- Pi Network becomes MiCAR compliant, laying the foundation for a stock exchange listing in the EU.

- The correspondingly adapted white paper describes the token structure, risks, delivery details and the compliant KYC and audit rules.

Pi Network hat Published a revised white paperwhich is intended to make the project fit for the EU internal market and the EEA. The change will clear the way for the PI token to be traded on regulated exchanges.

For a project long known for its mobile mining model and large global community, the white paper marks the concrete step towards supervised trading and broader institutional access.

MiCAR compliance is crucial for crypto access in the EU. Pi Network’s announcement follows months of investigation as the project continues to expand its user base without organizing an ICO.

Pi Network with a fixed offer structure

The white paper describes Pi as an L1 asset running on a blockchain based on a fork of the Stellar Consensus Protocol.

The network works according to the “Federated Byzantine Agreement” model, which enables cost-effective and fast processing on the marketplace. The token’s maximum supply remains set at 100 billion PI, while its circulation is around 8.2 billion tokens.

Pi Network explains that the tokens were distributed through mobile mining and not through fundraising. The community of users, known as Pioneers, receive new tokens through participation rather than purchase.

The updated document confirms that Pi Network does not hold customer funds and offers a non-custodial wallet within the Pi Browser. This facility gives users complete control, but also warns that private keys cannot be recovered if lost.

The revised document states that PI does not offer any ownership, dividends, decision-making authority or financial interest in Pi Network or affiliates such as PiBit and the Pi Foundation.

Instead, PI is only intended for payments and market activities on the network.

Competitive pressure from L1 and L2 networks

The white paper clarifies that PI is not considered a utility token under Article 3 of MiCA as its role goes beyond simple access to a service. It also includes a detailed section on trading risks.

The document highlights market volatility, changing regulations, liquidity issues and the inability to reverse transactions due to the blockchain’s immutability. The competitive pressure from other Layer 1 and Layer 2 networks is also described.

Pi Network acknowledges that legal requirements may evolve and that new obligations may arise as governments refine digital asset regulations.

List of planned EU trading platforms

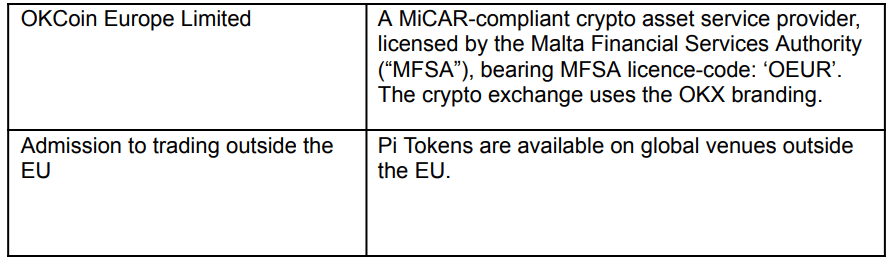

Pi Network intends to apply for market approvals to list PI on multiple MiCA compliant exchanges. The first expected platform is OKCoin Europe Limited, operating under the brand name OKX and licensed by the Malta Financial Services Authority under the code OEUR.

The project points out that all current trading takes place on secondary markets and assures that it has not raised any funds so far. Pi Network claims it is ready for a full listing in the EU after meeting MiCA regulations.

No Comments