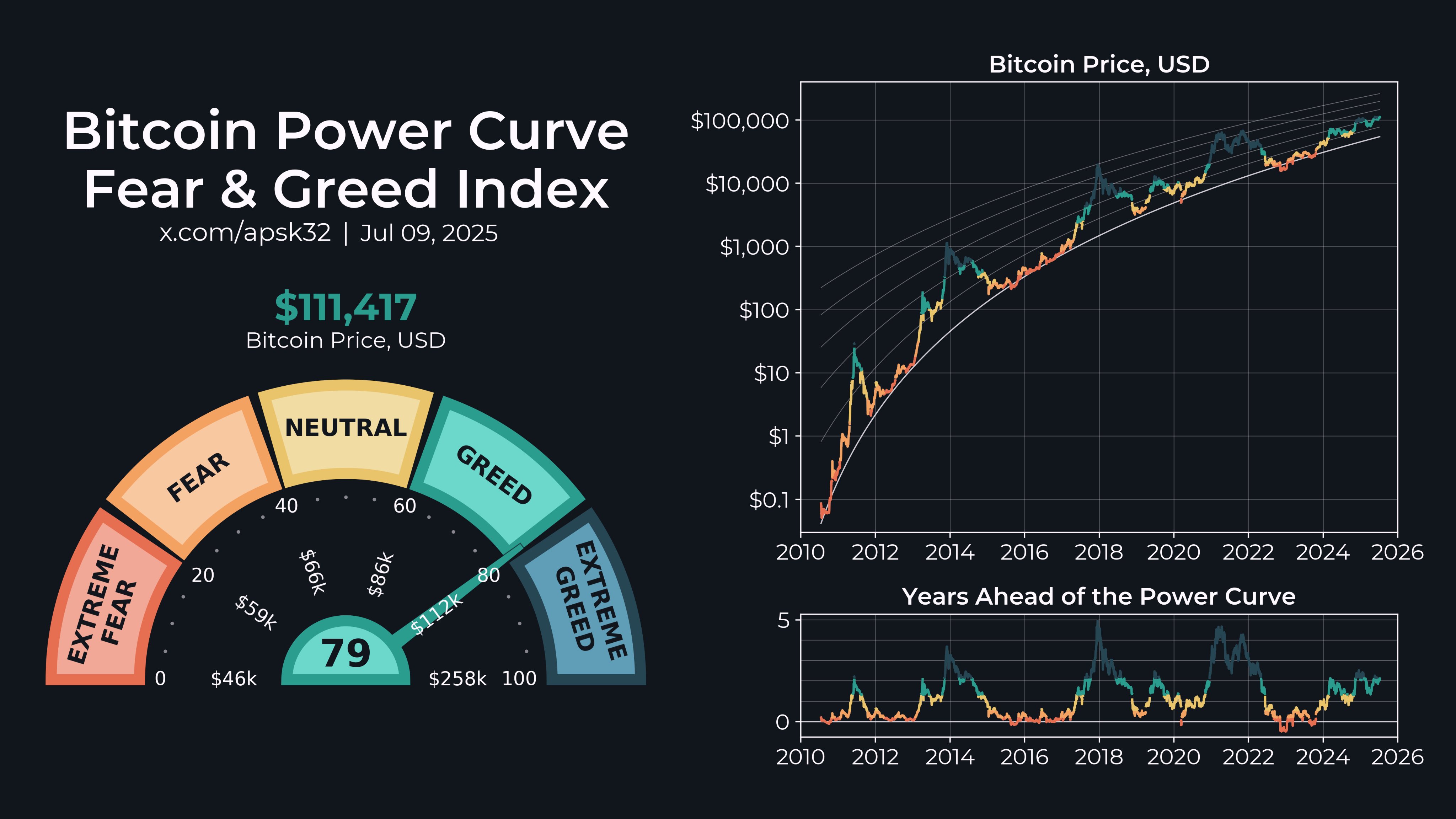

- Bitcoin could enter a historical “extreme greed” zone with a possible range of $ 112,000 to $ 258,000.

- The Power-Law model and likely kunjunstjunst trigger indicate a Bitcoin bullrun up to $ 300,000 at the end of the year.

Bitcoin shows the first signs that he stands on the threshold of the Bullrun. The cryptocurrency has increased 9.15 % this month alone and thus reached a new all -time high. How apsk32 shows that such a rash could only be the first step if the story should take its course.

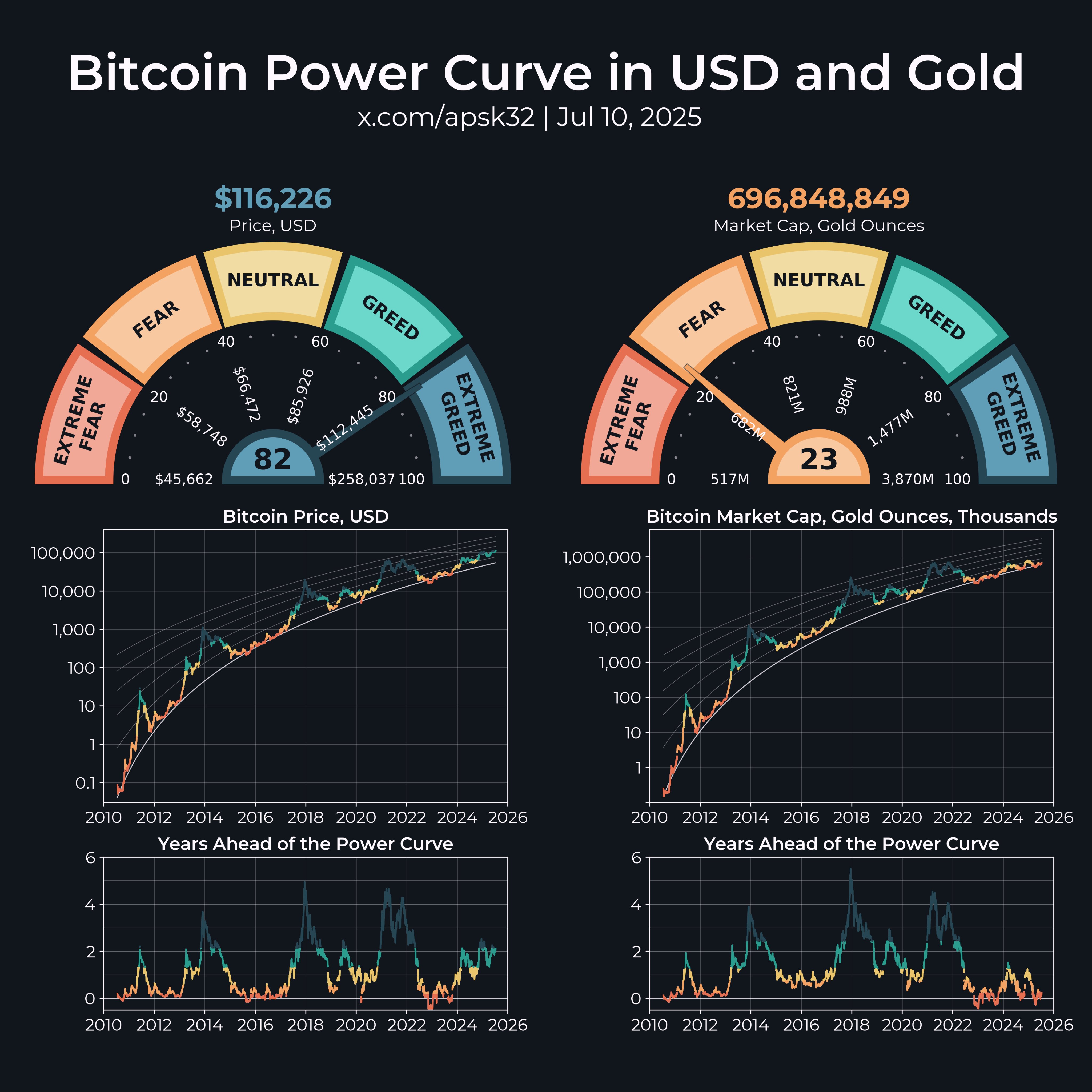

The chart of the analyst, the the Power-Law model exactly examined, shows that Bitcoin is currently in an upward movement that resembles the one, those during the blow-off tops in 2013, 2017 and 2021 were observed.

The Power-Law model used by APSK32 takes into account the deviation from the original trend line of Bitcoin on a timeline. In this approach, the current prices are 79 % of Bitcoin’s lifetime data.

The top 20% of the model that falls into the “Extreme Greed” category previously determined euphoric market leaders. At the moment, this range of $ 112,000 to $ 258,000 is sufficient.

If this story is repeated, APSK32 sees that the Bitcoin course could fall into this range up to the 4th quarter of 25 and the volatility reached its peak by the end of the year. For the model, prices could even reach $ 300,000 by Christmas before the dynamics declined by 2026.

Bitcoins Power Law curve signals start phase in the halving cycle

This performance curve technology is not new. Previous market cycles have seen parabolic movements at suitable points within the cycle -based halving time of Bitcoin. Every fourth year has triggered a climax that drove the course far beyond the previous highs.

The commentator continues that today, just like back then, we are at the same cycle position. Historically speaking, the current phase is similar to the third and fourth quarter of the previous swings, which could predict a rapid acceleration of the prices.

Incidentally, the “Years in advance” reported by APSK32 shows that Bitcoin’s performance curve will approach existing prices within two years. This is long -term proof that the current prices are not an upper limit, but a starting ramp.

Economic shifts can bring BTC towards $ 500,000

Macroeconomic forces can become another stimulus. Satraj Bambra, CEO of Rails, is loud that broader economic shifts could drive Bitcoin to another new high.

It names two main factors: a potential expansion of the balance of the Federal Reserve and a loosening of the interest. They are probably by -products of increasing tariffs and political changes, especially if there is a change in current leadership within the Fed.

Bambra also calls the drop in the DXY under 100 as an essential pre -signal. If this leads to interest reductions and additional liquidity injections, risk systems such as BTC should attract vigorously. In such a situation, Bambra sees a parabolic movement that increases the Bitcoin to $ 500,000.

No Comments