is withheld from the public. Last year Riples XRP was already ready for a CBDC function, but the central banks were covered in terms of XRP due to the procedure against Ripple and the associated legal uncertainty.

With his statement, Garlinghouse emphasized the position of Ripple at digital-asset applications for digital central bank currencies. It is expected that the regulatory hurdles will fall, which could subsequently change the cross -border payment sector. Financial institutions rely on blockchain technology in order to establish the next generation payment systems as part of their wider technological development.

Ripple is expanding its strategic activities with central banks worldwide

In one recently Interview confirmed Garlinghouse that Ripple maintains his commitment to improve global payment infrastructure. He explained that CBDCs concentrate on domestic operations, which limits their capacity to process border -crossing payments. According to Garlinghouse, blockchain payments supported by Ripple offer essential solutions for the problems of this system.

REMEMBER WHAT BRAD GARLINGHOUSE SAID:

„RIPPLE HAS PARTNERED WITH SEVERAL CENTRAL BANKS AROUND THE WORLD, SOME WE‘VE ANNOUNCED, SOME WE HAVEN‘T YET ANNOUNCED!“

NOW THAT THE SEC CASE IS RESOLVED, IMAGINE ALL THE PARTNERSHIPS THAT WILL SOON BE ANNOUNCED…

#XRP pic.twitter.com/Tl3lewnvmU

— 𝓐𝓶𝓮𝓵𝓲𝓮 (@_Crypto_Barbie) March 23, 2025

Garlinghouse announced that Ripple maintains cooperation with several central banks. The partnerships between Ripple and Central banks consist of both open and hidden form. Ripple uses his foundation as a partner for banks and payment systems to support the central banks in researching applications for digital currencies.

So the company already has CBDC development initiatives in the republic Palau And in Bhutan completed. According to the CEO’s statements, there are further business agreements that will be announced in a short time.

Legal clarity enables future planning

The legal clarification between Ripple and the US Securities and Exchange Commission (SEC) has led to Ripple increasingly focusing on the participation of central banks. The legal dispute began in December 2020 to determine whether XRP is considered a security. After Completion of theTrial Ripple has won regulatory security, which enables the company to carry out its business plans with regard to legal matters.

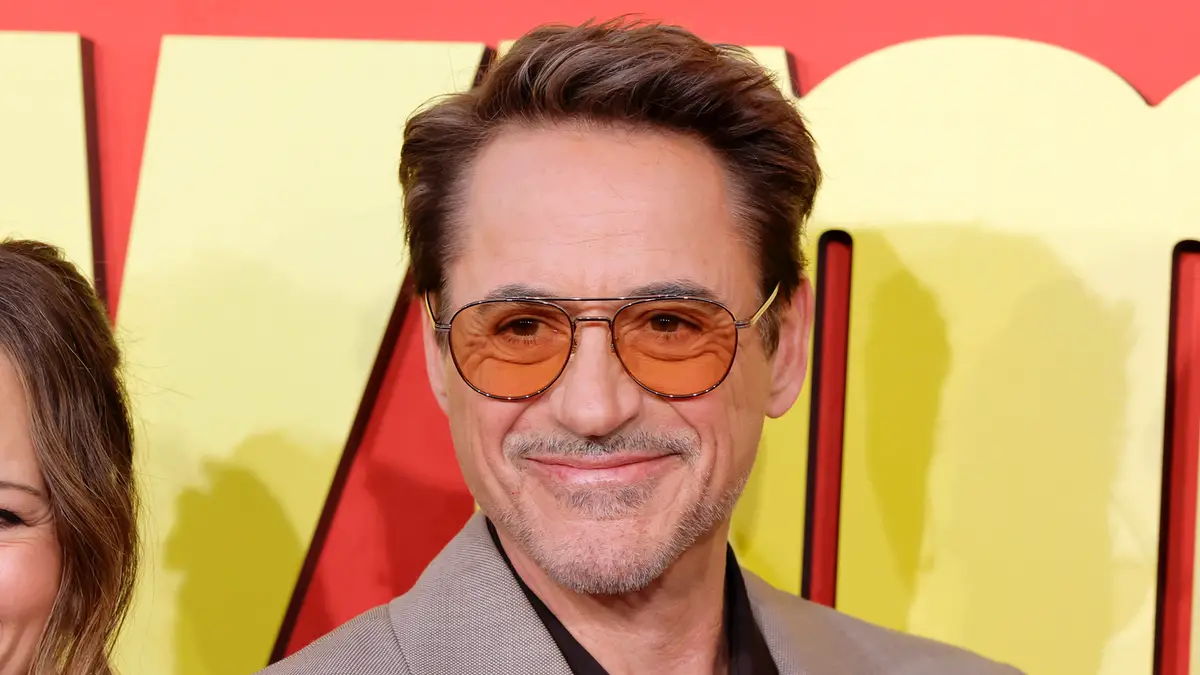

The recent interview of Garlinghouse with Amelie shows that Ripple will announce new partnerships due to the settlement of the SEC law. Garlinghouse was confident in this video segment in terms of cooperation with the company’s central bank. Amelie explains that the recent judgment of Ripple has been able to advance its activities in the financial sector, especially CBDC projects.

According to Garlinghouse, the financial sector now shows a growing interest in the use of blockchain for payments. The use of CBDCs and stablecoins is checked by states for the development of next generation financial network systems. The blockchain market attracted Ripple because institutions are increasingly recognizing the potential to make international financial transfers more efficient.

The growing partnerships of Ripple with central banks could secure its place in the global payment networks because digital currencies are becoming increasingly popular. Garlinghouse’s statement indicates not yet published partnerships, which will probably be announced shortly. The progress of the financial industry in the direction of blockchain solutions positions Ripple as an important player when defining the next generation of digital payment systems.

No Comments