- A renowned lawyer admits that the legal dispute between Ripple and the Sec could soon come to an end if both parties reach a private settlement and do not bring the case back to the court.

- Ripple reports reportedly about better comparative conditions in order to remove the restrictive part of the judgment issued.

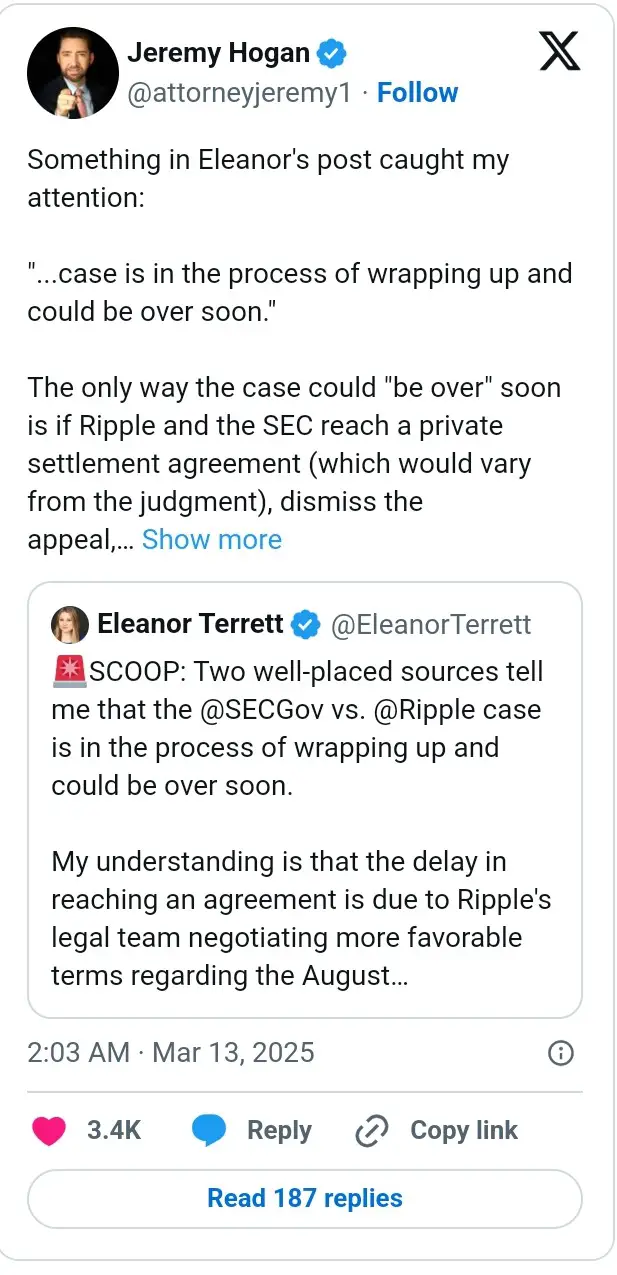

The several years of legal dispute between the US investment and stock exchange supervisory authority (SEC) and Ripple Labs could be completed this week, as the legal expert Jeremy Hogan indicates. According to him a private comparison agreement is the only way to bring the case to an end:

“In addition, both parties would have to reject the appeal and then simply no longer bring the conditions of the comparison agreement to the court to ratify them.”

Hogan’s comments follow a recent report by the FOX Business journalist Eleanor Terrett, who claims that Ripple’s decision to strive for better comparison conditions was the reason for the delay. As CNF reported, the 1,278 direct sales of Ripple have violated institutional customers, according to a judgment from 2023, against Federal Working Act. However, XRP sales to small investors via an exchange do not represent violations.

The blockchain company was then sentenced to the SEC in August 2024 to pay $ 125 million as a punishment. The recent decisions of the SEC under the direction of Mark Uyeda to withdraw from several top -class legal cases have forced Ripple to rethink the previous judgment. The company believes that the current problem with the SEC could be solved by clear regulation instead of only paying the imposed punishment. In addition, the assumption of the judgment would be the same as the admission of misconduct:

“The argument is that if the new SEC leadership abolishes the enforcement for all crypto companies previously targeted because it believes that regulatory clarity will solve the underlying problem, why should Ripple be punished?”

With a view to the current development, Hogan emphasized that the court could agree not to enforce the judicial decision if this is the main obstacle. According to his observation, Ripple could get what it wants, including the registration of XRP sales to institutional investors:

“It is difficult for me to believe that the SEC could agree, for example, to give Ripple the possibility of actually registering sales of XRP to institutional investors.

The lawyer James Murphy agrees with this “psychocosmetics” and believes that Ripple is negotiating with the Commission on the abolition of parts of the judgment of judge Torres, which is the reason for the delay. In particular, the SEC could be ready to agree on the $ 125 million. Ripple may also be negotiating on the abolition of the restrictive aspects of the judgment.

As soon as a common basis has been reached, the case could be officially ended. In the meantime, the crypto industry industry could benefit to a great extent from the urgently needed regulatory clarity.

At the editorial deadline, XRP was traded at $ 2.3 after it has dropped by 2.6 % in the last 24 hours and 16 % in the last 30 days. According to our most recent analysis, XRP could do an upward movement to $ 5 if retailers “remain steadfast” with a massive increase.

No Comments