- The Ethereum price loss can be a healthy correction, allowing investors to strategically accumulate at a low price during times of market uncertainty.

- Pectra and Fusaka upgrades combined with strong technical signals could soon trigger new buying momentum.

Ethereum has fallen by around 30% compared to Bitcoin in recent weeks, but prominent crypto analyst Michaël van de Poppe maintains his strongly bullish outlook. He describes the setback as a healthy correction that allows investors to strategically accumulate at low prices during times of market uncertainty.

I stand my thesis on $ETH.

It’s provided a 30% correction against $BTC.

However, this is an ideal zone for accumulation and it’s holding up nicely over the past few weeks while Bitcoin has seen the worst week of 2025.

I don’t think that these prices on Ethereum will last for… pic.twitter.com/O3WWENVKwJ

— Michaël van de Poppe (@CryptoMichNL) November 17, 2025

Van de Poppe highlighted that Ethereum remained strong despite Bitcoin having one of its worst weeks of the year. He said ETH’s stability shows its true strength and proves that investors trust it even as the entire crypto market struggles and sales are under severe pressure.

The analyst also noted that trading activity and price movements suggest Ethereum remains in a healthy range. He said that technical indicators show stability, not weakness, emphasizing that the recent decline is just a normal correction and not a sign of a long-term downtrend for the cryptocurrency.

Ethereum in ideal investor accumulation zone

Van de Poppe explained that Ethereum has entered what he calls an “ideal zone for accumulation,” where investors can take positions ahead of a possible price increase. He emphasized that current prices are unlikely to remain the same, noting that ETH’s previous strength against Bitcoin makes it poised for a possible rebound.

He added that market conditions and ETH’s performance against Bitcoin are generating renewed buying interest. Van de Poppe emphasized that traders can use this time to build stronger positions before sentiment turns positive, which could support Ethereum’s price recovery and give investors more confidence in the coming market rally.

Technical observations show that Ethereum trading volume and price patterns still point to strength. Analysts believe that ETH could regain momentum if investors continue to accumulate. Traders are watching key levels closely and viewing this pullback as an opportunity for cautious buying rather than viewing it as continued weakness or a continued downtrend.

At the time of writing, Ethereum is trading at $3,198.71, down 1.03% in the last 24 hours. Investor interest remains high as ETH remains above the key support level of $3,000. With a market cap of $386.07 billion and active trading, the market is showing cautious optimism as buyers move cautiously.

Pectra and Fusaka upgrades make traders optimistic

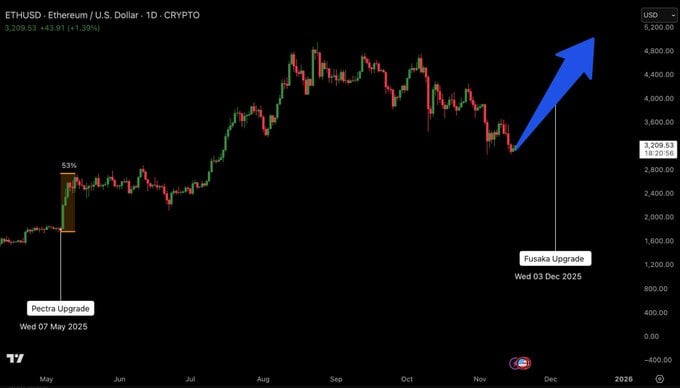

The Ethereum commentator Cas Abbé pointed out important developments for the network hin and emphasized that the “Pectra upgrade” on May 7, 2025 and the “Fusaka upgrade” on December 3, 2025 could influence market trends. More than 25,000 people saw his post, suggesting that these updates could trigger new buying and stronger market activity.

Abbé’s chart shows Ethereum price near $3,200 with a clear upward arrow. Traders are optimistic about the upcoming upgrades and expect positive results. Analysts believe that these catalysts, along with strong buying areas, can help ETH recover from recent losses in the market.

Fusaka’s upcoming appreciation is likely to attract investor attention once again. Abbé’s analysis shows that pre-event price movements could trigger buying. Ethereum’s strong market position and technical strength support the view that it can steadily recover from its recent decline rather than remain weak.

Analysts observe that accumulation zones, strong technical signals and impending network upgrades give Ethereum a chance to win. If buyers remain active and sentiment improves, ETH could slowly rise back to previous levels. Experts note that the December upgrade could soon affect prices.

No Comments